FTT jumps 50% after FTX gets court approval to repay customers in full

Key Takeaways

- FTX's Chapter 11 reorganization plan was approved by a US bankruptcy court on Monday.

- FTX creditors will receive 119% of approved claims in cash following court approval.

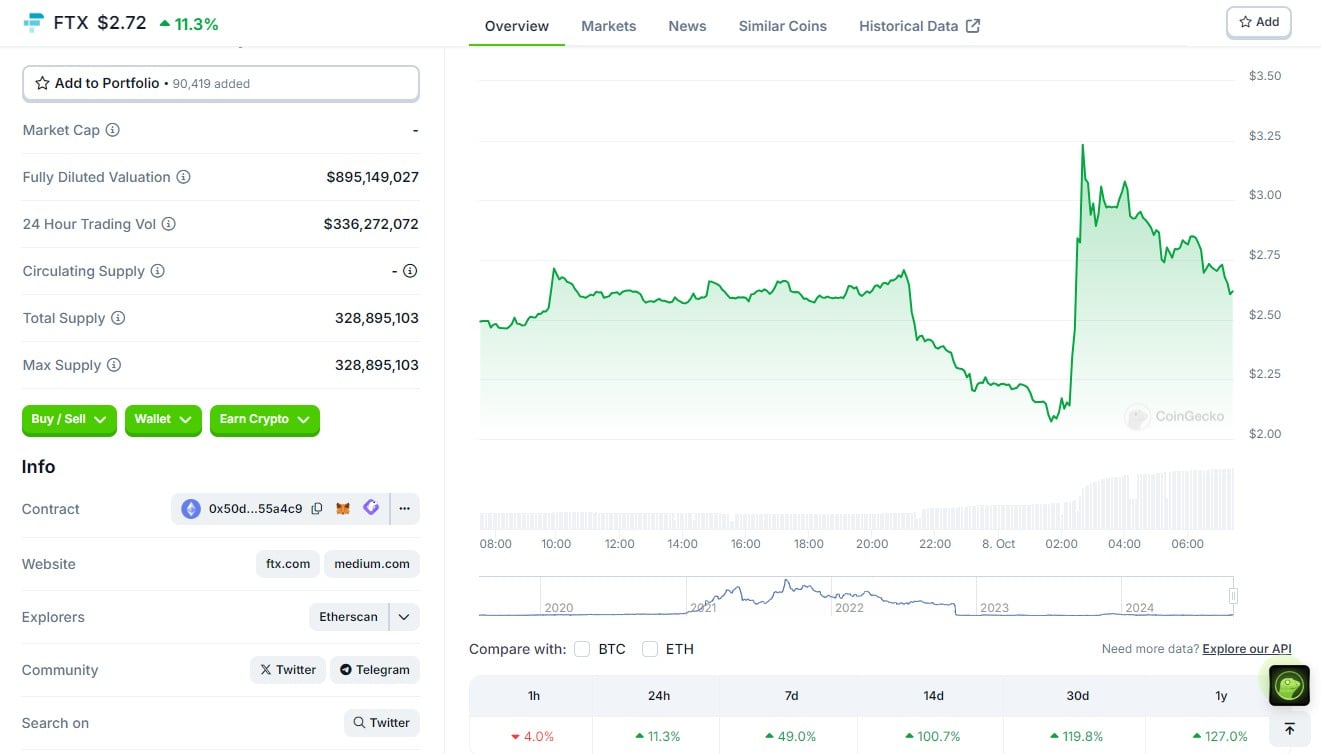

FTX’s native token, FTT, soared over 50% to $3.23 on Monday after FTX received court approval for its bankruptcy plan. The plan will allow FTX to repay customers in full using $16 billion in recovered assets, including interest.

After the surge, FTT is now settled at around $2.72, CoinGecko data shows. The token’s value rose 100% in the last two weeks as investors awaited a confirmation hearing.

Source: CoinGecko

Source: CoinGecko

On Monday, Judge John Dorsey in the US Bankruptcy Court for the District of Delaware confirmed FTX’s Chapter 11 Plan of Reorganization. Nearly two years after its collapse, FTX’s bankruptcy saga is nearing its conclusion.

Judge Dorsey also noted that the value of FTX’s native token, FTT, is zero, reinforcing the exchange’s current inability to revive.

“I have no evidence today that the value of FTT tokens would be anything other than zero,” said Judge Dorsey.

Under the restructuring plan, 98% of creditors will receive approximately 119% of their approved claims within 60 days after the plan takes effect. The decision follows a favorable vote by 94% of creditors, representing approximately $6.83 billion in claims.

The total recovered funds are estimated to be between $14.7 billion and $16.5 billion. The money includes the liquidation of assets from FTX itself, international branches, government agencies, and collaborating parties.

“Today’s achievement is only possible because of the experience and tireless work of the team of professionals supporting this case, who have recovered billions of dollars by rebuilding FTX’s books from the ground up and from there marshaling assets from around the globe,” said John J. Ray III, Chief Executive Officer and Chief Restructuring Officer of FTX. “It also reflects the strong collaboration we have had with governments and agencies from around the world that share our goal of mitigating the wrongdoings of the FTX insiders.”

The exact date of the plan’s implementation is not specified. Ray III said funds will be distributed to creditors across over 200 jurisdictions and the estate is working with specialized agents to ensure safe and efficient delivery.

Despite some opposition regarding payment methods, the plan will proceed with cash distributions, as confirmed during Monday’s court session. With today’s court approval, it is expected that FTX customers will receive repayments of their losses in the coming months.

FTX, once a respected crypto empire, collapsed in November 2022 after it was revealed that the company had been using customer funds to make risky investments.

The former CEO of FTX, Sam Bankman-Fried, was convicted on multiple counts of fraud and conspiracy, leading to a 25-year prison sentence . Last month, he filed an appeal against his conviction for fraud and conspiracy.

Bankman-Fried’s circle of partners in crime, including Caroline Ellison, CEO of Alameda Research, have also faced legal outcomes for their role in the FTX fraud. Ellison was sentenced to two years in prison last month. In addition to her prison term, she is required to forfeit $11 billion due to her involvement in the exchange’s collapse.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%