Bitcoin Faces Critical Demand Challenges as Q4 Begins

According to a report from CryptoQuant analysts released on Tuesday, Bitcoin's demand appears to be stabilizing, but significant growth is needed in the fourth quarter to support higher price levels.

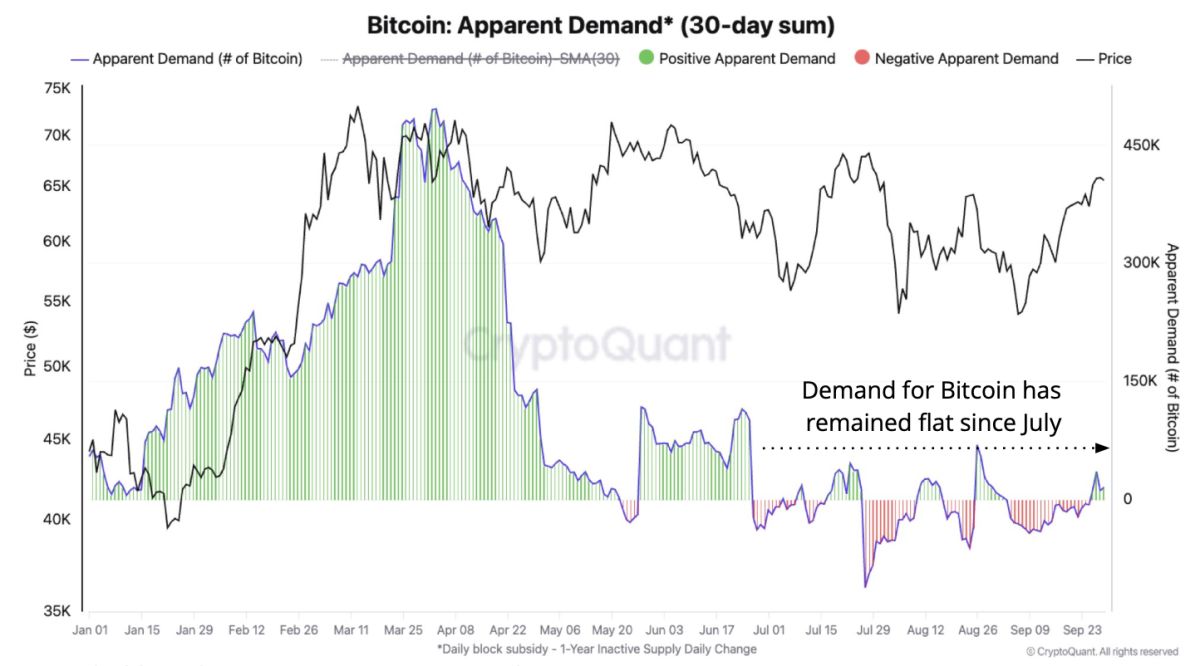

Since July, the demand for Bitcoin , which CryptoQuant measures as the difference between the daily block subsidy and the change in the number of BTC that have remained untouched for a year or more, has varied widely, showing a monthly net loss of 23,000 BTC to a gain of 69,000.

September, however, experienced reduced volatility, with demand gradually increasing throughout the month.

Despite this uptick, analysts believe the growth observed in September was not enough to initiate a sustained price increase. They noted that in April, for example, apparent demand surged by as much as 496,000 BTC while prices were around $70,000, indicating that there is still significant potential for demand growth in the upcoming quarter.

READ MORE:

Here’s How Low Bitcoin Could Go if Geopolitical Tensions Escalate FurtherThe report also pointed out that the behavior of Bitcoin holders at the beginning of 2024 is reminiscent of patterns from previous halving cycles in 2016 and 2020. Earlier in the year, long-term holders sold portions of their Bitcoin to new investors, which contributed to demand growth, but this momentum slowed during the summer months.

Analysts concluded that if historical trends hold true, demand growth is expected to pick up again, potentially leading to an increase in short-term supply.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buy PLAI,Get 100% fee rebate in PLAI!

Bitget to support loan and margin functions for select assets in unified account

Bitget launches cross margin trading for BGB/USDT and BGB/USDC

Announcement on Bitget listing LLYUSDT,MAUSDT,UNHUSDT STOCK Index perpetual futures