Grayscale lists SUI, TAO, OP, CELO among top "high potential" tokens for Q4 2024

Key Takeaways

- Grayscale adds new cryptocurrencies like Sui and Bittensor to its top 20 list for Q4 2024.

- The list highlights themes such as decentralized AI and traditional asset tokenization.

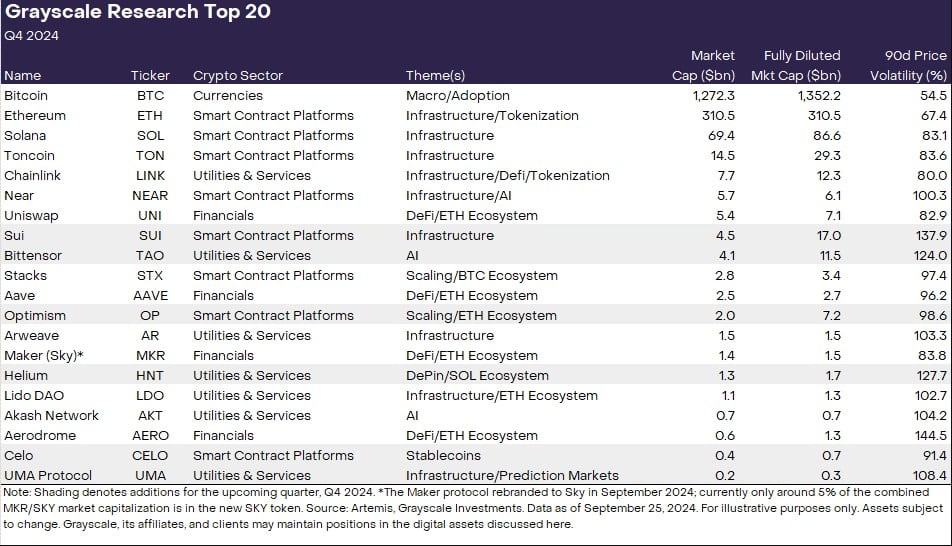

As the year’s final quarter is only four days away, Grayscale Research has revealed its updated list of the top 20 crypto assets expected to excel in the next quarter. The revised list comes with six new altcoins, including Sui (SUI), Bittensor (TAO), Optimism (OP), Celo (CELO), Helium (HNT), and UMA Protocol (UMA).

Grayscale Research notes that these new additions reflect crypto market themes that the team “is focused on.”

“The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. Our approach incorporates a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks,” the team wrote.

“Grayscale believes that these new additions, along with the existing assets in the Top 20, offer compelling investment opportunities with potential for growth and high risk-adjusted returns,” they added.

Based on the list, the focused areas are decentralized AI, high-performance infrastructure, as well as projects with “unique adoption trends.” Grayscale Research also highlights decentralized AI platforms, traditional asset tokenization, and the ongoing appeal of memecoins as key emerging themes.

Source: Grayscale

Source: Grayscale

According to the team, Sui is recognized for its 80% increase in transaction speed following a network upgrade while Bittensor is enhancing the integration of crypto and AI. Notably, Grayscale currently offers trust products for Sui and Bittensor , namely the Grayscale Sui Trust and the Grayscale Bittensor Trust, which were debuted last month.

Optimism, an Ethereum layer 2 solution, and Helium, known for its decentralized physical infrastructure networks, also made the list, while Celo’s transition to an Ethereum layer 2 network and its growing adoption in payment solutions are key factors in its inclusion.

The growth in Celo’s stablecoin usage was noticed not only by Grayscale Research but also by Vitalik Buterin. The Ethereum co-founder recently praised Celo’s milestone in daily active stablecoin addresses, driven by increased app adoption and demand in Africa.

UMA Protocol, supporting the Polymarket prediction platform, is the final addition. The presence of UMA on the list emphasizes the importance of oracles in blockchain predictive markets.

Bitcoin, Ethereum, and Solana are still in the spotlight

Established crypto assets like Bitcoin, Ethereum, and Solana still take the leading spots in Grayscale’s portfolio. The research team states that Bitcoin and the crypto sector have outperformed other segments this year, likely due to the debut of US spot Bitcoin ETFs and favorable macro conditions.

As noted in the analysis, Ethereum has underperformed Bitcoin but outperformed most other crypto assets. Despite facing competition from prominent blockchains like Solana, Ethereum maintains its dominance in terms of applications, developers, fee revenue, and value locked.

Grayscale Research expects the entire smart contract platform sector to grow, benefiting Ethereum due to its network effects. In addition to Ethereum’s high network reliability, security, and decentralization, the team believes that its regulatory status provides it a competitive advantage over competing networks.

Apart from making space for new crypto assets, the research team removed six ones from the list. These tokens are Render, Mantle, THORChain, Pendle, Illuvium, and Raydium. According to the team, while these assets still hold value within the broader crypto ecosystem, the revised list offers more compelling risk-adjusted returns for the coming quarter.

Grayscale Research also cautions about the inherent risks of crypto investments, noting the high volatility and unique challenges such as smart contract vulnerabilities and regulatory uncertainty.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m

ZEC Rises 4.77% Amid Increased Short Positions and Market Rebound

- ZEC surged 4.77% in 24 hours to $386.31, with a 584.4% annual gain despite recent declines. - A prominent trader increased ZEC short positions to $17.29M, showing a $20k gain but larger losses in BTC and SOL. - Market recovery and short-position adjustments highlight ZEC’s volatility, with analysts warning of potential downward pressure if prices rise further.

ALGO Falls 1.01% While Investors Anticipate Crucial U.S. Inflation Report

- Algorand (ALGO) fell 1.01% in 24 hours to $0.1372, but rose 0.44% weekly/monthly amid market uncertainty. - Investors focus on U.S. inflation data and Fed policy, with Chair Powell signaling cautious rate-cut approach for 2026. - Earnings reports from Airbnb , Coca-Cola , and Coinbase will shape sector sentiment, while unrelated lawsuits impact PRGO and ALVO. - Global volatility in travel/aviation sectors and India's IndiGo disruptions highlight broader market risks unrelated to crypto.

BCH has increased by 32.06% over the past year as the market remains steady

- Bitcoin Cash (BCH) fell 0.19% in 24 hours but rose 32.06% annually, reflecting strong long-term demand and institutional interest. - Analysts highlight BCH's resilience amid stable trading ranges, driven by cross-border transactions and micropayments adoption. - Sustained 6.1% gains over 30 days and 7-day periods underscore BCH's role as a high-utility altcoin in diversified portfolios. - Market stability and growing mainstream recognition position BCH for continued performance amid broader crypto sustai