Yellen and Bernanke unanimously agree: The United States is expected to achieve a soft landing, avoiding economic recession

U.S. Treasury Secretary Janet Yellen and former Federal Reserve Chairman Ben Bernanke stated in their respective speeches that the U.S. is likely to avoid an economic recession. In an interview, Yellen pointed out that despite the rising unemployment rate, the labor market remains strong and inflation has significantly fallen back, with the economy moving towards a "soft landing". She also emphasized that although progress in combating inflation has been slow during its final stages due to falling rents and housing prices, overall trends are positive.

During Fidelity Investments' online event, Bernanke said that the Fed's current "soft landing" policy has taken effect as inflation and interest rates gradually return to normal. However, he also warned that unemployment could rise further especially against a backdrop of slowing economic growth. If new economic shocks occur, the Fed may be forced to make new policy adjustments. He predicts that the Fed will cut interest rates by 50 to 75 basis points this year and may continue easing policies within next 12-18 months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

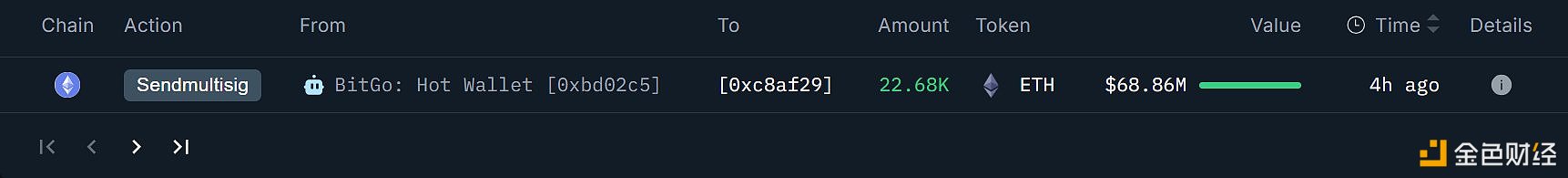

Suspected BitMine address increased holdings by 22,676 ETH again 4 hours ago

Japan's expected interest rate hike may curb the liquidity of risk assets such as bitcoin