Bitcoin is approaching $64,000 after gaining around 7% since last week. Gold is also seeing a rise in demand due to various reasons globally, including economic uncertainty. Meanwhile, analysts are watching the effects of the recent interest rate cuts by the Fed.

With festive demand in regions like India and the rise of spot Bitcoin ETFs, there is growing optimism in gold and BTC. However, Bitcoin’s correlation with gold remains weak.

Bitcoin gains strength after rate cuts

Bitcoin has grown stronger and is inching towards $64,000 as of press time. At the same time, gold is rising in a steep curve.

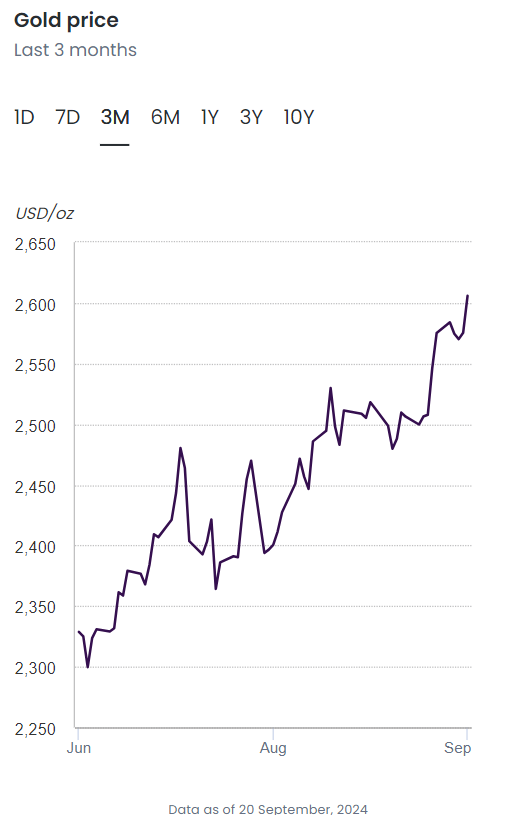

Per World Gold Council data, the yellow metal prices seem to be experiencing strong demand over the last 3 months. Since gold is considered a safe haven asset, economic uncertainties tend to push its demand upward.

In the US, the Fed’s half-point rate cut has gotten analysts concerned about a potential slowdown. In other regions like India, the last quarter of a calendar year indicates festive demand for gold as an auspicious metal.

According to analyst Peter Brandt, gold is possibly entering a “parabolic advance” where prices rise very quickly in a short time. Mridul Gupta, Founding Partner at Indian crypto exchange CoinDCX told Cryptopolitan, “Currently, gold is at an all-time high, while Bitcoin is still lagging.”

Gold Spot Prices | Source: World Gold Council

Gold Spot Prices | Source: World Gold Council

As of September 2024, Bitcoin is around 14% below its record high of around $74K. However, he explains that there’s often a positive correlation between gold and Bitcoin, indicating that BTC could catch up with gold’s rise.

In the context of the 0.50% interest rate hike in the US, Gupta points out that it is favorable for assets like gold, Bitcoin, and stocks as it makes borrowing cheaper.

Gold and BTC correlation is weak

Maruf Yusuf, co-founder of gold-based stablecoin Deenar (DEEN) told Cryptopolitan that gold serves as a hedge against inflation. He explained, “This sentiment holds today, as seen in retail investors’ huge embrace of the asset in key regions like India, China, and the United States.”

That said, the co-founder adds that BTC has entered a similar territory but its price has been unpredictable, slowing its growth. However, it does seem that the trend is shifting with the introduction of spot Bitcoin ETFs in major countries. He cites data to claim that spot Bitcoin ETF products have become the best-performing assets globally, displacing gold.

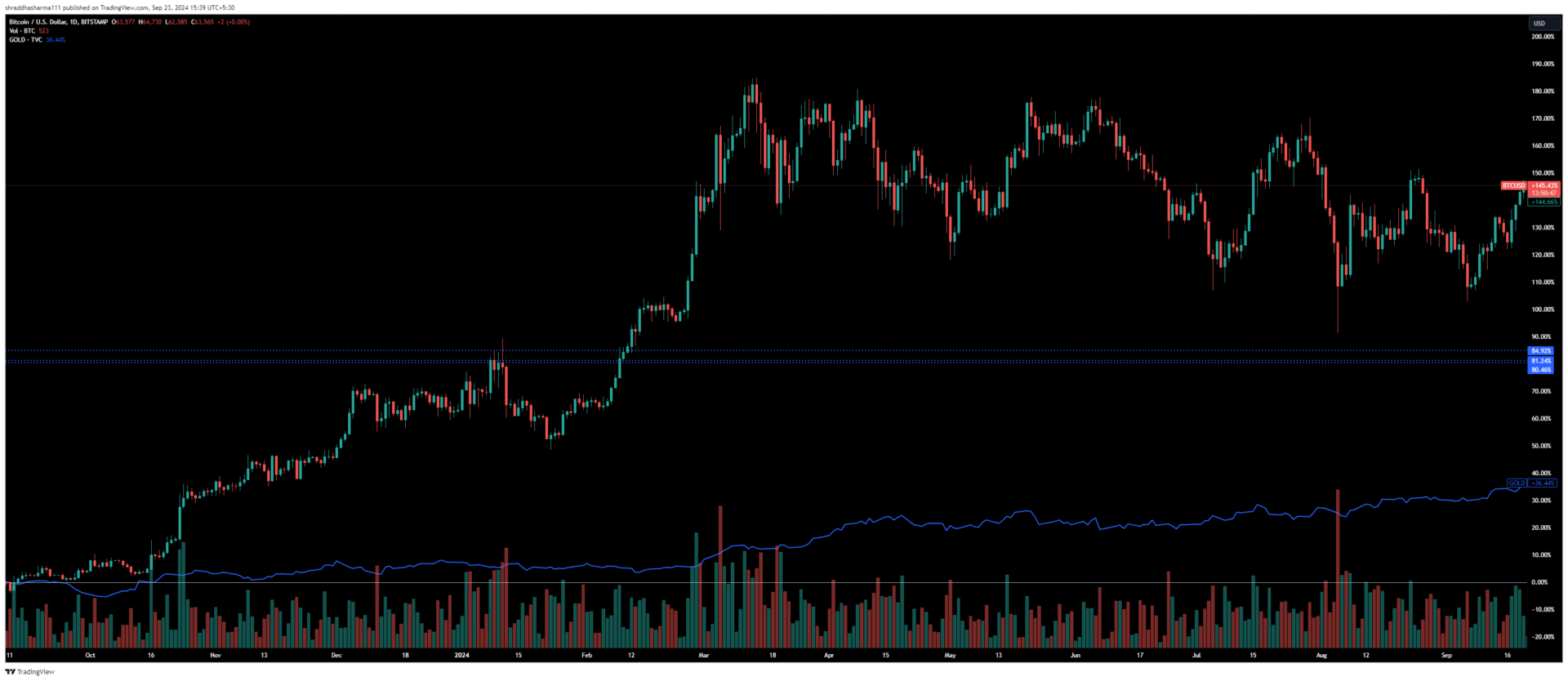

BTC vs Gold on TradingView charts

BTC vs Gold on TradingView charts

At the time of writing, a 30-day Pearson correlation between BTC and gold stands at 0.32 as calculated by the Block. This means that the price movements of Bitcoin and gold currently have a weak and inconsistent positive relationship.

What could change this is the US inflation figures. According to a recent analysis by Bloomberg , the Fed’s actions could align with the economy’s current state. The Federal Reserve Chair Jerome Powell had stated after the rate cuts that the economy was strong, suggesting that the US would not slip into a recession.

Yusuf maintains a strong case for Bitcoin in value preservation. He says that if this trend plays out as projected, demand might surge for gold, BTC, and even gold-backed stablecoins.