CBDCs Face ‘Chicken-and-Egg Problem’ When It Comes to Adoption: IMF

The IMF highlights merchants may be reluctant to adopt CBDCs if consumers aren’t using them, while consumers may avoid CBDCs if merchants don’t accept them.

Central Bank Digital Currencies (CBDCs) face a “chicken-and-egg” problem, says the International Monetary Fund (IMF), where consumer adoption depends heavily on merchant participation, and vice versa.

The phrase “chicken-and-egg” is a metaphor used to describe a situation where two interdependent factors make it difficult to determine which one should come first.

In this case, the IMF highlights merchants may be reluctant to adopt CBDCs if consumers aren’t using them, while consumers may avoid CBDCs if merchants don’t accept them.

CBDCs are digital forms of a country’s national currency, issued and regulated by the central bank. Unlike cryptocurrencies, which are decentralized, CBDCs are fully backed by the central authority.

They aim to provide the same functions as physical currency but in digital form, offering a safe, regulated alternative to private digital currencies and payment systems.

Central banks around the world are exploring CBDCs to modernize payment systems, improve financial inclusion, and reduce reliance on cash.

Consumers Slow to Engage, Unsure About Widespread Acceptance

In the retail payments market, coordination challenges are common. Products can struggle if stakeholders hesitate to adopt them, fearing others won’t.

This dynamic applies to CBDCs, where both consumers and merchants might be slow to engage if they are unsure about widespread acceptance. This creates a self-reinforcing cycle of hesitation that central banks must address to foster adoption.

Central banks, as the primary drivers of the CBDC initiative, can play a proactive role in aligning expectations and creating a consensus among stakeholders, says the IMF.

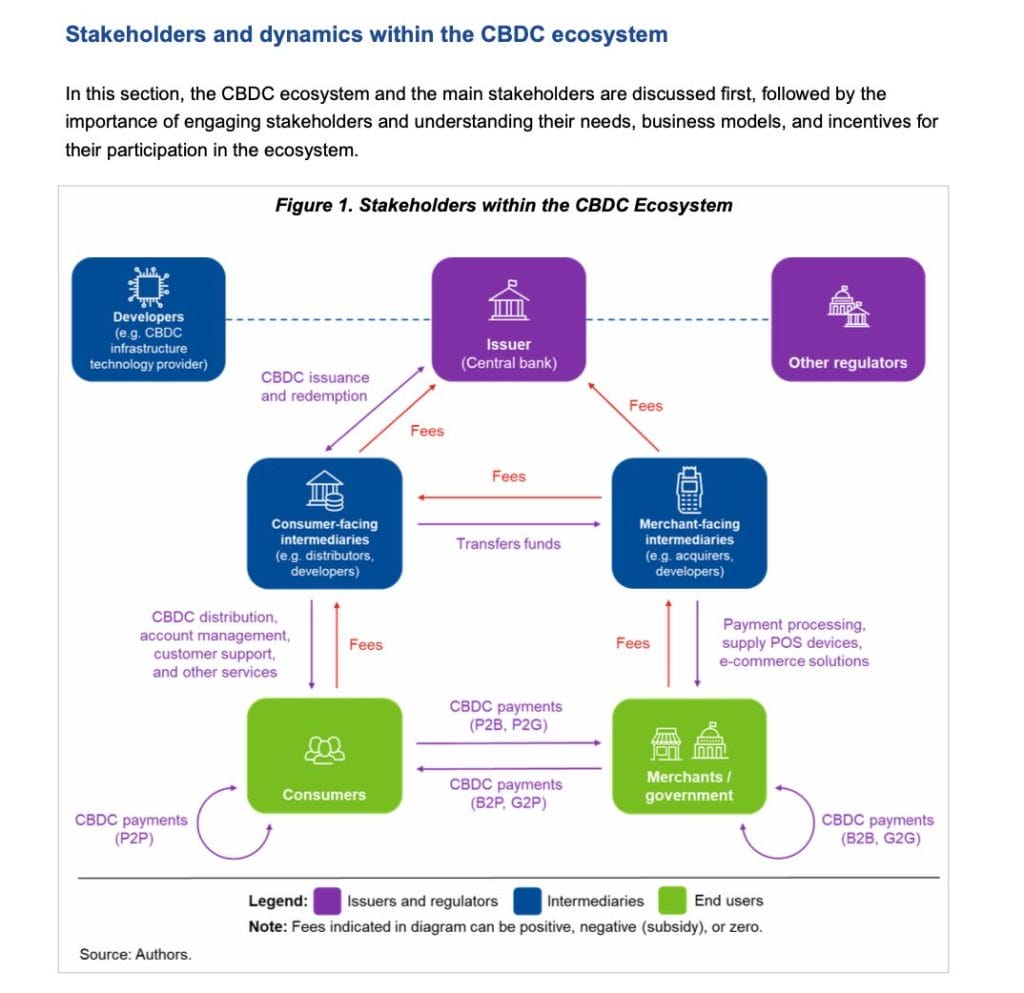

Many central banks are exploring a two-tier model for CBDC distribution, where intermediaries such as commercial banks and payment service providers facilitate distribution and user adoption. This model helps by using existing financial infrastructures while ensuring that central banks maintain oversight, said the IMF.

Stakeholder engagement will play an important role in the adoption of CBDCs. The IMF advises central banks to adopt an iterative, inclusive approach to understanding the needs and concerns of merchants, intermediaries, and consumers. This involves not only addressing market challenges but also achieving a “product-market fit” for CBDCs.

In June, the IMF surveyed 19 countries in the Middle East and Central Asia, exploring the adoption and potential of CBDCs. The survey insights concluded that CBDCs could promote financial inclusion and enhance the efficiency of international remittances.

Out of those 19 countries surveyed, many are exploring CBDCs at its research stage. “Bahrain, Georgia, Saudi Arabia, and the United Arab Emirates have moved to the more advanced “proof-of-concept” stage,” the insights read. “Kazakhstan is the most advanced after two pilot programs for the digital tenge.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%