FTX’s continued offloading of its massive Solana holdings has experts worried about a potential market crash. With over $1 billion worth of SOL tokens still to be liquidated, the bankrupt exchange’s actions could significantly impact Solana’s price and overall market sentiment.

FTX and its affiliate Alameda Research have recently unstacked substantial amounts of Solana tokens. Over the past three months, 530,000 SOL worth about $71,000 have been unstaked, averaging 176,700 SOL or $23.5 million per month. While a significant portion has been liquidated, 7.06 million SOL, valued at $945.7 million, remains staked.

FTX’s collapse hits Solana hard, draws federal scrutiny

FTX has been gradually selling its Solana holdings since the exchange collapsed in November 2022, with some sales potentially occurring over the counter (OTC) to reduce the impact on market prices.

In addition to its Solana holdings, FTX has also offloaded $1 billion worth of Grayscale Bitcoin Trust’s (GBTC) shares. This follows the approval of spot Bitcoin exchange-traded funds (ETFs).

FTX’s liquidation efforts are drawing increased scrutiny from federal authorities. Caroline Ellison, the former CEO of Alameda Research and an ex-partner of Sam Bankman-Fried, is set to be sentenced on September 24 for her role in the collapse, having accepted all charges in a plea deal.

Solana struggles amid FTX liquidation, but Brazil’s ETF approval offers hope

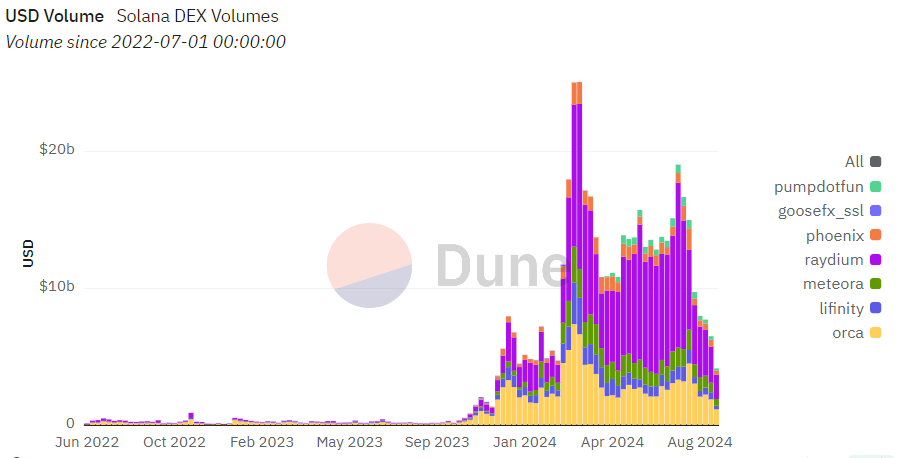

While Solana is entangled in FTX’s asset sales, the blockchain’s on-chain activity has waned. Last week, decentralized exchange (DEX) volumes within the Solana ecosystem hit a six-month low at $7.7 billion , according to data from Dune Analytics, down sharply from earlier peaks when it outperformed Ethereum.

Solana DEX Volumes-Source: Dune

Solana DEX Volumes-Source: Dune

Technically, Solana is at a crucial juncture. After losing support at its 200-day exponential moving average (EMA), the token’s price hovers around $127. Analysts caution that a break below $126 could lead to further declines, potentially sending prices toward the $92 to $110 range.

As FTX continues liquidating assets, the market remains on edge, waiting to see how Solana’s price and ecosystem will respond in the coming months.

Still, Brazil’s recent approval of the world’s first Solana spot exchange-traded fund (ETF), signifies a growing acceptance of digital assets within the traditional financial framework. This development is likely to spur further innovation and adoption within the industry.