U.S. Bitcoin ETFs Continue Outflows, Losing $211 Million

On Thursday, U.S. spot Bitcoin ETFs saw significant withdrawals, totaling $211.15 million, marking a week-long trend of outflows.

Fidelity’s FBTC led with $149.49 million in withdrawals, followed by Bitwise’s BITB, which lost $30 million. Grayscale’s GBTC and mini trust also saw declines of $23.22 million and $8.45 million, respectively.

No funds saw gains, while others, including BlackRock’s IBIT, recorded no activity. Trading volumes across 12 ETFs dropped to $1.35 billion, continuing the downward trend.

In the Ethereum ETF space, movements were minimal with $152,720 in outflows. Grayscale’s ETHE lost $7.39 million, but its Ethereum Mini Trust gained $7.24 million.

Other Ethereum ETFs showed no change, and trading volumes decreased to $108.59 million. Since launching, these Ethereum funds have experienced $562.31 million in outflows.

As markets await U.S. non-farm payroll data, experts suggest that a moderately weak report could ease concerns about economic growth and benefit both stocks and Bitcoin .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

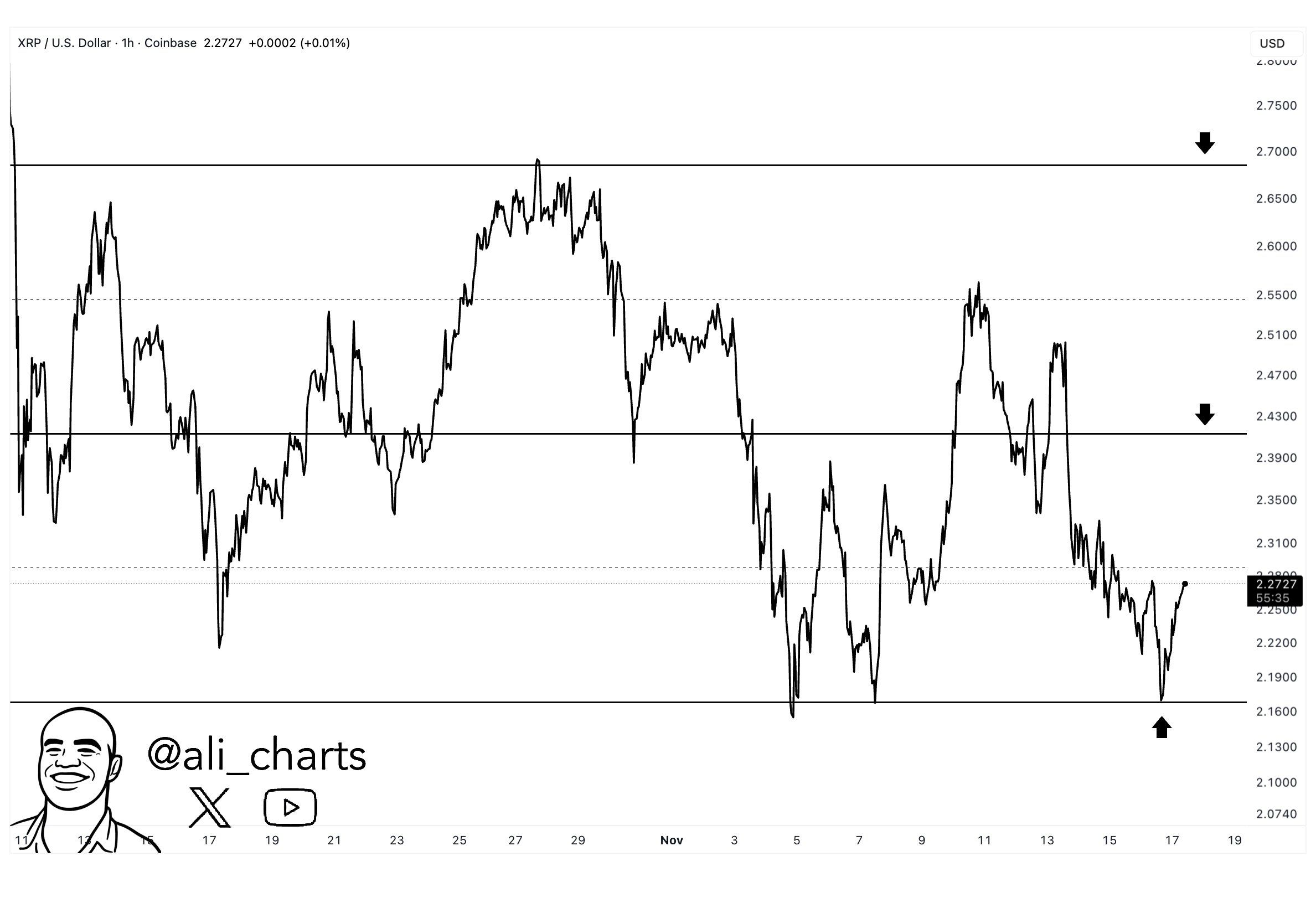

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.