Bitcoin fees fell almost 5% this week to $3.3 million, according to IntoTheBlock data. This marks the third consecutive week of decline in the fees and the lowest weekly fee on the network this year.

The decline in fees follows a recent dip in Bitcoin price and the slowdown in activity on the network. With fees dipping and struggling prices, Bitcoin miners are now in a difficult position as profitability continues to suffer.

Bitcoin transaction fees have been in free fall since halving

This week’s decline continues a trend that the Bitcoin network has been experiencing since the halving event in April. Following the halving, Bitcoin recorded a massive surge in transaction fees thanks to the Runes protocol, enabling it to surpass Ethereum in daily fees for four consecutive days between April 15 and April 18.

Since then, fees have been dropping as attention shifted away from Runes. Even the Ordinals protocol, which drove activity on the Bitcoin network before Runes, has also seen less activity recently as Bitcoin users have moved away from Bitcoin-based meme tokens.

Bitcoin Mining Fees (Source: IntoTheBlock)

Bitcoin Mining Fees (Source: IntoTheBlock)

With the lower volume of activity, the average fee for medium-priority transactions on the network for medium priority is now 4 sats/byte ($0.33), according to mempool space . While the lower fees mean cheaper transactions, it also means less revenue for miners.

Ycharts data also shows that average transaction fees have been below $500,000 since August started. The last time that Bitcoin recorded over a million in daily fees was on July 13, when it had $1.167 million

Miners struggle amidst multiple challenges

The continuous decline in transaction fees adds another layer to the problems that Bitcoin miners face. Many analysts have earlier predicted that these fees could be an alternative revenue source to replace the reduced block subsidy rewards due to halving.

However, that has not happened, and instead, miners are struggling to break even in an environment of high Bitcoin production costs and volatile price performance. Unsurprisingly, miners are selling off their crypto holdings to sustain operations.

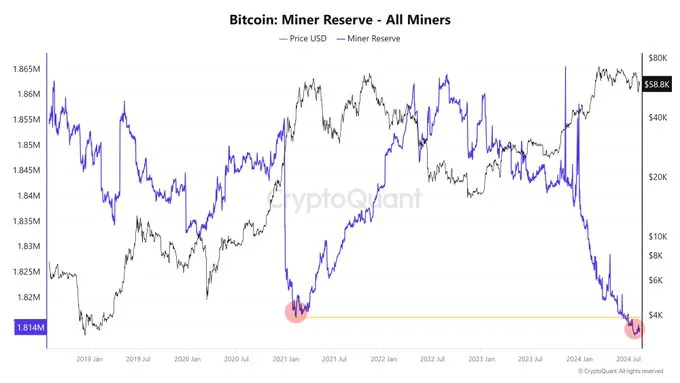

Data from CryptoQuant shows that miners’ reserves are at their lowest level ever, even below when Bitcoin reached its all-time high in 2021. Not all miners are selling, though; Marathon Digital plans to raise $250 million in convertible notes to acquire more Bitcoin.

Bitcoin miners reserve now at an all-time low – CryptoQuant

Bitcoin miners reserve now at an all-time low – CryptoQuant

With the decline in mining revenue and fees, Bitcoin miners appear to be slowing down production. Bitcoin hashrate , the computing capacity available on the network, reached a record high of 700 EH/s on August 15 but has now fallen to 573.11 EH/s after falling by 8.5%. Mining difficulty also fell from 90.66 T to 86.87 T.