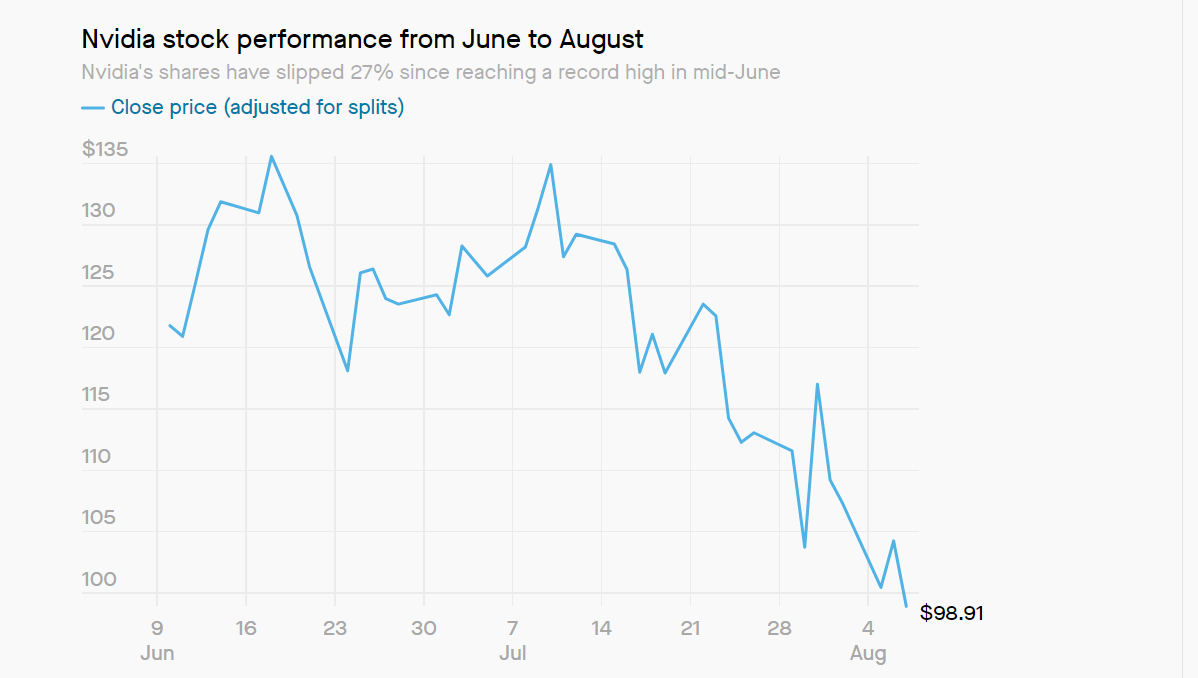

Nvidia, the leading chip maker that has been at the forefront of artificial intelligence, saw its stock price drop significantly after soaring to a record high earlier this year. The company that once boasted a $2 trillion market capitalization and even exceeded $3 trillion now faces high market volatility.

Nvidia’s market value has since dropped significantly, with a decline of $900 billion. Nvidia’s share price topped $135.58 on June 18 after a 10-for-1 stock split and impressive financial results.

Nvidia stock price experiences significant volatility and pullback

The company’s revenue for the first quarter of fiscal year 2025 was $26 billion, a 262% increase compared to the previous year. This was due to the high demand for Nvidia’s chips. However, this meteoric rise was followed by a substantial drop, with Nvidia’s shares having since fallen 27% from their peak.

Nvidia’s market capitalization also dropped significantly within one week after its high, and the company lost more than $500 billion in market value within three trading days. This decline also impacted the European and Asian-based chip makers.

The chip maker faces several challenges from regulators, who have been quite concerned about market competition. Nvidia currently holds about 90% of the artificial intelligence (AI) chip market.

Geopolitical tensions contribute to the recent Nvidia stock decline

Global chip stocks, including Nvidia, declined in July after reports surfaced that the U.S. might impose export restrictions on China. There were reports that the Biden administration was planning to limit the export of advanced chip-making equipment to China.

Further, the sales were sparked by remarks made by the former President of the United States, Donald Trump, regarding Taiwan. Jefferies and Bank of America analysts have noted that the market went overboard with these geopolitical risks.

Nvidia’s stock also declined earlier this week. The company’s shares fell when the market opened following reports that shipments of its Blackwell AI platform could be delayed by at least three months due to design problems. Earlier in the year, during Nvidia’s fiscal Q1 2025 earnings call in May, CEO Jensen Huang said, “We will see a lot of Blackwell revenue this year.”

Nvidia is set to present its earnings report for the second quarter of fiscal year 2025 on August 28, which may shed more light on the company’s financial health and plans.