Grayscale Ethereum ETF outflows hit record low of nearly $40 million

Key Takeaways

- Grayscale's Ethereum ETF experienced its lowest daily outflow.

- Despite mixed performance, the nine ETFs collectively saw net inflows of $98 million on Wednesday.

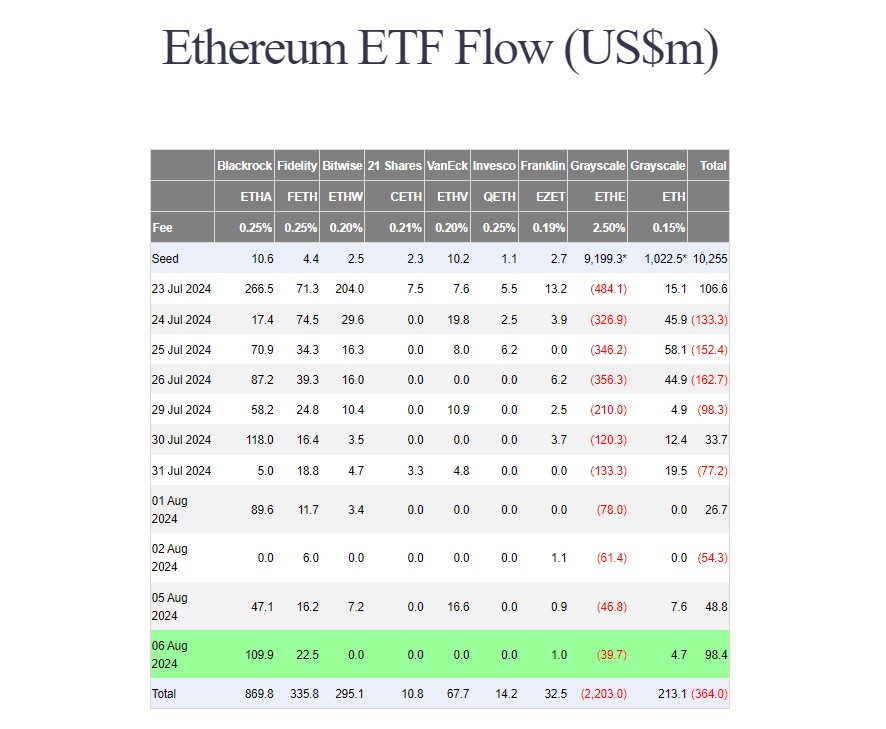

Around $40 million exited the Grayscale Ethereum Trust, now trading as an exchange-traded fund (ETF) on August 6, according to data from Farside Investors. This marks the lowest daily outflow since its conversion from a trust last month.

US spot

Ethereum ETF saw positive flows on August 6

US spot

Ethereum ETF saw positive flows on August 6

The daily pace of outflows from the fund, operating under the ETHE ticker, hit a peak of $484 million on its debut date. ETHE outflows topped $1.5 billion after the first week of trading.

However, the pace of exits has cooled since the start of this week. On Monday, ETHE reported over $61 million in net outflows, followed by approximately $47 million drained on Tuesday. With the new outflows reported on Wednesday, the total ETHE outflows have exceeded $147 million so far this week.

Previously, analyst Mads Eberhardts anticipated a slowdown in ETHE outflows this week. He also suggested a potential price increase after outflows stabilized.

US spot Ethereum ETFs are experiencing a mixed trend due to slower inflows into the majority of funds. BlackRock’s iShares Ethereum Trust (ETHA) has been the most successful among others in the group. The ETF ended Wednesday with almost $110 million in net inflows, bringing the total to nearly $870 million since its launch.

Overall, the nine funds took in a net $98 million in cash on Wednesday. Fidelity’s Ethereum (FETH) fund followed BlackRock with $22.5 million in inflows. Other gains were also seen in Grayscale’s Ethereum Mini Trust (ETH) and Franklin Templeton’s Ethereum ETF (EZET).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.