- Bitcoin long-term holders control 45% of the network’s wealth, a historically high level.

- Mt. Gox creditor distributions have not significantly impacted Bitcoin’s market resilience.

- HODLing behavior is on the rise, with more coins maturing into long-term holder status.

Recent analysis of Bitcoin market dynamics reveals a significant trend among long-term holders (LTHs). As of July 26, 2023, LTHs control approximately 45% of the network’s Bitcoin wealth. This level is relatively high compared to historical macro cycle tops. This trend suggests that these investors are patiently HODLing their coins, waiting for higher prices before selling.

The Mt. Gox creditor distribution has been a major event for the Bitcoin industry. After a prolonged legal process, creditors are finally receiving Bitcoin from the infamous exchange hack. Out of the 142,000 BTC recovered, 59,000 BTC have been distributed via Kraken and Bitstamp. Despite this large distribution, the Bitcoin market has shown resilience. The sell-side pressure remains within typical ranges, indicating that many creditors might still be HODLing their coins.

A comparison of large entity sell-side volumes shows that Mt. Gox distributions are larger than ETF inflows, miner issuance, and government sell-offs. The German government sold over 48,000 BTC in one month, but the market absorbed this supply and rallied. This resilience suggests strong demand and an inclination towards HODLing among creditors.

The Realized Cap HODL Wave metric shows that the wealth held by new investors is declining. This shift indicates a return to HODLing behavior and a slowdown in new demand since the $73,000 all-time high (ATH). Investors who acquired coins earlier in the year are HODLing them, causing these coins to mature into senior age bands.

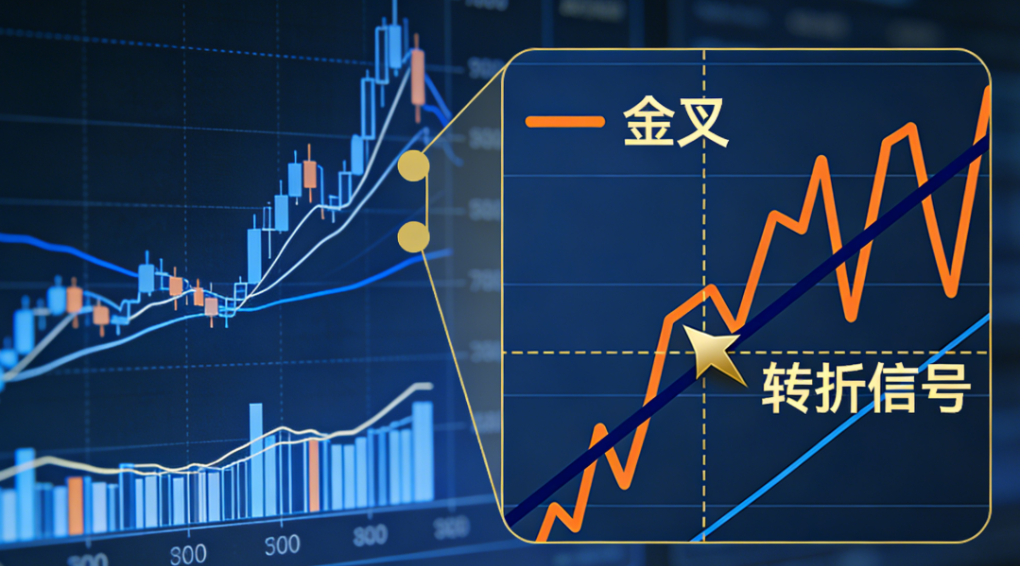

An analysis of long-term and short-term holders reveals a divergence. The supply held by long-term holders is increasing, while that held by short-term holders is declining. Coins acquired before late February 2024, when the Bitcoin price was around $51,000, are now moving into LTH status. This trend is likely to continue, with more coins transitioning into the LTH category.

The LTH Binary Spending Indicator shows that distribution pressure from long-term holders is light and declining. This supports the thesis that the Bitcoin supply is dominated by high-conviction, long-term investors. These investors prefer to HODL their coins, waiting for market strength before considering any significant sell-off.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.