MicroStrategy, the world’s largest public Bitcoin (BTC) holder, filed a regulatory filing on August 1 seeking $2 billion in capital to double down on its crypto strategy.

In a regulatory filing with the United States Securities and Exchange Commission (SEC), the Virginia-based corporation stated that it intends to raise $2 billion by selling class A shares.

While the exact timing for selling these shares has not been disclosed, the filing s tates that the profits will be used for “general corporate purposes, including the acquisition of Bitcoin.”

The company also did not clarify how much of the earnings will be used for Bitcoin purchases, claiming that it has not established the amount of net proceeds “to be used specifically for any particular purpose.”

The filing coincides with MicroStrategy’s second-quarter financial earnings report. The corporation reported acquiring 12,222 BTC during the quarter, spending more than $805 million at an average price of $65,880 per BTC.

The company’s most recent buy takes its total Bitcoin holdings to 226,500 BTC, which cost $8.3 billion as of July 31. MicroStrategy also introduced a new KPI called “BTC Yield,” which aims to achieve 4-8% annual returns over the next three years.

MicroStrategy faces financial challenges

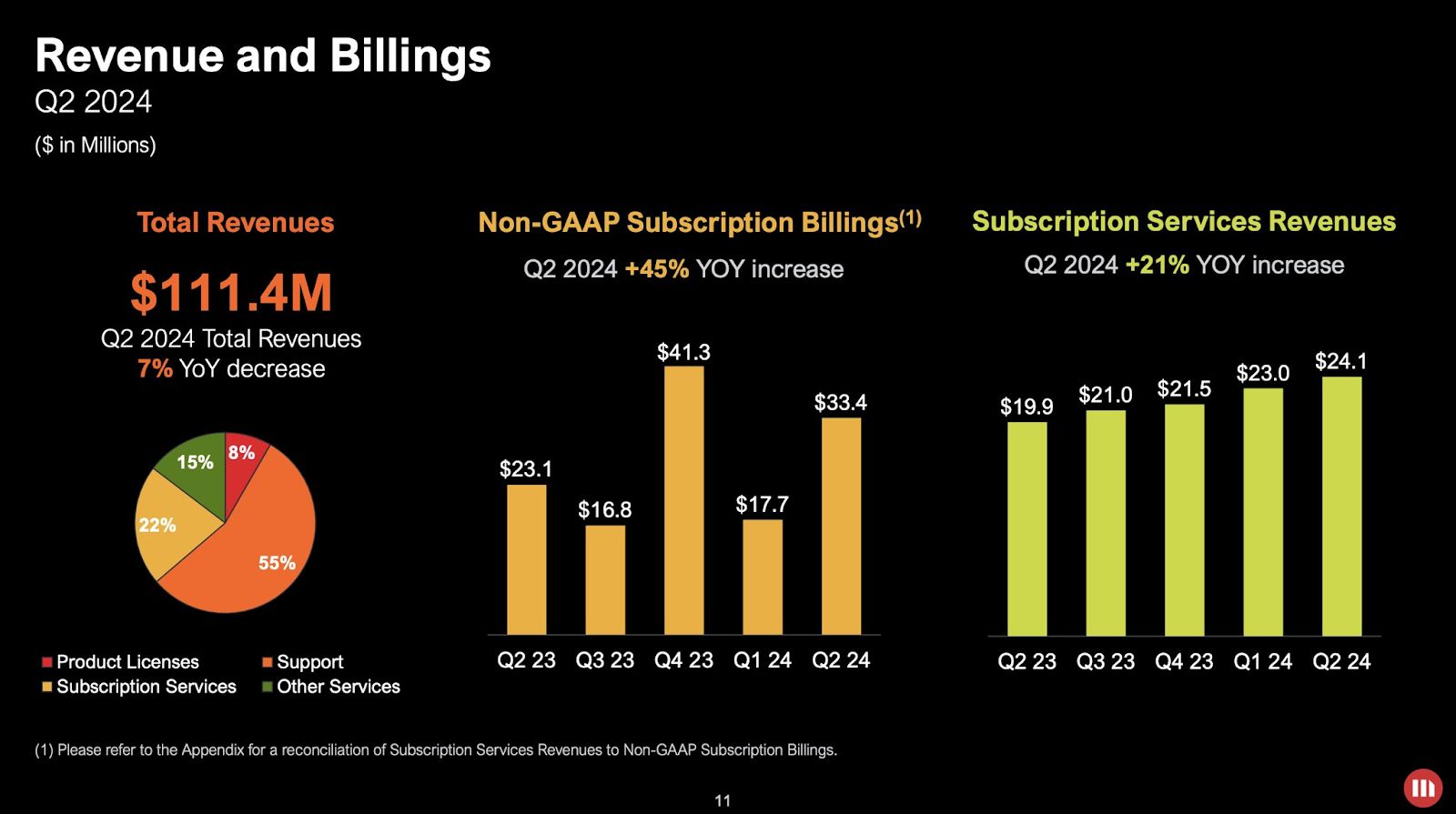

In its Q2 earnings call, MicroStrategy reported huge losses of $5.74 per share on quarterly sales of $111.4 million, a 7% decrease year on year.

According to Bloomberg survey data, this fell far short of analyst forecasts, which called for a quarterly loss of $0.78 per share and revenue of $119.3 million.

Notably, the company reported a net loss of $123 million for Q2, a little improvement over its net loss of $137 million in the same quarter last year. Analysts are paying more attention to MicroStrategy.

MicroStrategy Q2 Revenue. Source: MicroStrategy

MicroStrategy Q2 Revenue. Source: MicroStrategy

MicroStrategy’s Bitcoin stockpile has grown to about $15 billion in recent years, making it the largest corporate holder of the digital asset. However, the software firm’s revenue has stagnated.

This year, the company will incur around $45 million in interest expenses and $20 million in cash taxes and will earn approximately $82 million before taxes. Due to liquidity shortages, analysts expect that the corporation will postpone issuing new notes to purchase more Bitcoin until next year.

Despite nearly doubling the value of the firm’s Bitcoin assets, the tokens have no impact on the top or bottom lines because they generate no revenue.

So far, most investors have shown concern about MSTR’s cash flow. The company’s stock has risen 156% this year, beating the roughly 50% increase in Bitcoin’s price during the same period.