After the launch of the ETF, what other long-term catalysts does Ethereum have?

Original author: The DeFi Investor

Original translation: TechFlow

Ethereum’s Future Outlook

The spot Ethereum ETF is finally available.

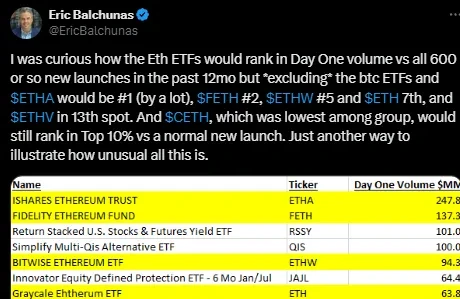

Judging from the initial trading volumes, the launch has been quite successful.

However, as we can see, ETH started to fall after the launch.

In this article, I will discuss the reasons behind this, the future trend of ETH price, and two important catalysts that Ethereum is about to usher in.

My expectations for ETH price movement

I think there are two main reasons why ETH is currently underperforming BTC:

The launch of the spot ETH ETF was a “sell the news” event: This phenomenon also occurred in the short term after the launch of the spot BTC ETF.

Since the spot ETH ETF was approved months ago, everyone who wanted to buy ETH had plenty of time to do so. Therefore, catalysts that are known in advance tend to become “sell the news” events.

The launch of the ETH ETF unlocks $9 billion in ETH in the Grayscale Ethereum Trust: these ETH have been locked up for years, and now holders can finally sell them, so many people are selling.

So how long will it take for this decline to end?

In the case of BTC, the spot BTC ETF bottomed out about two weeks after its launch. Afterwards, the price moved sideways for a few days before hitting a new all-time high.

If demand for spot Ethereum ETFs is high in the coming weeks, a similar situation could also occur with ETH. But for this to happen, net flows into the ETH ETF would need to turn positive.

For example, yesterday the ETH ETF saw $133 million in outflows due to selling pressure from the Grayscale Ethereum Trust.

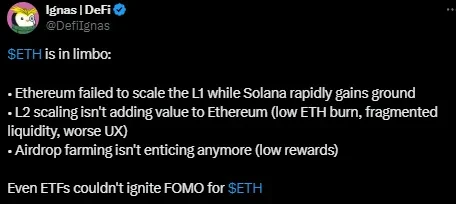

There are also some legitimate concerns about ETH in the short term:

Ethereum’s Upcoming Catalyst

I also want to touch upon two important catalysts coming to Ethereum.

The first is the approval of Ethereum ETF staking. This could significantly increase demand for spot Ethereum ETFs. Although the annual ETH staking yield of about 3.2% does not seem like much, due to the low annual inflation rate of ETH and the fact that staking can earn returns, this may make ETH more attractive to some institutions than BTC.

According to the SEC commissioner , the Ethereum collateralized ETF “can always be reconsidered,” so its approval is only a matter of time.

The second catalyst is the release of Pectra, Ethereum’s next hard fork. This major upgrade is expected to take place in late Q4 of this year or Q1 of 2024. Pectra will introduce several major changes:

Making Ethereum account addresses more programmable

Increase the maximum stake for ETH validators from 32 to 2048 ETH

By making Ethereum account addresses more programmable, Pectra will bring significant on-chain user experience improvements.

For example, it will support batch sending of transactions, develop social recovery features for wallets, and allow dApps to pay users’ gas fees. Such user experience upgrades are what cryptocurrencies need to achieve mass adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.

PFDEX Makes a Grand Debut at the PopChain Global Ecosystem Conference in Hong Kong

Cathie Wood Revises Bitcoin’s 2030 Forecast: Will Stablecoins Take Over?

In Brief Cathie Wood revises Bitcoin's 2030 target due to rapid stablecoin adoption. Stablecoins serve as digital dollars, impacting Bitcoin's expected role. Trump's crypto-friendly policies encourage Bitcoin's market prominence.