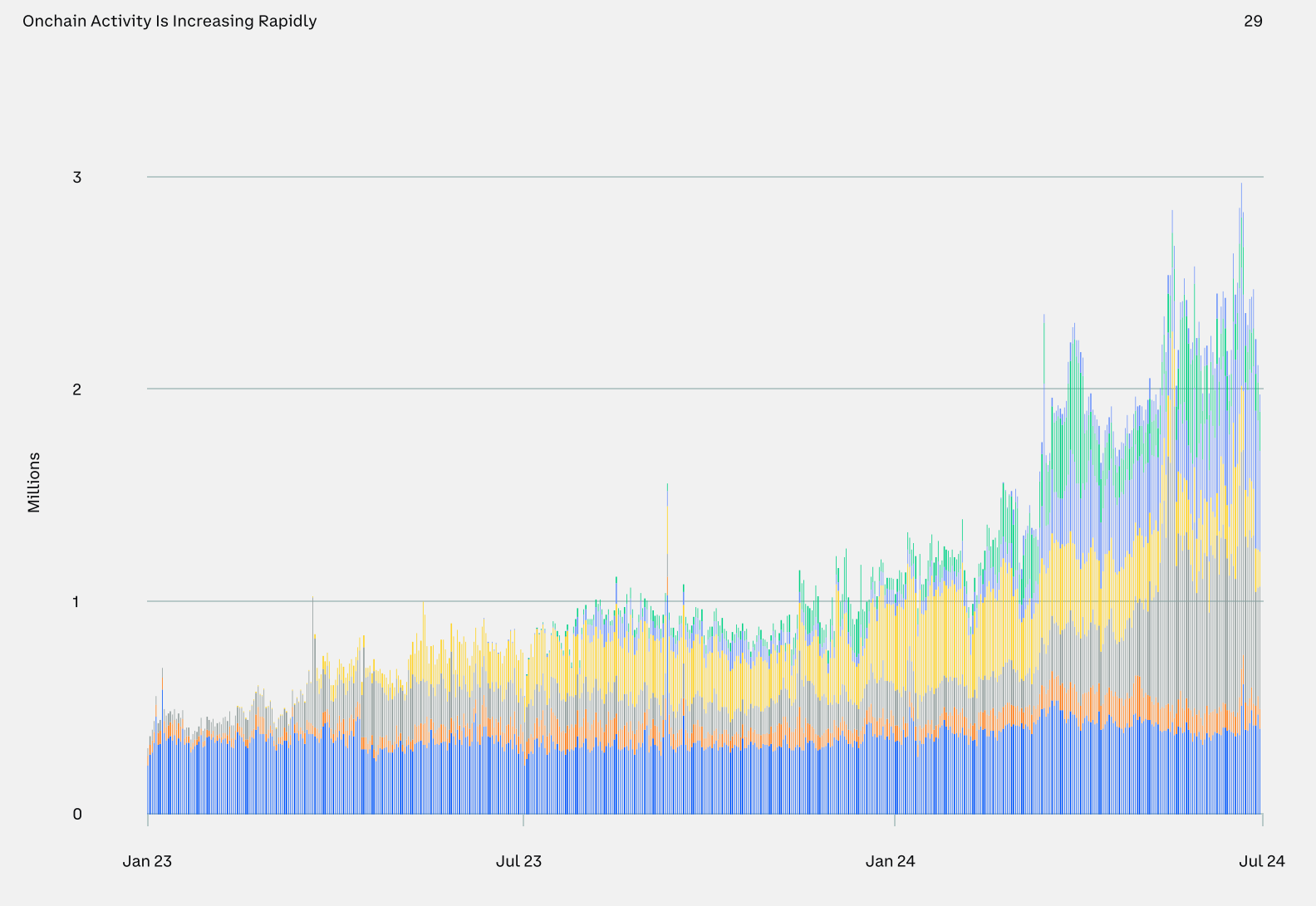

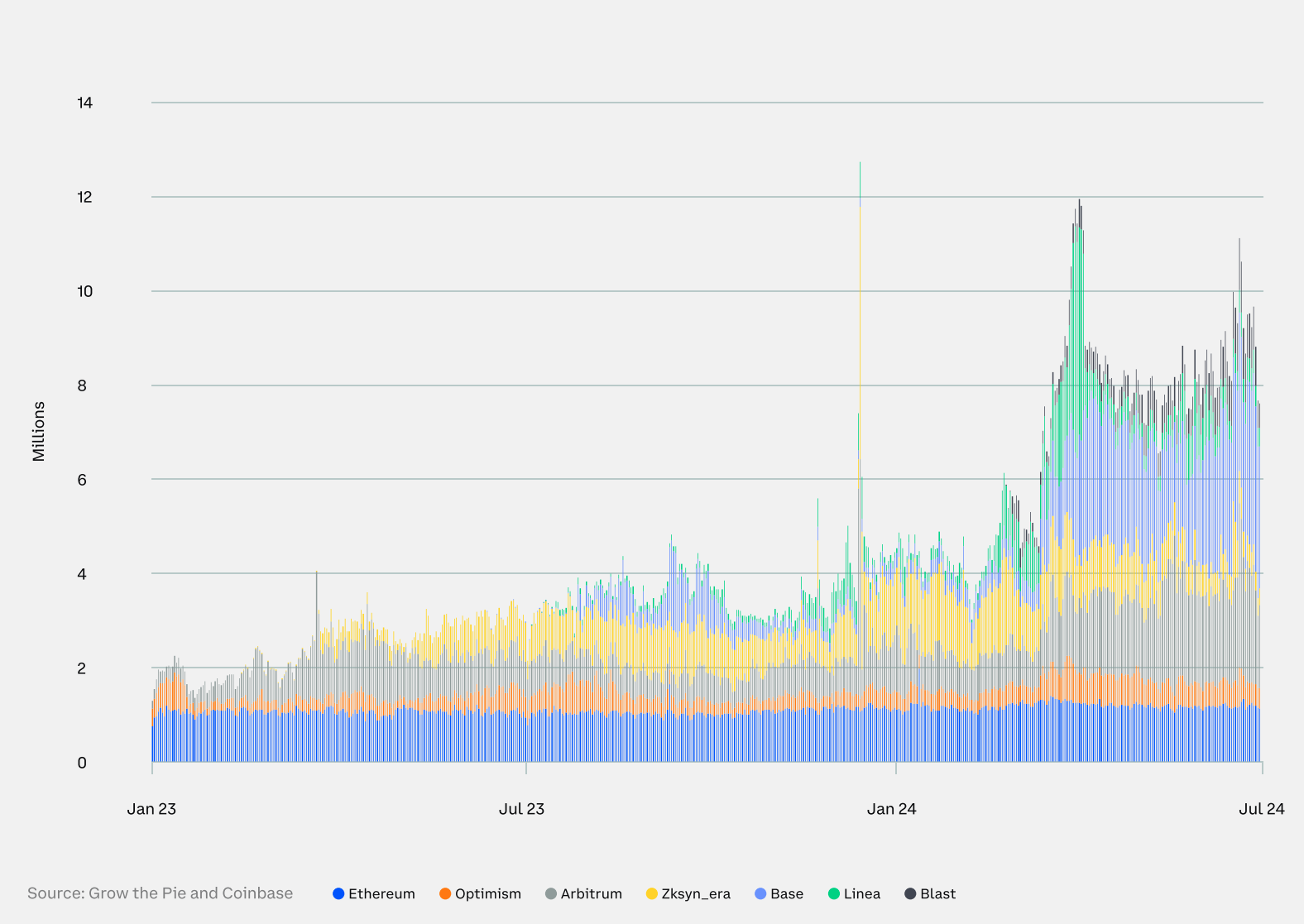

Ethereum and its Layer 2 (L2) solutions are on fire this year, showing a huge 127% increase in daily active addresses. A report by Coinbase and Glassnode reveals that people are flocking to Ethereum and its L2s for reasons like lending, staking, and trading.

So, what’s driving this surge? The short answer: Layer 2 solutions. These are faster and cheaper alternatives built on top of the main Ethereum blockchain.

They’ve become incredibly popular, with their user growth vastly outpacing Ethereum itself. The number of transactions on these L2s jumped by 59% in the second quarter alone.

Plus, even with all this activity, the report shows that transaction fees have dropped by 58% thanks to Ethereum’s Dencun upgrade in March 2024, which slashed fees per transaction.

Ethereum’s market performance

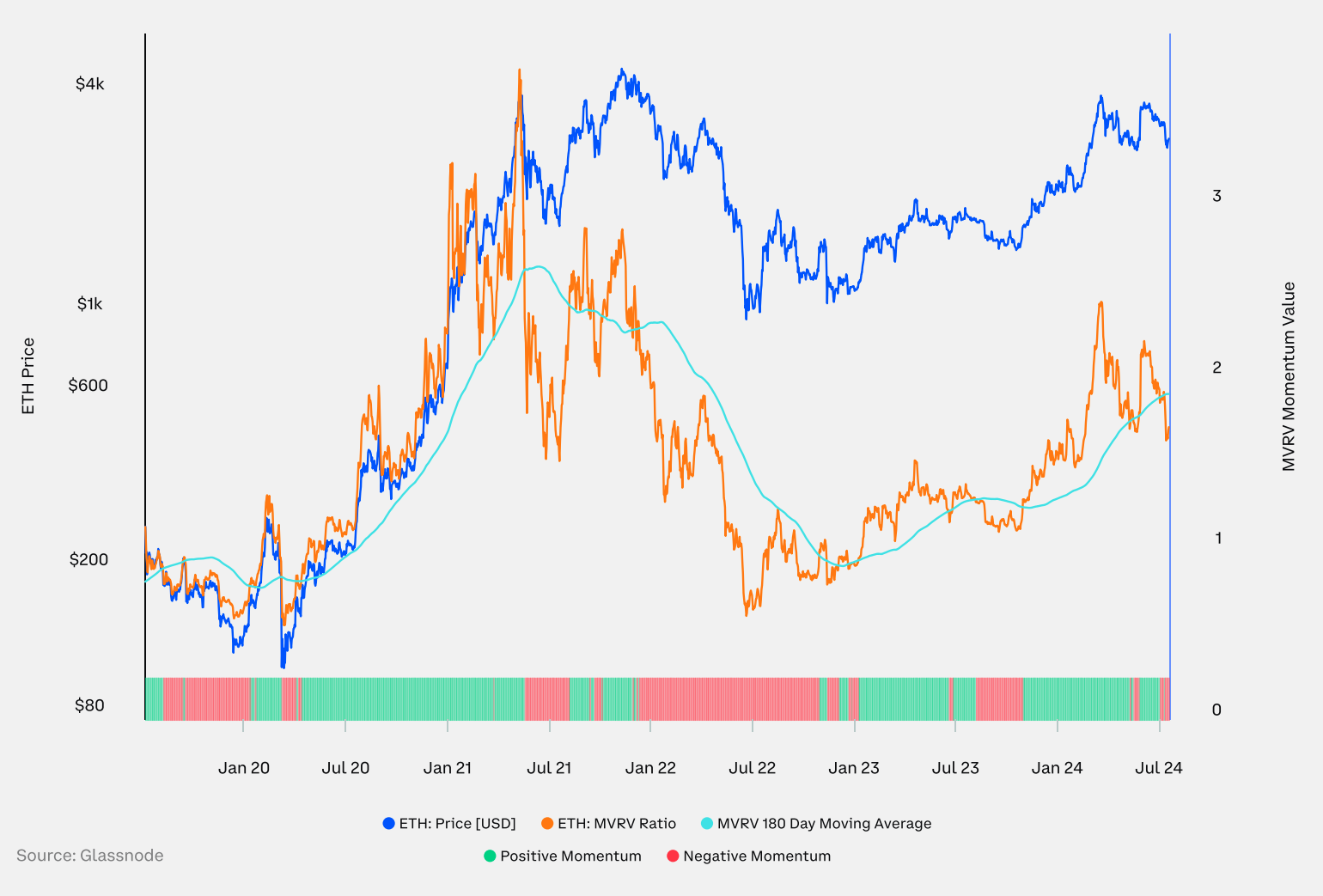

Despite the uptick in activity, the price of ETH saw a 6% drop in the second quarter. But it still did better than Bitcoin, thanks to optimism around spot Ether ETFs and the utility of the network.

ETH has been through two cycles of bull and bear markets. Since hitting its cycle low in November 2022, it’s up over 240%.

This current cycle is looking a lot like the one from 2018-2022, where Ether shot up by 6,000% from its cycle low. Even with a 29% drop in the first half of 2024, it’s not as severe as past cycles, so there could be more room for growth.

Now let’s talk about supply and market phases.

Coinbase and Glassnode point out that crypto market cycles often have three phases: Bottom Discovery, Euphoria, and Bull/Bear Transition. Bottom Discovery happens at the end of a bear market when the share of supply in loss is high.

Euphoria is the bull market phase with a parabolic price rise. The transition period sits between these phases, where supply profitability balances out. Recently, ETH’s volatility increased by 8% in the second quarter after years of trending lower.

Metrics and market dynamics

Realized Price is a key metric here. It’s the average price of ETH’s supply, valued on the day each coin last transacted on-chain.

MVRV, or Market Value to Realized Value, compares the market value (spot price) to the realized value (realized price). An MVRV of 2.0 means the current price is twice the market’s average cost basis. Extreme MVRV values can signal when the market is overheated or undervalued.

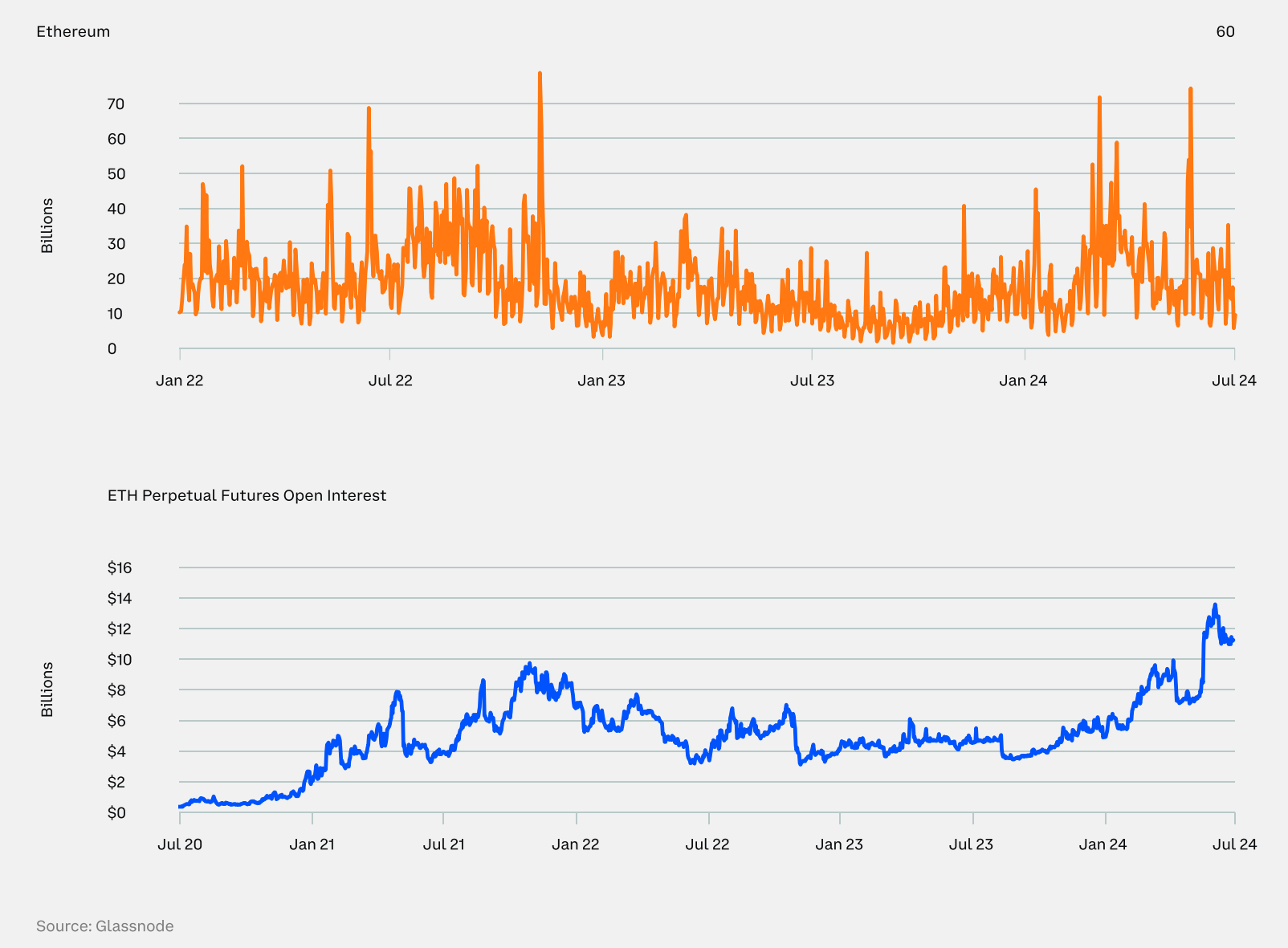

Moving on to ETH Perpetual Futures, which don’t have an expiration date, the volume in these futures dropped by 8% in the second quarter after a 69% rise in the first quarter.

Per the report , open interest in these futures hit a new all-time high in the second quarter, rising by 37% compared to the first quarter. Weekly average open interest in ETH options slipped by 3% in the second quarter after reaching a new high in the first quarter,.