Mt. Gox transfers $3.2 billion in Bitcoin with $150 million to Bitstamp

Key Takeaways

- Mt Gox moved around $3.2 billion in Bitcoin on Tuesday.

- The transfer is part of a $9 billion repayment plan to creditors.

A wallet linked to the now-defunct crypto exchange Mt. Gox transferred $3.2 billion worth of Bitcoin early Tuesday, including 42,587 Bitcoin (BTC), valued at $2.8 billion, to an unidentified address, and almost $150 million in Bitcoin to Bitstamp’s wallet, according to data from Arkham Intelligence.

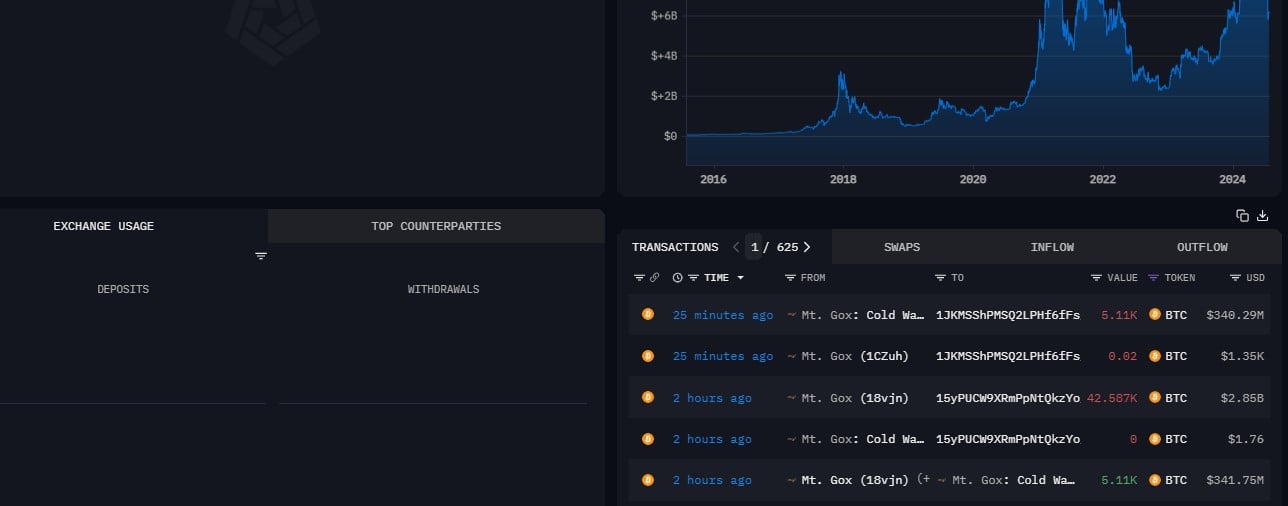

Mt. Gox’s recent wallet activities – Source: Arkham Intelligence

Mt. Gox’s recent wallet activities – Source: Arkham Intelligence

These transactions could be part of an ongoing process to repay $9 billion in Bitcoin to creditors, which was confirmed earlier this month. Mt. Gox’s latest wallet activities follow a number of small Bitcoin transfers made yesterday, including one linked to Bitstamp . Those were believed to be test transactions before major distributions.

Bitstamp is one of the designated exchanges to handle Mt. Gox’s repayments. Other exchanges like Kraken have also received their shares , with Bitbank and SBI VC Trade reportedly distributing the funds to creditors shortly after receipt.

At the time of reporting, Mt. Gox’s Bitcoin holdings are valued at over $6 billion.

The recent transfer led to a sudden drop in Bitcoin’s price, which fell below $66,500 after hitting a high of $68,200 earlier today, CoinGecko’s data shows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.