Ethereum ETFs set for July 23 launch as S-1 forms updated

Key Takeaways

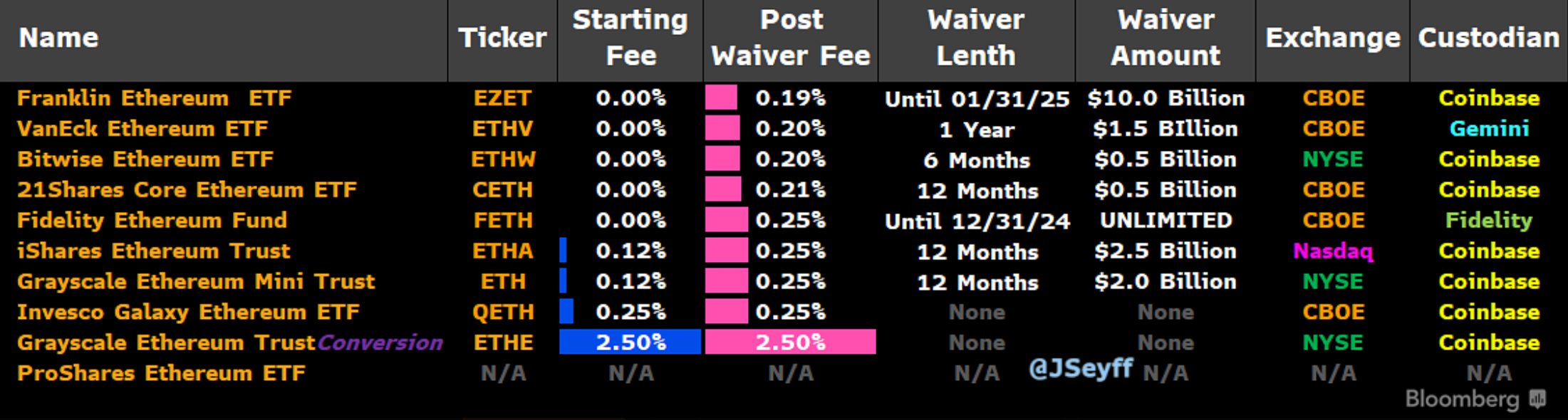

- Most Ethereum ETFs have updated S-1 forms with revised fees, preparing for a July 23 launch.

- Grayscale's ETHE charges a 2.5% fee, significantly higher than competitors offering waiver fees.

All spot Ethereum exchange-traded funds (ETF) got their S-1 forms amended with updated fees, except Proshares, as reported by Bloomberg ETF analyst James Seyffart. This is the last step before the Ethereum ETFs potentially start trading next Tuesday, July 23rd, as predicted by James’ fellow analyst Eric Balchunas.

Image: James Seyffart/Bloomberg Terminal

Image: James Seyffart/Bloomberg Terminal

Notably, Balchunas and Seyffart doubled down on X after the updated S-1 forms were filed that the “Ethness Stakes” would start next week.

https://twitter.com/EricBalchunas/status/1813697086241571086

Seyffart pointed out that seven out of 10 ETFs have waiver fees, which is a discount given by the asset manager on ETF trading fees for a determined period. Fidelity, Bitwise, VanEck, Franklin Templeton, and 21Shares will concede up to a year of zero trading fees.

The 2.5% fee charged by Grayscale on their converted trust ETHE draws attention, as it is 10 times higher than the fees charged by their competitors. As explained by Seyffart, the asset manager will divest 10% of the shares from the trust to the ETF, which means that a potential heavy outflow would benefit them.

Moreover, despite charging 0.25% fees on their “Ethereum Mini Trust,” Balchunas assessed that this probably won’t make Grayscale competitive in the Ethereum ETF run.

“Cheap but not sure cheap enough to move the needle (as most are cheaper and brand name BlackRock is same fee) to attract organic flows to offset The Big Unlock. And do these newborns have enough strength to offset those outflows a la btc,” he added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot Weekly Report | Polkadot Hub launches user growth plan! Hydration TVL surpasses $250 millions!

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.