- BTC and ETH lead altcoins in perpetual futures market volume and available derivatives instruments.

- The number of newly listed perpetual futures instruments has doubled over the past year.

- In the spot market, altcoins compete fiercely with Bitcoin and Ethereum.

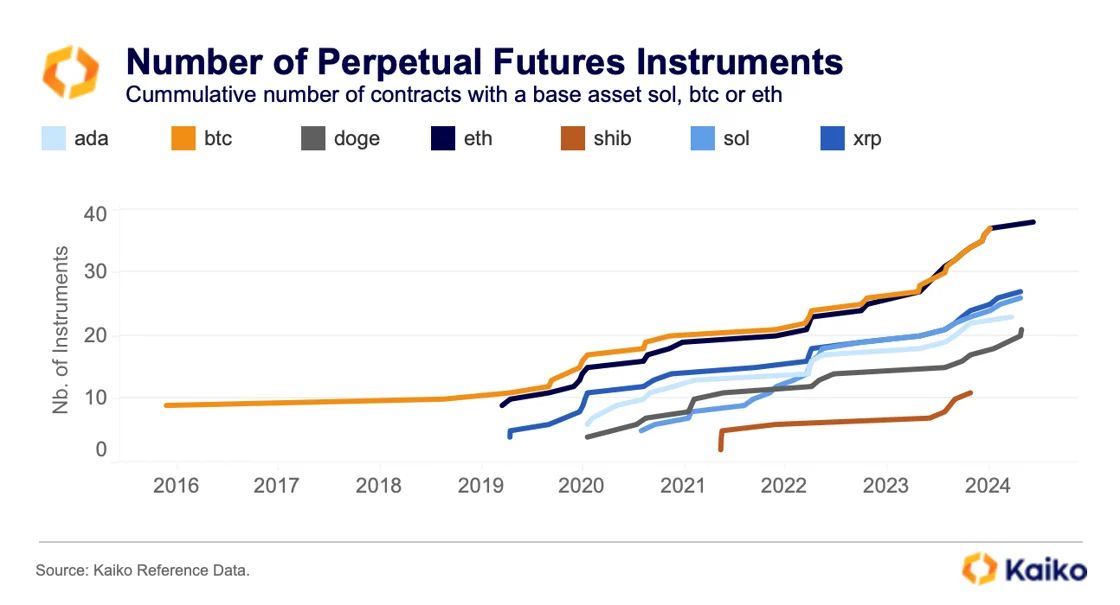

Bitcoin (BTC) and Ethereum (ETH) remain the undisputed champions of the perpetual futures market, outpacing altcoins in trading volume and the number of available derivative instruments.

According to recent data from Kaiko, a leading data analytics platform, the two largest cryptocurrencies have consistently maintained a significant lead over their smaller counterparts.

Large-cap altcoins such as Solana (SOL), Cardano (ADA), XRP , and Dogecoin (DOGE) have recently seen an increase in the number of available perpetual futures contracts. However, the gap between these altcoins and BTC and ETH has widened.

Kaiko noted that perpetual futures is a crucial tool for traders that enable hedging and speculation on assets, ultimately driving price discovery. A consistent trend over the years has seen BTC and ETH maintain a significant lead over other cryptocurrencies in terms of the number of available contracts.

The decline of altcoin perpetual futures listings on exchanges began in May 2022, following the collapse of Terra , which led to a decline in speculative demand and market participation.

However, this trend has reversed over the past year, with the number of newly listed perpetual futures instruments rising by double digits. Despite this uptick, BTC and ETH continue to reign supreme. It solidifies their position as the go-to assets for traders looking to hedge and speculate on the market.

Meanwhile, in the spot market, prominent altcoins have been fiercely competing with Bitcoin and Ethereum amid the recent resurgence of bullish momentum. Bitcoin has grown by 11% over the last seven days, reaching a high of $66,101 today.

Similar double-digit percentage growth is observable for Ethereum, Solana, and Cardano. Meanwhile, XRP’s price gains have been even more impressive, registering a 38% increase this week alone to reclaim a four-month high of $0.61.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.