I. Project introduction

MANTRA is a security-first Layer 1 blockchain that focuses on compliance and management of real-world assets (RWA). MANTRA aims to provide an efficient, secure, and regulatory-compliant platform for the DeFi ecosystem, and provides a variety of Financial Services, including staking, lending, trading, and governance, to meet the needs of different users and promote the development of decentralized finance. Through MANTRA Chain, users can seamlessly manage and trade assets in a decentralized environment.

MANTRA Chain is the core of the MANTRA ecosystem, built on the Cosmos SDK, and is a high-performance, low-cost blockchain. Its design focuses on security and compliance to ensure compliance with regulatory requirements around the world. MANTRA Chain uses the Tendermint consensus mechanism to provide fast transaction confirmation and high throughput, ensuring platform stability and reliability.

II. Project highlights

1. Focus on compliance. ANTRA focuses on the management of real-world assets (RWA) to ensure that the platform can comply with regulatory requirements around the world. Through compliance frameworks and tools, MANTRA provides a safe and legal trading environment, while ensuring the security of user assets and transactions through multi-level security measures and smart contract audits.

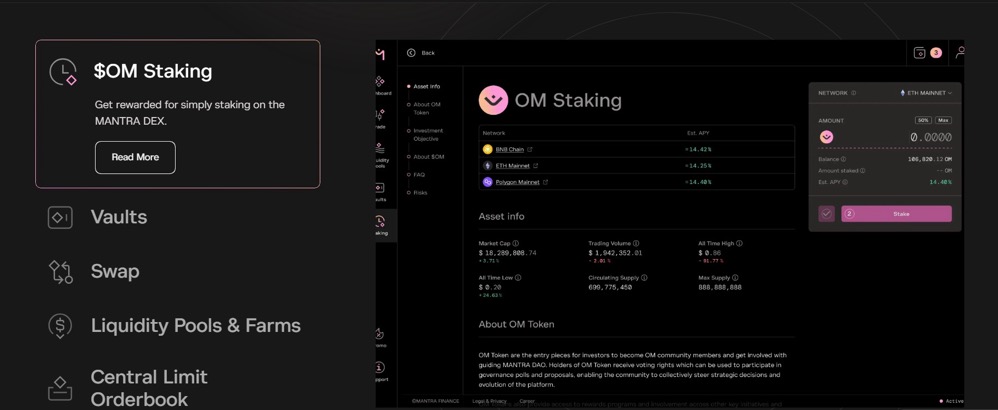

2. Cross-chain compatibility. MANTRA supports multiple blockchain networks, including Ethereum, Binance Smart Chain, and Polkadot. Cross-chain bridges allow assets on different chains to flow freely within the MANTRA ecosystem, increasing user flexibility and convenience.

3. Efficient staking mechanism and lending platform. MANTRA provides multiple staking options, and users can earn OM token rewards by participating in staking. The staking mechanism is designed flexibly, supports multiple assets, and provides a transparent reward distribution mechanism.

MANTRA's lending platform allows users to borrow or lend encrypted assets. Borrowers can borrow funds at a certain interest rate, while lenders can earn interest by providing liquidity. The platform design focuses on security and adopts an over-collateralization mechanism to reduce default risks.

4. Provide token service function. MANTRA Token Service ("MTS") is a powerful and flexible SDK (using Golang + NodeJS) that enables Web3 enterprises to create, publish, distribute, and manage their own digital assets on the MANTRA network.

One of the key features of MTS is that it allows companies to create digital assets that comply with various regulatory frameworks, such as those for legal tender, securities, commodities, or other financial instruments. This can make it easier for companies to create and trade assets regulated in different jurisdictions. At the same time, adopting a permission model means that only approved entities can create, manage, or transfer tokens on the platform. This helps ensure responsible use of the platform and compliance with relevant laws and regulations.

III. Market value expectations

Coinmarketcap data shows that OM's current market value is around $840 million, with a token circulation of 93.45%. OM is in the "compliance" and "real-world asset (RWA) " tracks that the market is optimistic about, and has been widely favored by traditional Financial Institutions. MANTRA Chain supports the digitization of real-world assets, meeting the demand for compliance and transparency. With more traditional assets entering the blockchain field, it is expected that the market demand for OM will further increase, and it has market speculation expectations.

Meanwhile, the latest news is that Mantra has partnered with UAE real estate giant MAG to tokenize $500 million real estate assets, which is the largest collaboration in the RWA field to date. Previously, the media also announced that UAE's regulated Zand Bank is collaborating with MANTRA to tokenize real estate. These important partnerships to some extent indicate MANTRA's leading position in the RWA track. This may also be one of the reasons why OM tokens remain strong in the short term.

Overall, the OM track concept is good, favored by institutions, and the partners have strength or long-term potential.

IV. Economic model

OM is the native token of the Mantra ecosystem. It has the following main uses: Users can stake OM tokens to participate in various DeFi activities on the Mantra platform, including lending and earning rewards. By staking OM, users can access various financial tools and services on the platform and enjoy related economic incentives.

OM token holders have the right to vote on proposals that affect the future development of Mantra. This means that users holding OM tokens can participate in the platform's governance process, vote on proposals, and express their opinions on the platform's development direction.

The total token supply of MANTRA DAO is 888,888,888 OM.

Among them, 75.6 million OM (8.5%) were sold during the pre-sale and "initial membership sale" period starting in July 2020. Another 80 million (9%) were allocated to private publishers with a six-month vesting period.

The remaining token allocation is as follows:

155.60 million OM (17.5%) is used for teams and consultants, with one eighteenth circulating every 30 days.

266.70 million OM (30%) is used for staking rewards, most of which will be released in about five years with a non-linear decay growth function.

111.10 million OM (12.5%) is used to fund referral programs, most of which will be rolled out in a linear pattern over approximately five years.

88.90 million OM (10%) for reserves, most of which will be released in a rolling linear pattern over five years.

111.10 million OM (12.5%) was used to fund protocol development programs.

In addition, according to the white paper, users need to send 1 OM to the wallet of MANTRA DAO to enter MANTRA POOL.

V. Team and financing

The MANTRA DAO team is composed of a group of experienced blockchain and financial industry professionals, including CEO John Patrick Mullin and others. The team members have extensive experience in blockchain technology, Financial Services, and entrepreneurship.

In terms of financing, MANTRA completed a financing round worth $11 million in March, led by Shorooq Partners, a well-known venture capital firm in the Middle East and North Africa region. This financing will help MANTRA promote its tokenization solution for real-world assets globally and further develop its blockchain technology and ecosystem

In May, MANTRA announced the completion of a new round of strategic financing, with participation from Laser Digital, a digital asset subsidiary of global Financial Services giant Nomura Securities. This round of financing aims to accelerate MANTRA's goal of building a RWA Layer 1 blockchain in the Middle East and Asian markets. The specific financing amount and valuation have not been disclosed yet.

VI. Risk Warning

1. The cryptocurrency market is volatile, and large price fluctuations may lead to investment losses. Therefore, cautious decisions should be made and market risks should be fully understood.

2. Smart contracts and DeFi platforms may have technical vulnerabilities, and attention should be paid to security risks.

VII. Official link