Token Price Plunges 15% After Hack – User Loses $8 Million

On July 3, the Bittensor (TAO) blockchain was temporarily suspended due to an attack on several user wallets, resulting in at least one of them losing $8 million.

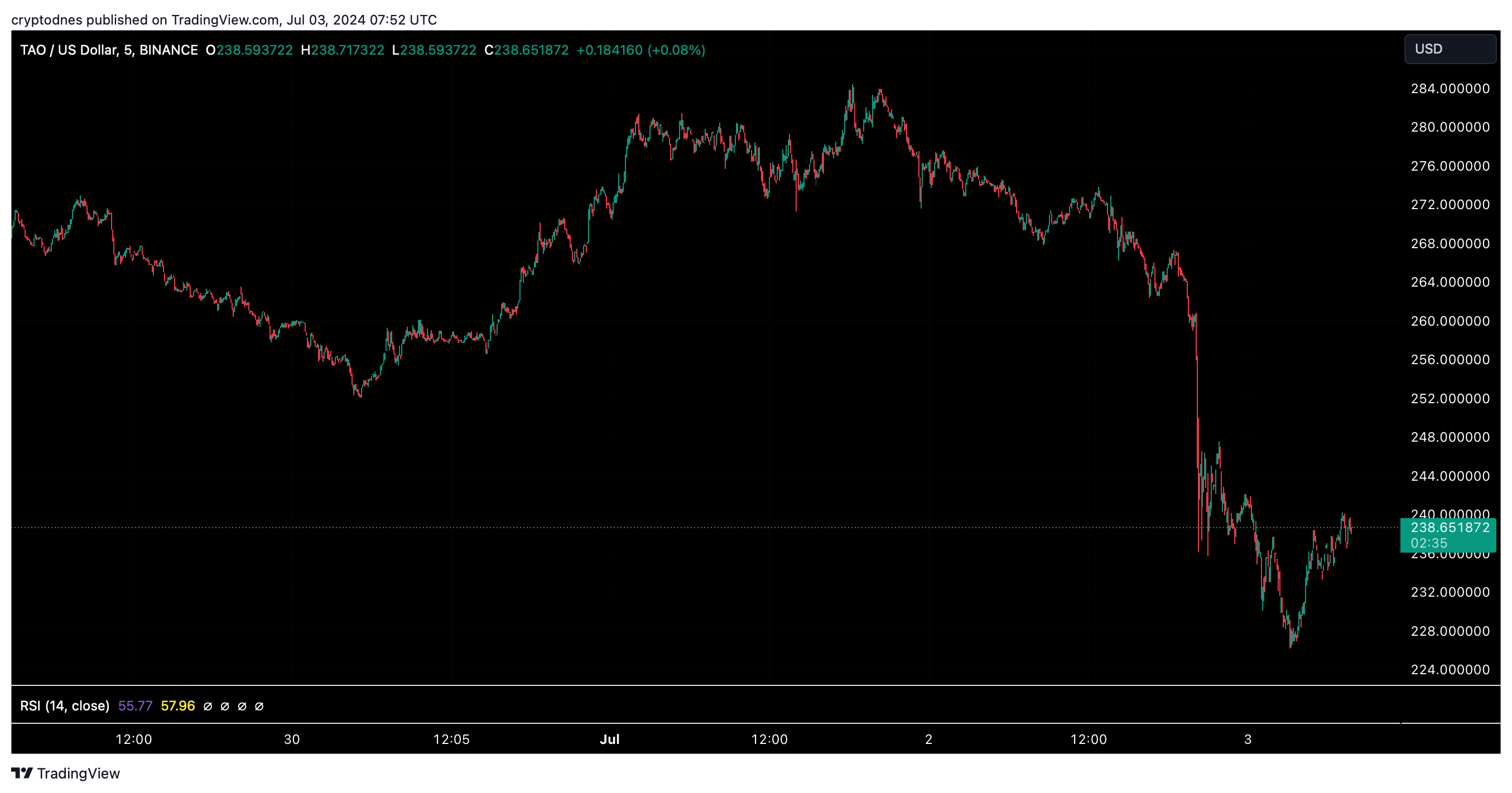

Following the attack, TAO ‘s price dropped by as much as 15% to $227, but has recovered slightly to $238 at the time of writing, and the platform has assured that measures are in place to prevent further incidents.

“We are conducting an investigation and out of an abundance of caution have completely halted transactions on the chain until we receive more information about the attack,” a member of Bittensor’s core team wrote on the project’s Discord channel.

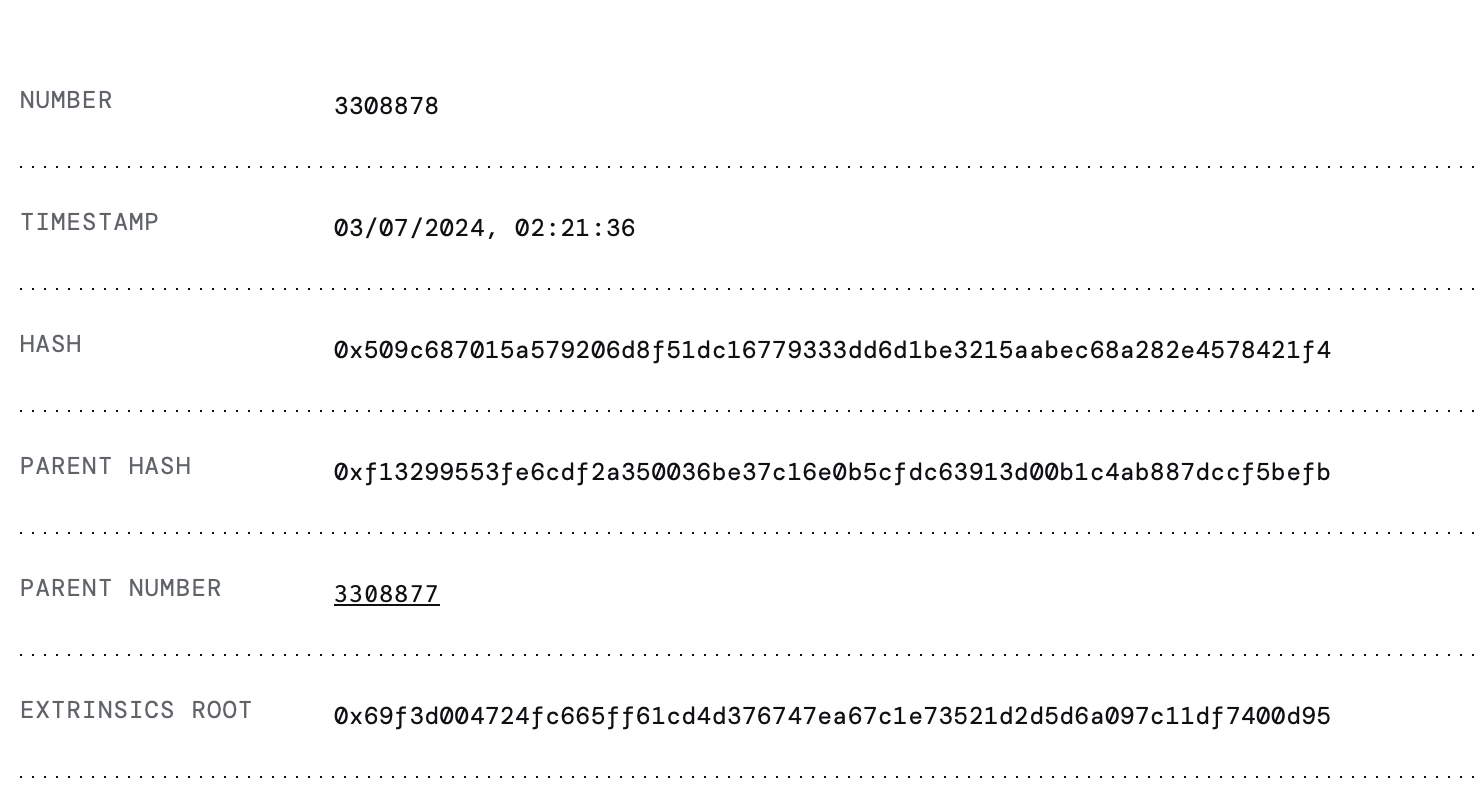

Later, co-founder Ala Shaabana confirmed on X that the chain had been put into “safe mode,” meaning that while blocks were still being produced, no transactions were being processed.

Blockchain trackers for the Bittensor network indicated that the last transactions and blocks were processed around 2:20 a.m. EDT on June 3.

Independent security analyst ZachXBT reported on his Telegram channel that one user lost 32,000 TAOs, valued at $8 million at the time, and suggested that a private key leak may have caused the attack.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens