Bitcoin sinks under $60,000 as $157 million in long positions are liquidated

Key Takeaways

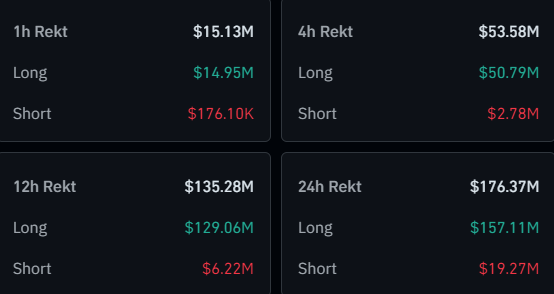

- Bitcoin fell 4.4% in 24 hours, dropping below $60,000 and triggering $157m in long position liquidations.

- Market concerns stem from potential Mt. Gox creditor sell-offs and Fed Chairman Powell's remarks on US economic instability.

Bitcoin (BTC) is down 4.4% in the past 24 hours after losing the $60,000 price floor today, according to data aggregator CoinGecko. This movement prompted a price slump in the whole market, resulting in nearly $157 million in long positions being liquidated intraday.

Image: Coinglass

Image: Coinglass

The negative performance of Bitcoin and other crypto could be tied to the looming fears of a Mt. Gox creditors’ sell-off this month, and a potential negative reaction to Jerome Powell’s remarks yesterday about the US economy.

As reported by Crypto Briefing, a CoinShares study highlights that the fear of a huge BTC sell-off by the repayment of Mt. Gox creditors might be exaggerated. The worst-case scenario shared in the study reveals a single 19% daily drop in price, although CoinShares analysts find this outcome to be unlikely.

Moreover, the speech by the Chairman of the Federal Reserve yesterday, in Portugal, raised some concerns among investors. Highlights from Powell’s remarks are the budget deficit being “very large and unsustainable,” the unemployment rate at 4% is still very low, and the Fed is not confident enough to cut interest rates.

This paints a picture of continuous economic instability in the US and leaves the market wondering how long it will take for the first interest rate cut. Therefore, this impacts crypto directly, as risk assets need both smaller interest rates and an optimistic landscape to become more attractive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.