Bitget Contract Market Update

In the past 24 hours, the total open interest and trading volume of BTC and ETH contracts have both declined. The total liquidation amount for BTC ($23.38 million) was higher than that for ETH ($23.92 million), with more short liquidations for BTC and more long liquidations for ETH. The long/short ratio for both is nearly equal, with BTC at 49.86%/50.14% and ETH at 49.45%/50.55%.

Bitcoin Contract Update

BTC Total Open Interest: $32.1 billion (-1.86%)

BTC Trading Volume (24h): $41.35 billion (-22.74%)

BTC Liquidation Volume (24h): $9.29 million (long) / $14.09 million (short)

Long/Short Ratio: 49.86%/50.14%

Funding Rate: 0.0089%

Ethereum Contract Update

ETH Total Open Interest: $15.06 billion (-0.38%)

ETH Trading Volume (24h): $18.56 billion (-5.82%)

ETH Liquidation Volume (24h): $12.90 million (long) / $11.02 million (short)

Long/Short Ratio: 49.45%/50.55%

Funding Rate: 0.0078%

---

Top 3 OI Surges

BLAST: $138,460 (+11525.92%)

RAD: $3.83 million (+811.70%)

LADYS: $121,750 (+46.75%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

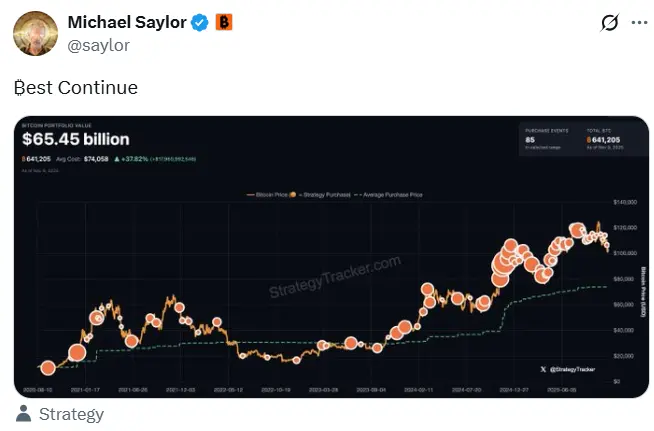

Michael Saylor releases Bitcoin Tracker information again, may disclose additional holdings data next week

BNB Chain: Fourier hard fork version has been released and is scheduled to go live on the testnet on November 10

Visa and Mastercard to reach settlement with US merchants to lower credit card payment fees

MIT brothers' $25 million Ethereum fraud trial declared a mistrial