EtherMail (EMT): Decentralized E-mail System

Project Introduction

EtherMail (EMT) is building a bridge between Web2 and Web3 through email, returning full inbox ownership, control, and sovereignty to users. To solve the problem of users' cluttered inboxes and irrelevant ads, EtherMail is building a new email system that respects user privacy and time.

EtherMail's unique platform allows users to control what they see and profit from promotions, achieving a win-win situation for users and advertisers. By using EtherMail, users can turn their inboxes into a passive source of income.

EMAIL token ($EMT) is the native token in the EtherMail ecosystem, which fairly rewards users who participate in consensus marketing activities and has the following utilities:

1. Token rewards: Active participation in consensus marketing activities can earn $EMT.

2. Consensus marketing and artificial intelligence: Artificial intelligence algorithms analyze preferences to provide resonant content, giving full control over the promotional content received.

3. Advanced features: Access advanced features and services within the EtherMail platform and unlock advanced features.

4. Ecosystem Growth: $EMT is used to incentivize developers to build and integrate decentralized applications (dApps) to complement and improve the platform.

EMT is different in that

1. Actual Utility: EMT allows users to be rewarded for their time spent and access advanced features.

2. User-based attribution: Unlocks are based on the number of actual users.

3. Benefit redistribution: therMail reinvests at least 50% of all advertising revenue to its users in the form of EMT.

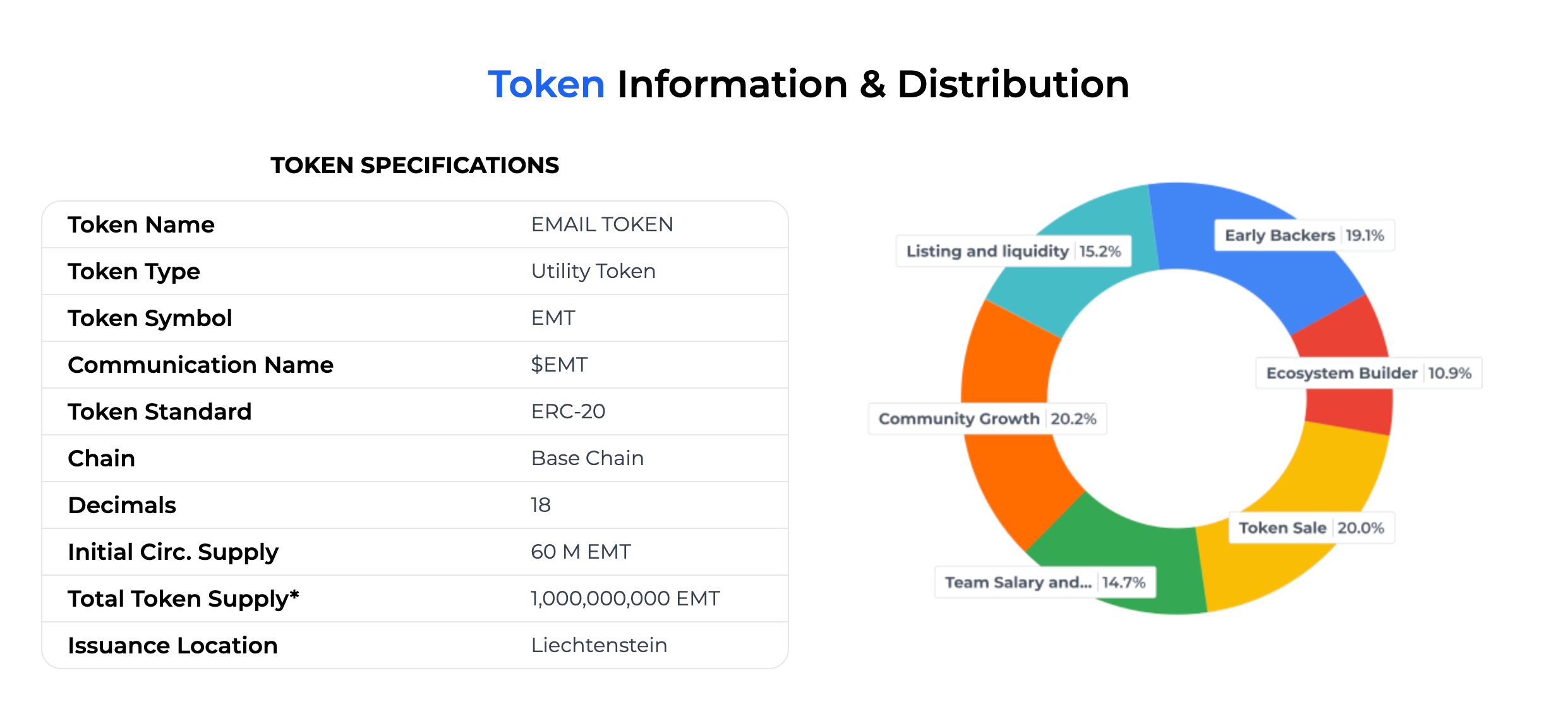

Token Economics

The total amount of EMT tokens is 1 billion, released on the Base chain, of which:

19.1% is allocated to early investors

10.9% is allocated to ecological partners

20% is used for token sales

14.7% is for team expenses

20.2% is used for community growth

15.2% is for user listing and liquidity

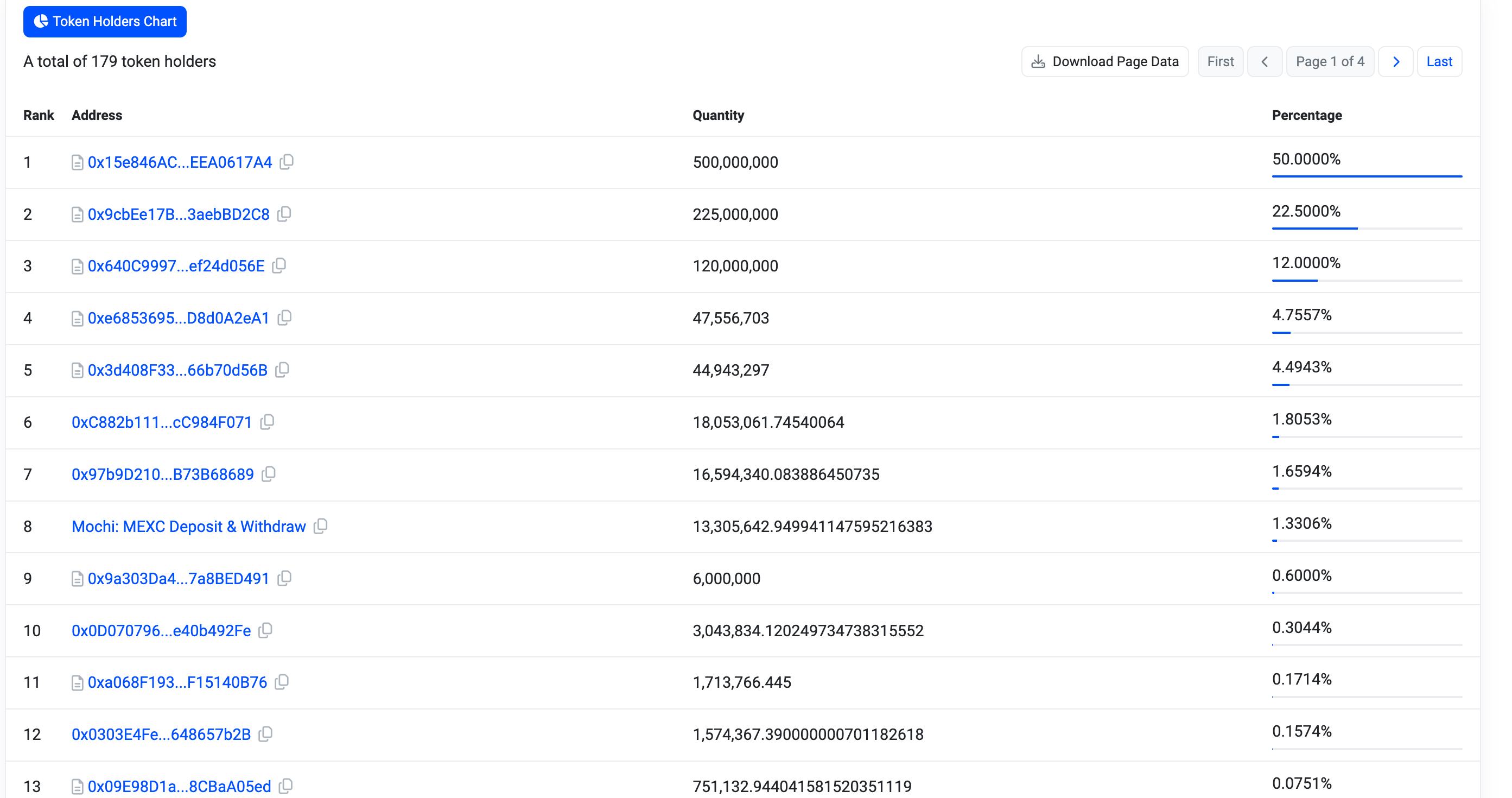

On-chain holdings

As of June 13, there are 179 addresses holding EMT tokens on the chain. The first address holds 500 million EMTs, accounting for 50% of the total. The top five addresses hold 93.75% of the tokens, and 18 addresses hold more than 100,000 (0.01%).

Market value comparison

The current FDV of EMT tokens is about 300 million US dollars, and the increase after listing on Bitget is more than 550%. Combined with similar projects on the market such as RSS3 292 million US dollars and MASK 290 million US dollars, EMT FDV seems to be close to the upper edge of market estimates. However, EMT's current liquidity is low, and its overall circulating market value is still far lower than FDV. Users can pay attention to its on-chain token unlocking and large transactions to make trading decisions.

Related links

Official website: https://ethermail.io/

Twitter: https://x.com/ethermail_io

Block browser token details page: https://basescan.org/token/0xe2c86869216aC578bd62a4b8313770d9EE359A05#balances

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.