Expectations for the Federal Reserve to cut interest rates are increasing, with market focus on April's PCE inflation index

Against the backdrop of weak GDP data, market participants have increased their expectations for a rate cut by the Federal Reserve. The related FOMC swap is now priced at about 37 basis points of cuts within 2024, slightly lower than the approximately 33 basis points before the release of GDP data. Today's market trend will be driven by April's PCE inflation index, which is most closely watched by the Fed.

The market consensus expects that both year-on-year and month-on-month overall and core PCE data will remain flat compared to last month. It's worth noting that due to falling ticket prices, core services PCE excluding housing may see a significant (but temporary) decline. With signs of cooling in the U.S labor market, PCE data could weaken somewhat, although this level of weakness is unlikely to significantly reassure the Fed.

If indicators do show weakness, policymakers might welcome this positive news but are expected to still maintain a stance favoring higher interest rates over a longer term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

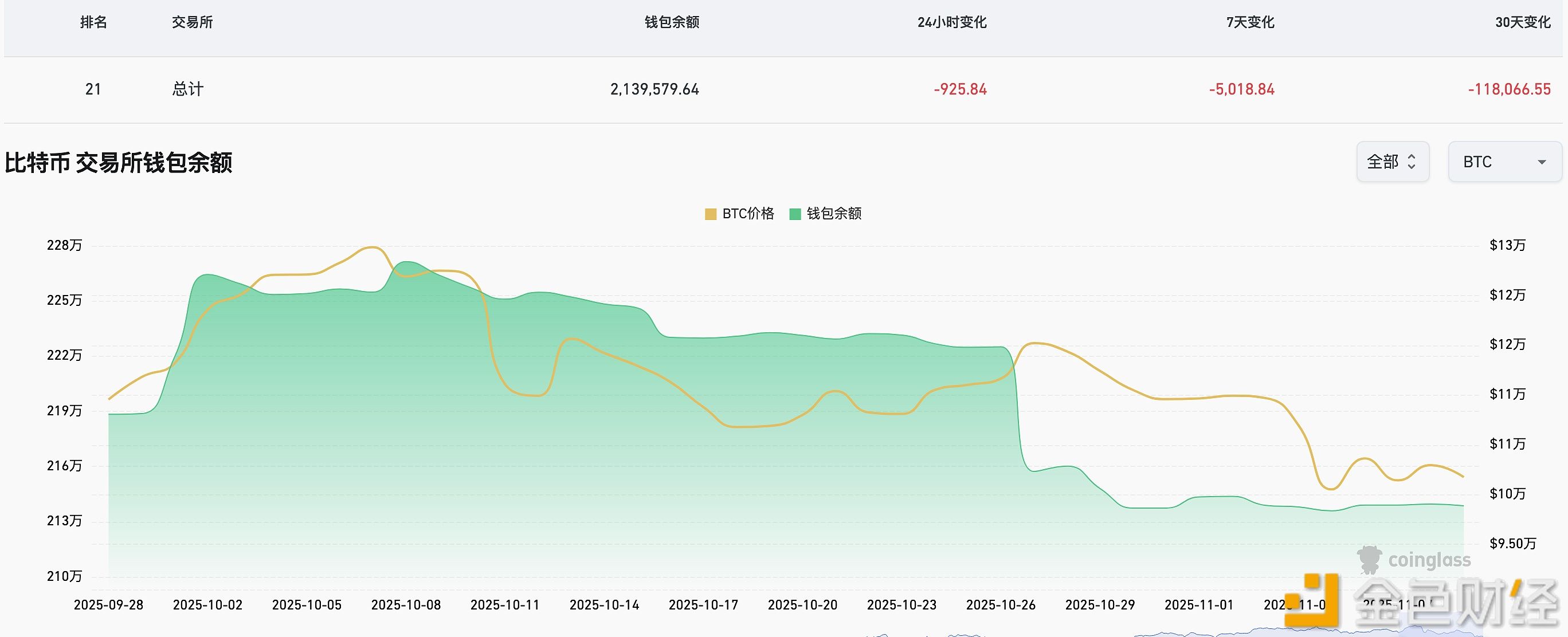

In the past week, 5,018.84 BTC have flowed out of CEX platforms.

RootData: VANA to unlock tokens worth approximately $4.57 million in one week

Analysis: Altseason Signals Hidden in Weeks of Bitcoin Dominance Weakness

Trump Media & Technology Group lost $54.8 million in Q3 and currently holds over 11,500 bitcoins