Vitalik: L2 is the cultural extension of Ethereum

Vitalik Buterin stated that L2 is a cultural extension of Ethereum, as Ethereum is a layer2-centric ecosystem where you can freely build an independent sub-ecosystem with unique features while still being part of the larger Ethereum ecosystem. This sub-ecosystem serves as a subcultural branch of Ethereum.

Researcher Paul Dylan-Ennis has spent considerable time exploring and understanding these subcultures within Ethereum. He identified three main types:

1. Crypto Punks: Crypto punks are dedicated to open-source development and some sort of DIY or punk attitude. In the case of Ethereum, crypto punks build infrastructure and tools but remain indifferent to how they are used, adopting a neutral stance. Historically, crypto punks have emphasized privacy explicitly; however, in Ethereum it's not always prioritized even though a new movement called Lunarpunk advocating for privacy-first has emerged.

2. Regens: Many influential voices within Ethereum are committed to building technology in regenerative ways. Rooted in Vitalik Buterin's interest in political and social sciences, many regens participate in governance experiments aimed at revitalizing, improving or even replacing contemporary institutions. This subculture is characterized by its experimental nature and interest in public goods.

3. Degens: Users driven purely by speculation and relentless wealth accumulation are known as Degens - financial nihilists who focus on current trends and hype to strike it lucky and escape the rat race of neoliberal capitalism. Degens often take extraordinary risks but do so ironically or almost detachedly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

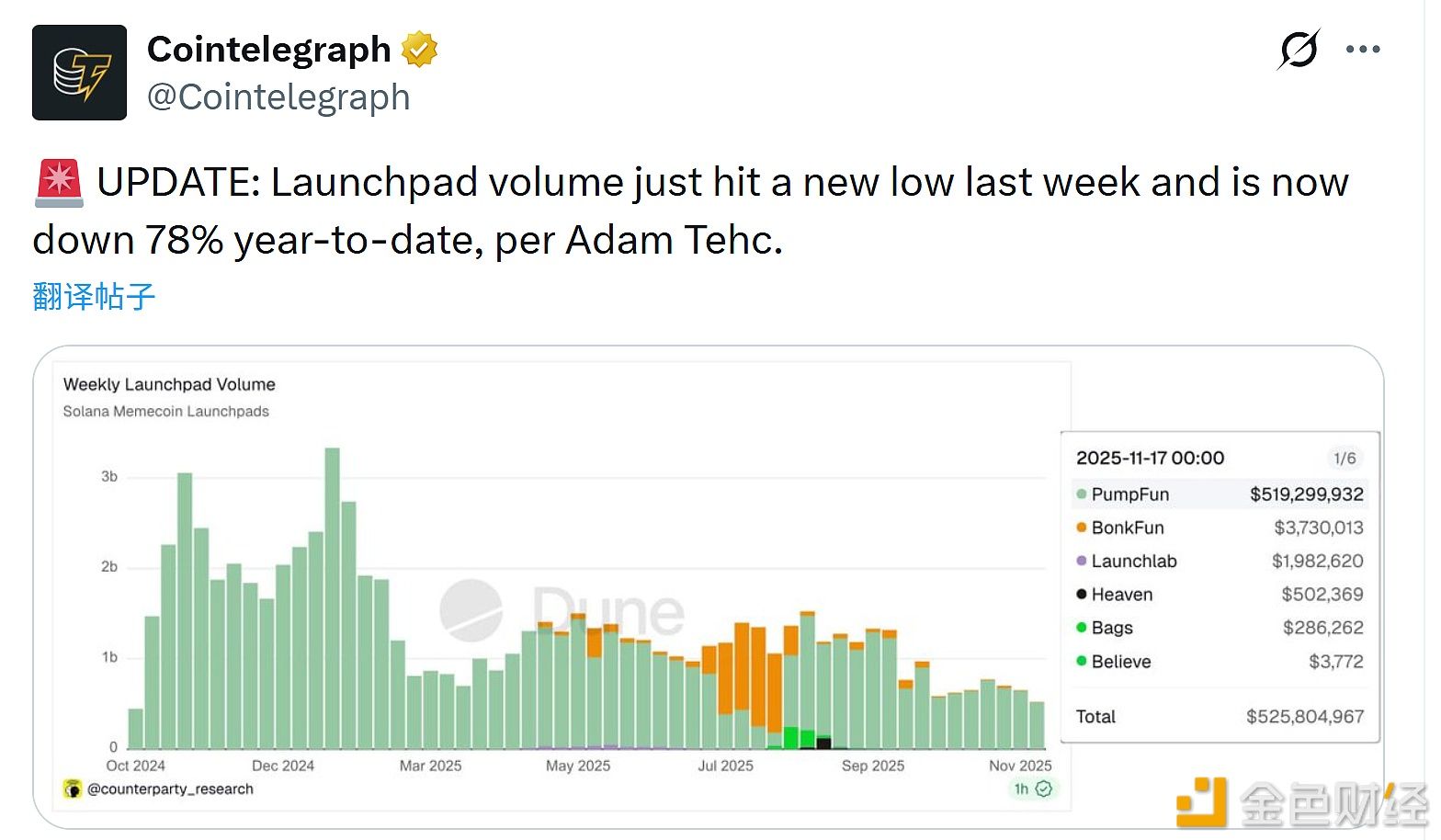

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93