Largest corporate bitcoin holder MicroStrategy added to key global equity index

MicroStrategy, whose bitcoin holdings are currently valued at $13.5 billion, will be added to the MSCI World Index, effective May 31.The addition follows a surge in the price of MicroStrategy’s stock — which up more than 87% year-to-date.

On Tuesday, MSCI (originally Morgan Stanley Capital International), a global provider of investment decision support tools, including equity indexes, announced MicroStrategy as one of the three largest additions by market capitalization to its MSCI World Index, effective May 31.

Following its most recent bitcoin acquisition on April 29, MicroStrategy now holds 214,400 BTC +1.17% , currently valued at approximately $13.5 billion. MicroStrategy’s total acquisitions were made at a cost of $7.5 billion, or an average of $35,180 per bitcoin, meaning the firm has a paper profit of around $6 billion from its bitcoin purchases.

MicroStrategy’s stock price has surged since bottoming alongside the cryptocurrency market in December 2022. Its shares have gained more than eightfold since that time and are up over 87% year-to-date, outperforming bitcoin’s 45% gains in 2024, according to TradingView.

MSTR/USD price chart. Image: TradingView .

In March, investment firm Kerrisdale Capital, who holds a short position on MicroStrategy’s shares, said the stock was trading at an “ unjustifiable premium ” to bitcoin.

RELATED INDICES

MicroStrategy used as a bitcoin proxy

Given its substantial bitcoin holdings — equivalent to more than 1% of bitcoin’s total supply of 21 million — MicroStrategy has increasingly been used as a proxy to bitcoin exposure in the traditional market, especially before the launch of spot bitcoin exchange-traded funds in the U.S. in January.

MicroStrategy’s addition to the MSCI World Index is also indicative of how bitcoin exposure can creep into traditional portfolios, given that billions of dollars track or are benchmarked against the index, Bloomberg noted . However, the new spot bitcoin ETFs are now accelerating that trend.

Earlier this month, MicroStrategy announced plans to launch a bitcoin-based decentralized identity solution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

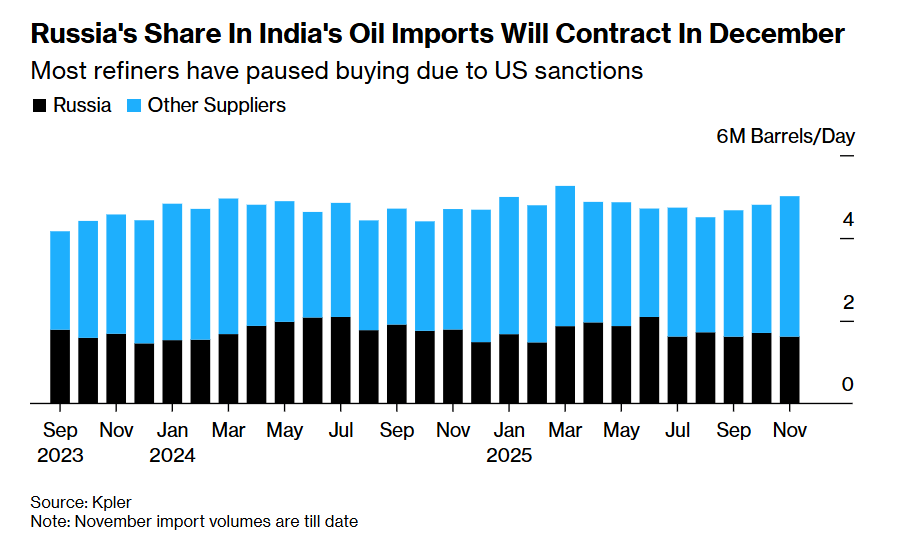

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)