Spot bitcoin ETFs record largest daily net outflows ever

The U.S. spot bitcoin ETFs recorded their largest net daily outflows on Wednesday, with $563.7 million leaving the funds, according to SosoValue data.Fidelity’s FBTC saw $191 million moved out of the fund, exceeding the $167.3 million net outflow recorded by Grayscale’s GBTC.BlackRock’s IBIT saw its first net daily outflow.

Fidelity’s FBTC experienced the largest net outflows among the ETFs, with over $191 million moving out of the fund. That exceeded the $167.3 million net outflow recorded by Grayscale’s GBTC, SosoValue data showed.

Ark Invest’s ARKB witnessed $98.1 million in daily net outflows, recording the third-largest net outflows of the day, followed by BlackRock IBIT’s $36.9 million and Bitwise BITB’s $29 million. This marked the first time that BlackRock’s spot bitcoin ETF recorded a net daily outflow.

All the U.S. spot bitcoin ETFs logged daily net outflows on the day, except for Hashdex’s DEFI, which recorded zero net inflows on the day.

The cumulative total net inflow for the 11 ETFs amounted to $11.2 billion as of Wednesday.

“So, iShares Bitcoin ETF has first day of outflows ($37mil),” Nate Geraci, president of investment advisor The ETF Store, wrote in a post on X. “This is what ETFs do. Inflows don’t go up in straight line.”

The spot bitcoin ETF hype has appeared to die down, with April’s net monthly outflows reaching $343.5 million , ending their three-month inflow streak. GBTC led the outflows in April with $2.5 billion leaving the ETF over the month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

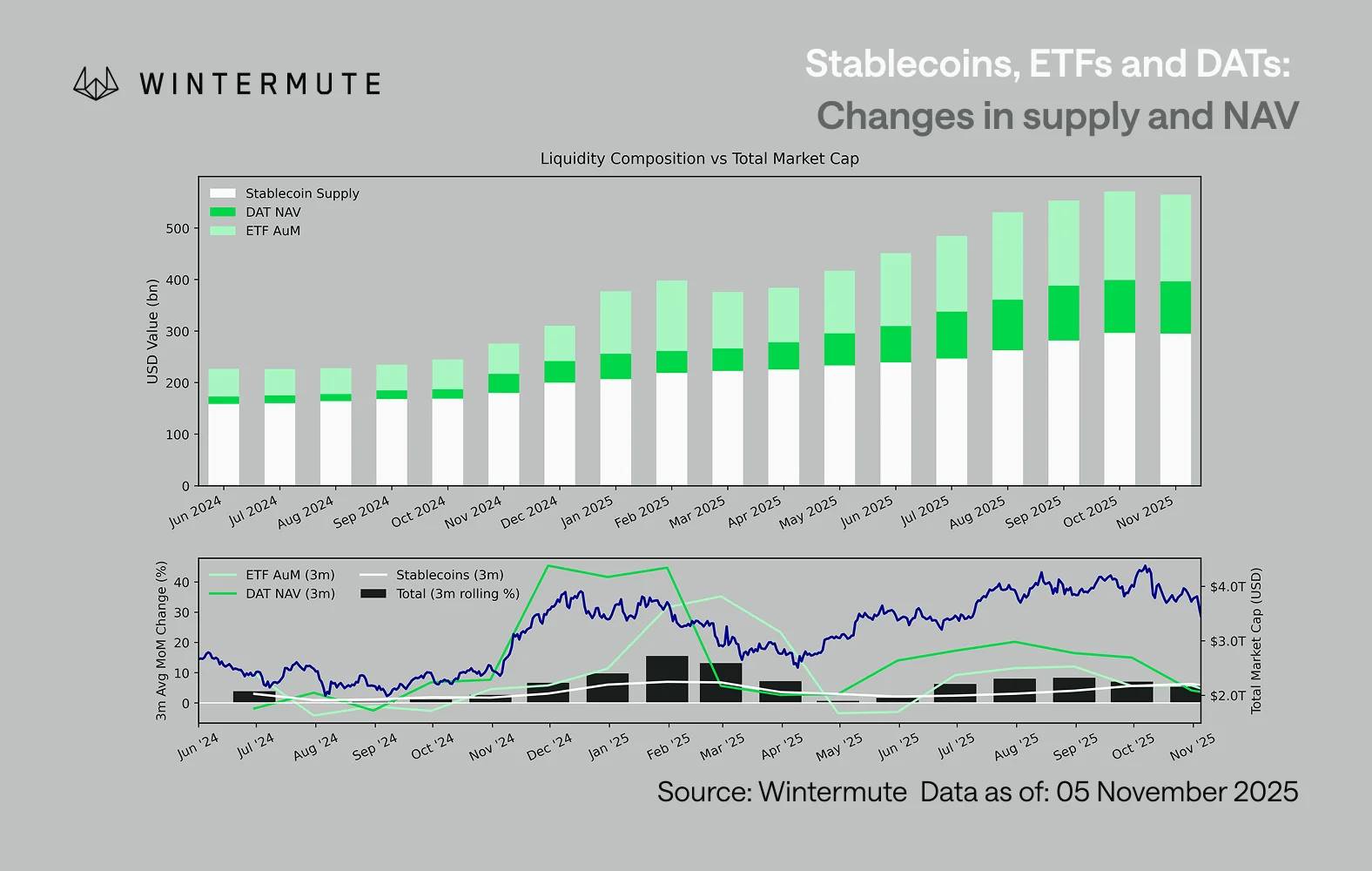

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.