These Alts Dumped the Most as Total Crypto Market Cap Lost $100B in a Day (Market Watch)

The total crypto market cap is below $2.5 trillion now as BTC slipped to $63,500.

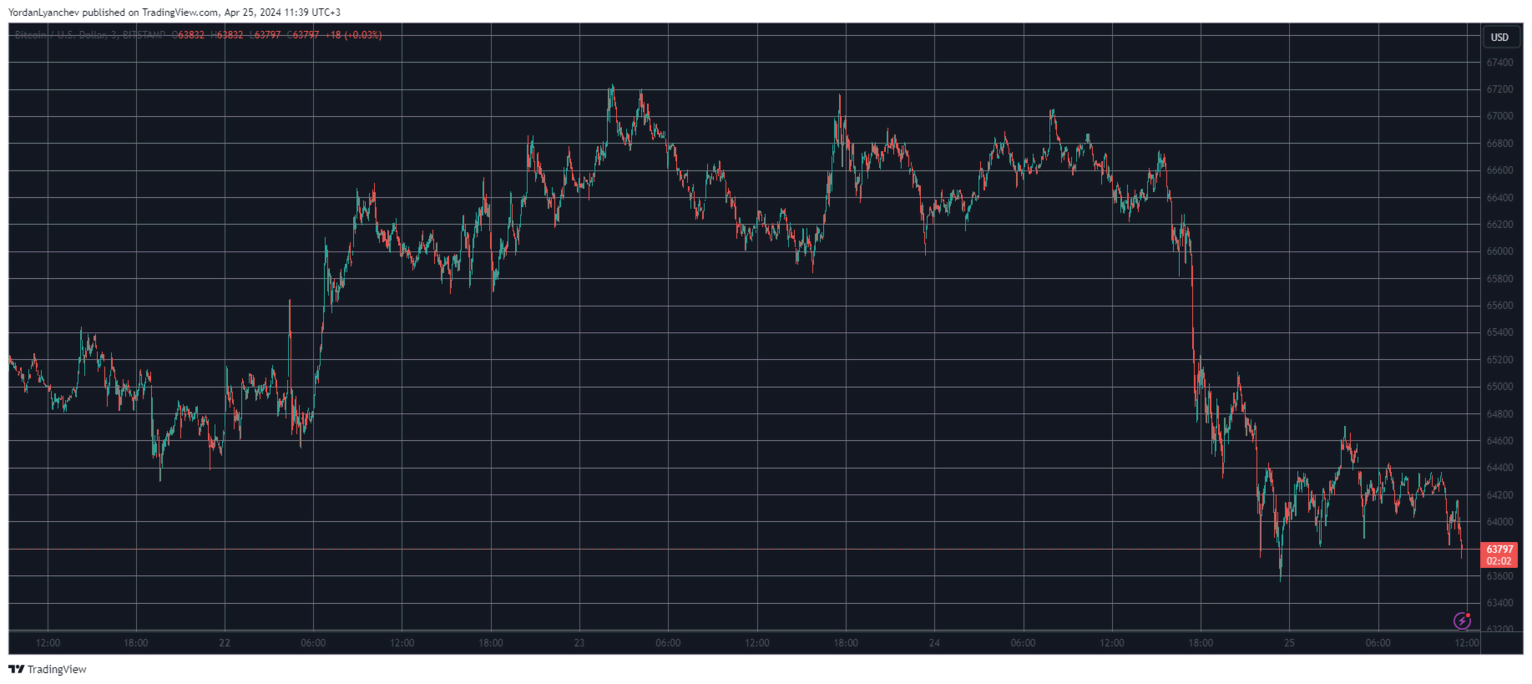

Bitcoin’s price movements over the past several days were quite promising as the asset had recovered from last week’s crash and stood above $66,000 and even $67,000 before the landscape changed for the worse once again today.

The altcoins, though, are in an even worse state, with numerous massive price declines across almost all charts.

BTC Slides Below $64K

CryptoPotato reported the adverse price movements last week that were propelled by the escalating tension between Iran and Israel. This culminated in a price drop to under $59,500 on Friday, hours before the fourth halving.

However, when Iran tried to calm the situation, bitcoin went on the offensive and jumped by over five grand in hours. It faced the completion of the halving at around $65,000 and kept climbing gradually over the next few days to just under $67,000.

The latest failed attempt to overcome that level was yesterday. However, the bears were quick to intercept the move and pushed the cryptocurrency south hard.

In a matter of hours, the asset fell by more than $3,000 and kept dropping to a multi-day low of $63,500 (on Bitstamp). Its current price tag is not much higher amid the growing ETF outflows , and its market cap has declined to $1.260 trillion on CG. Its dominance over the alts has remained at the same level of 50.7%.

Alts Turn Red

The landscape around the altcoins is even worse today. Aside from BNB, TRX, and LEO, who have been spared by the crash, the rest of the larger-cap alts are deep in the red. ETH is down by 4% and trades inches above $3,100. Similar losses are evident from XRP, LINK, LTC, and NEAR.

More painful declines come from the likes of Solana (-7%), Dogecoin (-8%), Toncoin (-9%), Cardano (-6%), Shiba Inu (-8%), Avalanche (-10%), Bitcoin Cash (-6%), and Polkadot (-8%).

The total crypto market cap has dumped by around $100 billion in a day and is under $2.5 trillion on CG now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capitalize on this trend.

Privacy Meets Social Trust: How UXLINK and ZEC Are Building the Next Generation of Web3 Infrastructure

As ZEC advances compliant privacy and UXLINK builds real-world social infrastructure, the industry is moving towards a safer, more inclusive, and more scalable future.

Market Prediction and Emerging Parataxis: What is the current major challenge?

The prediction market project is experimenting with new primitives and mechanisms, including a prediction derivatives market, advanced automated market makers and liquidity mechanisms, interoperability primitives, and more.

With the market continuing to decline, how are the whales, DAT, and ETFs doing?