BlackRock fund tokenized on Hedera blockchain, HBAR token price fell more than 25% in a short time

On April 24, Hedera announced that BlackRock’s ICS U.S. Treasury Money Market Fund has partnered with Archax to be tokenized on the Hedera blockchain, BlockBeats reported. Following the news, the price of Hedera’s native HBAR token surged more than 107% on Tuesday. However, Archax CEO Graham Rodford clarified that BlackRock was not directly involved in launching a tokenized money market fund on Hedera, which was Archax’s choice. Since then, the HBAR token price has briefly fallen by more than 25%. Currently, HBAR’s current funding rate is negative, which may be the result of short selling by some traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

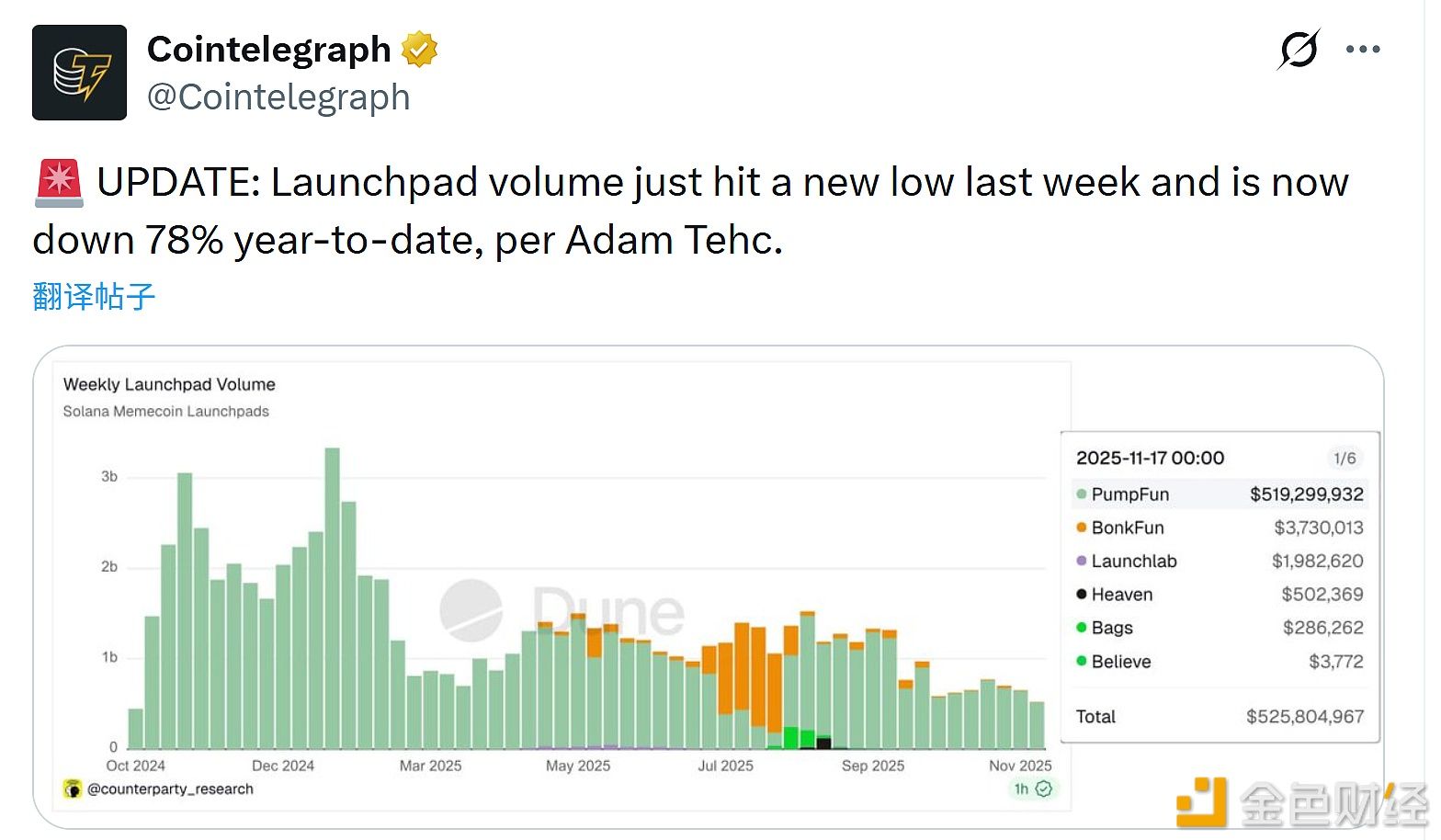

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93