What happens after the Bitcoin halving?

Institutional Crypto Research Written by Experts

👇1-12) A mere two days away, the Bitcoin halving has sparked a self-fulfilling prophecy. Google Trends has ‘Bitcoin Halving’ at its highest ‘search scale’ ever (score 100 vs. the 2020 Bitcoin halving search score of 60). Social media ‘analysis’ has consistently claimed that every prior halving has been bullish for the price of Bitcoin. While the price rally may not be immediate, we are focused on when, not if.

👇2-12) All our 10x Research subscribers know that as the pivotal 68,300 level was broken, the “downside could open to 60,000—if not 52,000,” as we frequently stated (here). Indeed, last night, Bitcoin briefly declined to sub-60,000, and while there was a large buy order in the market at that 60,000 level, we still think Bitcoin could further decline.

👇3-12) When we analyzed all the previous Bitcoin cycles, we realized that prices do not move randomly and that Bitcoin is such a powerful invention because of the incentives structured around it. That’s why pre- and post-halving price developments are predictable, in our view. Below is what we think will most likely happen after the Bitcoin halving.

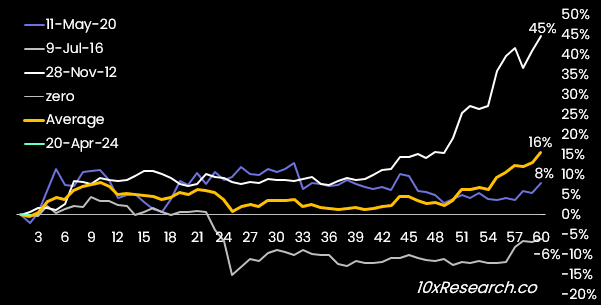

👇4-12) During the previous three halvings of 2012, 2016, and 2020, Bitcoin was up +45% (2012), down -6% (2016), and up +8% (2020) for an average 60-day post-halving return of +16%. This analysis is heavily skewed to the +45% return in 2012 - the return in latter years has diminished considerably.

Bitcoin price performance 60 days after the May 2020 halving

👇5-12) Comparing the average pre-halving return of +32% with the average post-halving return of +16%, it becomes apparent that the best risk/reward trade would be long Bitcoin INTO the halving but then expect a period of sideways consolidation AFTERWARD.

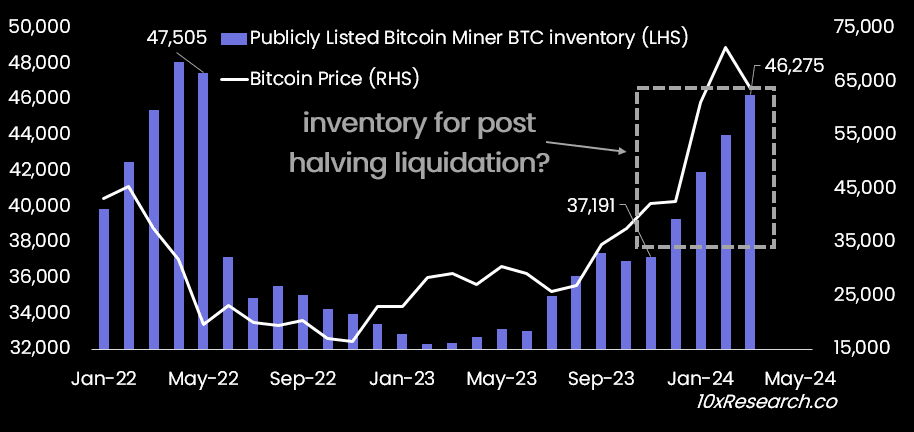

👇6-12) The key finding from our analysis of why Bitcoin tends to rally into halvings is that miners have tended to restrict supply ahead of the halving only to release more Bitcoins into the market afterward, as they need to sell twice as many BTC to make up for the 50% drop in mining rewards.

👇7-12) This way, their USD revenues remain relatively stable for some time – unless BTC rallies quickly. Last week, we published our report that this could result in a sale of $5 billion in BTC (report here) over four to six months.

👇8-12) The latest inventories had reached a similar level as when Terra/Luna imploded (47k BTC inventory). When Bitcoin traded sub-$30,000, miners had to liquidate their inventory as the average production cost was around $27,000. This caused the quick move lower to the $20,000 BTC price as other margin loans were also unwound.

👇9-12) The seventeen publicly listed miners sold 10k BTC inventory after Terra/Luna imploded. Fast-forward to 2024, and miner inventory has increased to 47k (46,275), increasing by nearly 10k to prepare themselves for the post-halving inventory liquidation. They will also sell almost 100% of their 450 daily BTC mining rewards.

Bitcoin inventory by the publicly listed Bitcoin miners

👇10-12) Despite the current macro headwinds (interest rate expectation repricing), this miner inventory will be an overhang for the market. For March 2024, many miners already have a liquidation/production ratio of 100%. Marathon is the exception. They produced 894 BTC in March and only sold 443 (liquidation/production ratio of 49.5%), and Marathon alone has 17k BTC in inventory. But this ‘produce two, sell one’ ratio might hint that they will produce one and sell two after the halving.

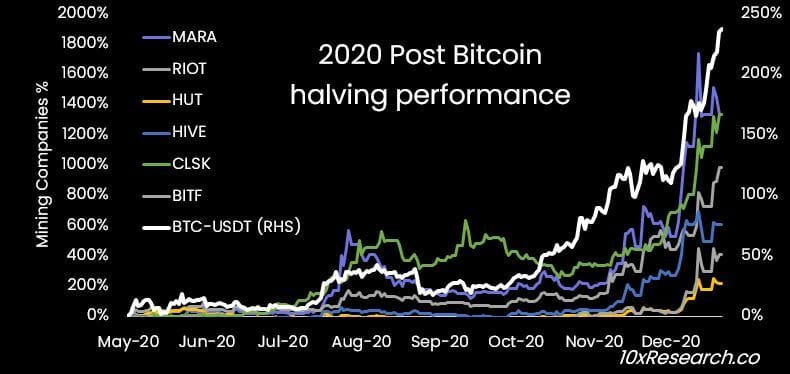

Bitcoin and Miner performance post May 2020 halving

👇11-12) One data set of the 2020 post-halving period has only limited statistical relevance. Still, based on this episode, Bitcoin traded sideways for nearly two months before a more forceful rally started in October (five months after the halving) and finished the year up +237% (left scale, chart below). The mining stocks also rallied three months after the halving, but from October 2020 onward, they exploded (right scale), with Marathon being up +1,300%.

👇12-12) The Bitcoin halving will not lift prices higher necessarily. There will likely be some overhang from miners selling BTC inventory, and as media attention declines, upside momentum should also wane. Being patient is essential, and we need to let other forces play out first. Tomorrow, we will analyze why Bitcoin and mining stocks started their massive rally in October 2020 and how that period is related or different to the current one.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.