Digital asset inflows into crypto investment products turned positive in the past week, with net inflows of $862 million compared to net outflows of $931 million a week prior.

However, the popularity of spot Bitcoin exchange-traded funds seems to be cooling down. The daily trading volume of exchange-traded funds (ETFs) has dropped to $5.4 billion, 36% less than its peak of $9.5 billion recorded in the first week of March.

Bitcoin ( BTC ) topped the digital asset flows with $863 million in inflows aided by ETF demand, with spot BTC ETFs recording $1.8 billion in inflows compared to $965 million in outflows from the Grayscale Bitcoin Trust (GBTC).

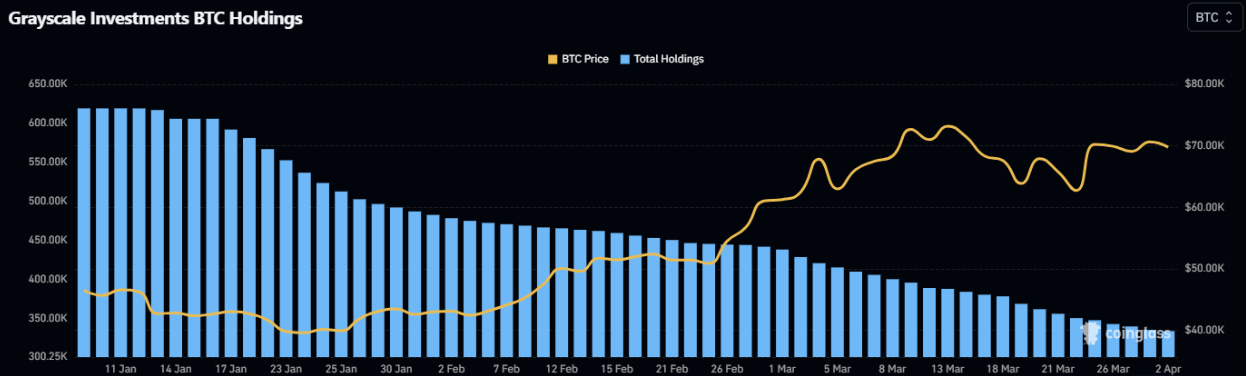

Grayscale’s ETF continues to see massive outflows nearly three months on from the approval of the products in the United States on Jan. 11.

Continuous outflows from GBTC have put significant selling pressure on BTC prices over the past three weeks.

Grayscale Bitcoin holdings. Source: CoinGlass

Market pundits had predicted that, over time, outflows from GBTC would slow down and dry up, leading to unprecedented demand for ETFs.

However, the current investor trends indicate that the GBTC outflows are far from over, with GBTC still dominating ETF flows.

The selling pressure from ETFs is visible on the BTC price as the world’s top cryptocurrency dropped by $4,000 over the past 24 hours, trading just above $66,000 at the time of writing.

Many market analysts have called it a routine correction before the Bitcoin halving event scheduled for April 20.

Crypto market sentiment turns bearish. Source: Marcel Knobloch

The BTC price correction saw nearly $500 million in liquidations while the options market heated up with heavy put calls, suggesting a bearish trader sentiment.

Ether ( ETH ) recorded its fourth consecutive week of outflows, with $19 million this past week. The altcoin market recorded a net inflow of $18.3 million last week, with Solana’s ( SOL ) token leading the charge with $6.1 million in inflows.

The U.S. is the region with the largest outflows in the past week, with $897 million, while Europe and Canada combined saw $49 million in outflows.