Bitcoin ( BTC ) has less time than ever remaining before demand outpaces supply, new research says.

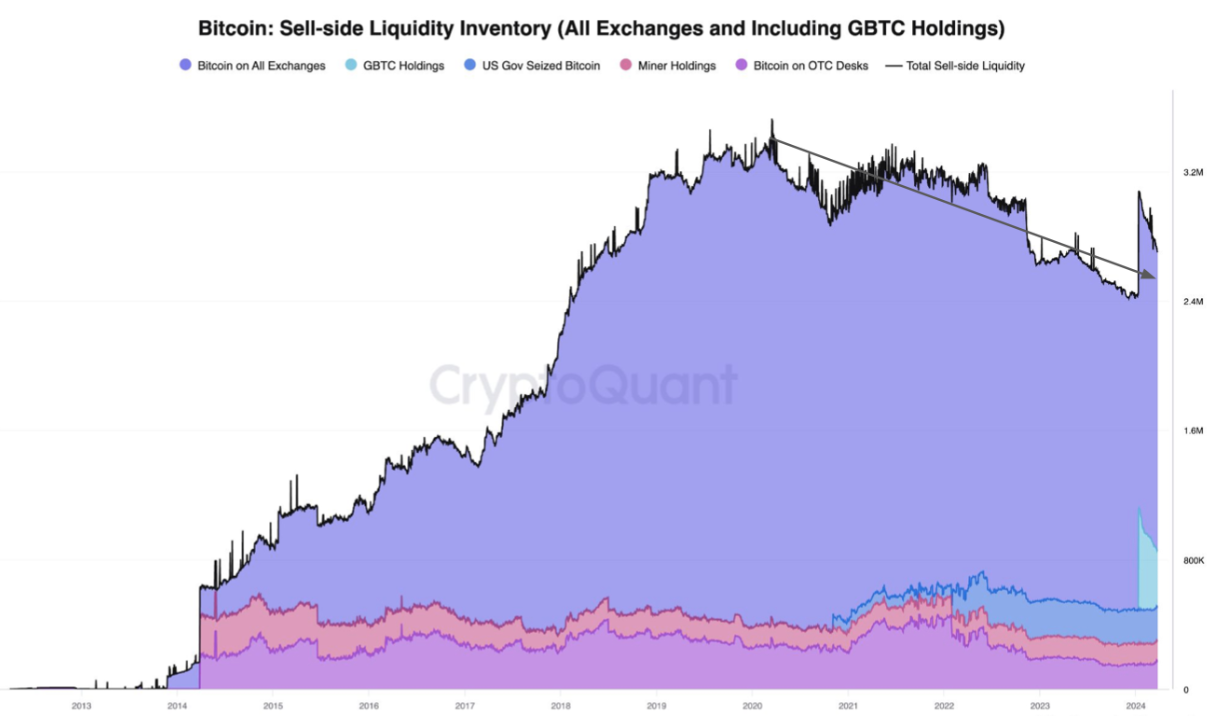

In its latest “ Weekly Crypto Report ” on March 26, on-chain analytics platform CryptoQuant described an unfolding “sell-side liquidity crisis.”

Report: “12 months” before available Bitcoin dries up

Bitcoin demand has rocketed this year, partly thanks to the United States’ spot Bitcoin exchange-traded funds (ETFs).

This constant bid is now beginning to make itself felt, CryptoQuant says — and supply dynamics may change forever by Q1 2025.

“Record Bitcoin demand paired with declining sell-side liquidity has resulted in the liquid inventory of Bitcoin plunging to the lowest ever in terms of months of demand,” the report states.

“We estimate that the present

Bitcoin sell-side liquidity inventory is only enough to cover demand growing at the current rate for twelve months.”

Bitcoin sell-side liquidity inventory (screenshot). Source: CryptoQuant

CryptoQuant added that only “accumulating addresses” — those with no outbound transactions — were included in its calculations, meaning that net demand may still be higher.

“This is only considering demand from accumulating addresses, which may be considered as the lower-end of Bitcoin demand,” it writes.

Assessing BTC available strictly on United States exchanges, the supply is able to meet demand for half as long.

“The Bitcoin liquid inventory drops to six months of demand if we exclude the Bitcoin on exchanges outside the US. We exclude these exchanges considering that US spot Bitcoin ETFs will only source Bitcoin from US entities,” the report explains.

2,000 BTC from 2010 on the move

Continuing the topic on X (formerly Twitter), CryptoQuant CEO Ki Young Ju described the sell-side liquidity crisis as “waking up” old supply.

He was responding to data showing coins mined in 2010 and dormant since suddenly moving to a newly created wallet address.

Source: Ki Young Ju

Ki has already championed the ETF supply squeeze narrative, predicting six months to run in mid-March as ETF inflows beat records.

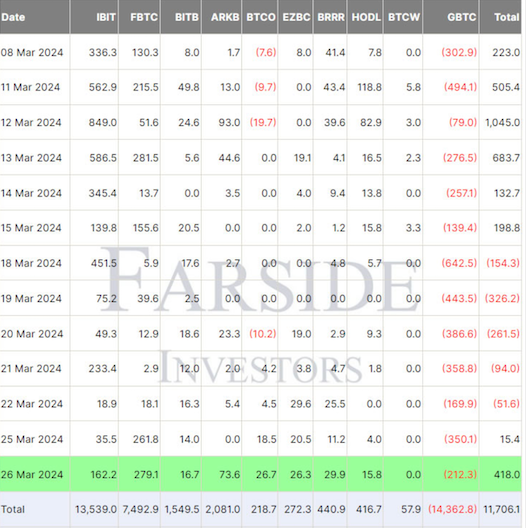

Since then, the products have seen a contrasting week of consecutive net outflows , a trend that appears to be reversing.

The latest data from United Kingdom-based investment firm Farside shows net inflows of $400 million for March 25 — the most in two weeks.

Bitcoin ETF flows (screenshot). Source: Farside

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.