Bitcoin price breaks above previous all-time high of $69,000 after 846 days

The price of Bitcoin breached its previous all-time high.The market-leading cryptocurrency has grown by around 70% this year.

Bitcoin has appreciated approximately 346% since bottoming out above $15,000 in the latter quarter of 2022. This year alone, it has increased by roughly 70%.

Events that impacted the wider cryptocurrency bear market included the collapse of the Terra Luna ecosystem and the subsequent bankruptcy of crypto exchange FTX — both of which hamstrung the larger industry as it took stock of the related contagion.

For many, the approval of spot bitcoin exchange-traded funds in the United States ultimately spurred on the new crypto bull market, with inflows — in some ways — surpassing even bullish expectations.

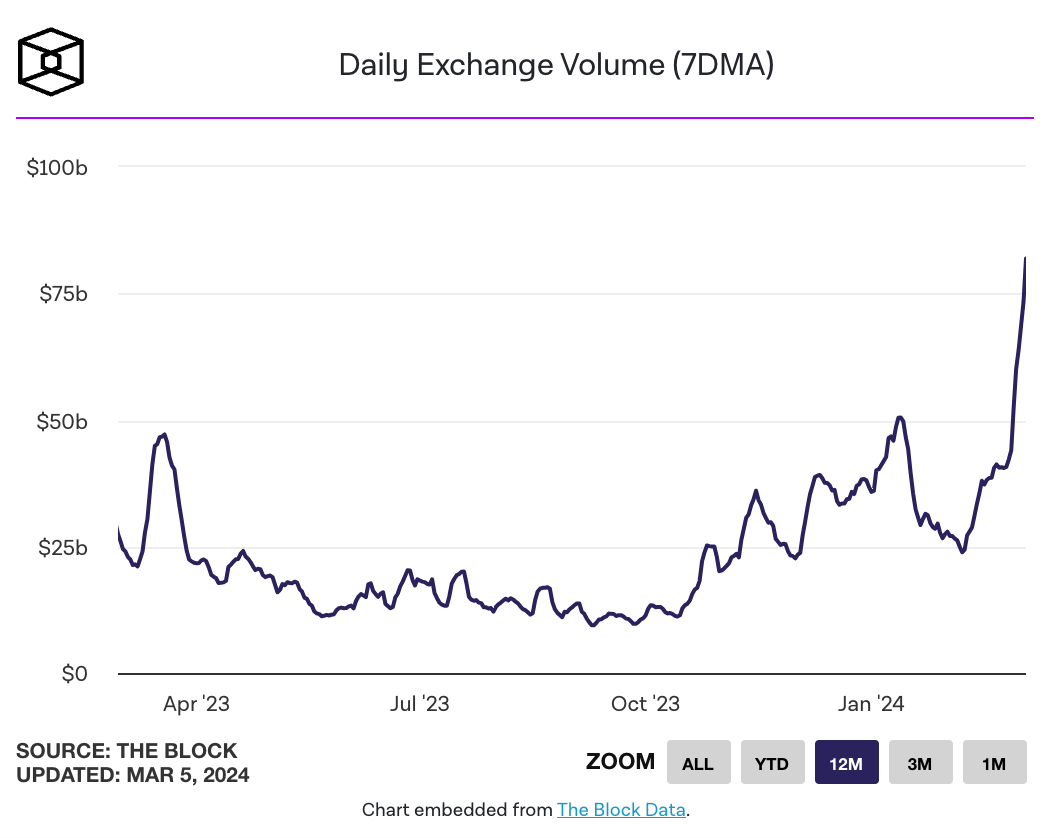

Daily exchange volume has surged alongside Bitcoin ETF inflows, largely trending upward since late last year.

Earlier Monday, bitcoin's price in euro and British pound terms broke all-time highs while its market capitalization in U.S. dollar terms broke above its previous record high of $1.303 trillion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA, ETH, XRP Climb as Bitcoin Zooms Above $93K, But Traders Warn of ‘Fakeout Rally’

Last Cycle’s Signal King Murad: 116 Reasons Why the 2026 Bull Market Will Come

I do not agree with the view that the market cycle is only four years; I believe this cycle may extend to four and a half or even five years, and could last until 2026.

Ethereum completes Fusaka upgrade, team claims it can unlock up to 8x data throughput

Major upgrades, which used to take place once a year, are now happening every six months, demonstrating that the foundation still maintains strong execution capabilities despite recent personnel changes.

Glassnode: Is Bitcoin Showing Signs of a 2022 Crash Again? Beware of a Key Range

The current bitcoin market structure is highly similar to Q1 2022, with over 25% of on-chain supply in a loss, ETF capital flows and spot momentum weakening, and the price relying on key cost basis areas.