BlackRock and Fidelity spot bitcoin ETFs are on track to outpace Grayscale in daily trading volume for first time

In what would be the first time since the new products began trading, spot bitcoin ETFs offered by BlackRock and Fidelity are on track to best Grayscale’s converted fund in terms of daily volume.Grayscale’s instrument, a conversion of its flagship GBTC, has shed billions of dollars in assets under management.

Grayscale's fund, a conversion rather than a brand new product, has shed billions of dollars after starting with more than $25 billion in assets under management. In terms of total trading volume — buying and selling — the BlackRock and Fidelity new spot bitcoin ETFs have been ranking second and third behind Grayscale.

As of 1:15 p.m. ET on Tuesday, BlackRock and Fidelity had generated, according to Yahoo Finance data compiled by The Block, $250 million and $207 million in trading volume, respectively. Grayscale ranked third about halfway through the day with $202 million.

Since trading began this month, the three issuers have dominated total trading volume, accounting for, at times, about 90% of all buying and selling activity. Other spot bitcoin ETFs like those offered by Invesco and Galaxy, Franklin Templeton and Ark Invest have trailed far behind the top three.

So far, Grayscale's ETF has lost more than $5 billion in assets under management, according to Bloomberg Intelligence ETF analyst James Seyffart. Both BlackRock and Fidelity's products are net positive by more than $2 billion.

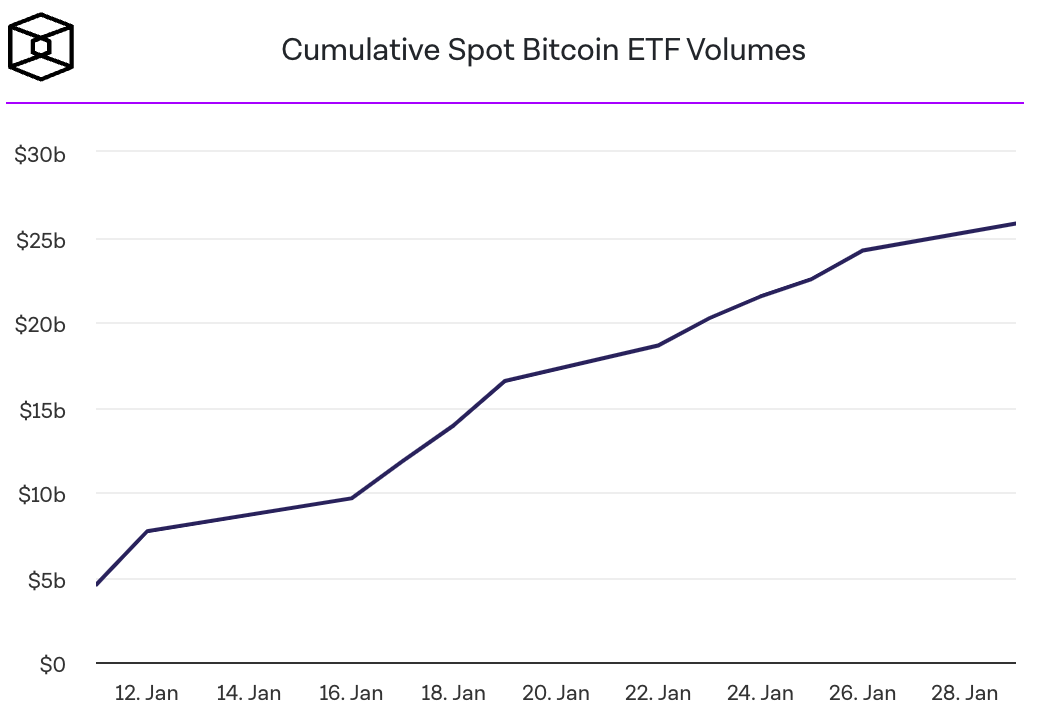

Total spot bitcoin ETF volume nears $27 billion

In what may be an effort to gain a competitive edge, Invesco and Galaxy Asset Management on Monday announced in a filing that the firms intend to cut their fund's fee from 0.39% to to 0.25%, which will put them on par with most rivals.

Total trading volume for all of the active spot bitcoin ETFs is nearing $27 billion, also according to Seyffart's post on Tuesday. Many market watchers and crypto enthusiasts have heralded the billions of dollars of money flowing into the new ETFs as a positive development for digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How we made 50 million dollars sniping altcoins on DEX

A true story of getting rich in one year, going from $50,000 to $50 million.

Creator Talk | Where Are the Opportunities in the Second Half of the Prediction Market?

"Creator Talk" is a dialogue column for content creators launched by Foresight News. Each month, we pose questions on trending market topics to outstanding creators selected for that month, gathering and organizing their responses into articles to capture diverse opinions and uncover deeper insights.

Monthly Column Report | October 2025 Foresight News Outstanding Content Creators List

The October 2025 rankings for the most popular columns, model workers, and newcomers have been released.

I mine bitcoin with graphics cards in Escape from Tarkov

An increasing number of games are incorporating cryptocurrency elements.