ETHZilla Corporation, the Nasdaq-listed decentralized finance technology firm, has raised a further $350 million through convertible debentures as part of a bid to expand its Ethereum-focused treasury strategy and also increase its investment in the tokenization of real-world assets to boost cash flow in the network.

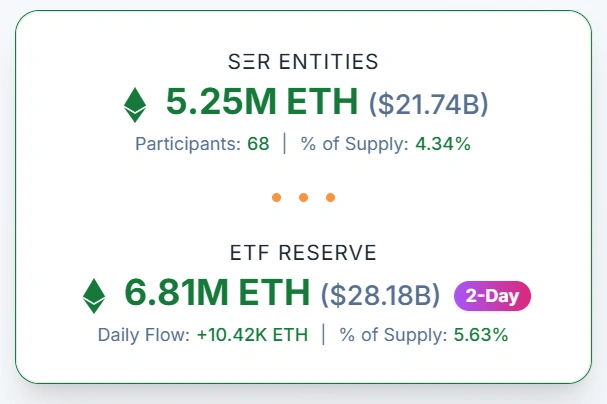

The move comes as so-called digital asset treasuries (DATs) continue to acquire a growing share of ETH, with industry data showing that 4.34% of the cryptocurrency’s supply is now held in corporate-style structures.

Ethereum DATs now control about 4.34% of the circulating supply. Source: Strategic ETH Reserve

Ethereum DATs now control about 4.34% of the circulating supply. Source: Strategic ETH Reserve

ETHZilla sees a fresh injection of capital

In its press release , ETHZilla stated that it had reached an agreement with an existing institutional investor to amend earlier financing terms and raise $350 million in new convertible debentures. The deal adds to a $156.5 million tranche issued previously, taking the total value of the company’s debenture program to roughly half a billion dollars.

Under the newly revised structure, the earlier notes will remain interest-free until February 2026 before reverting to a 2% annual interest rate, which is half of the previously agreed 4% interest rate.

The new debentures carry a 2% annual interest rate, while the conversion price was set at $3.05 per share.

“We are committed to being responsible stewards of our shareholders’ capital,” said McAndrew Rudisill, the company’s chairman and chief executive. “Our model is highly scalable, with fixed operating leverage and recurring positive cash flow. We believe ETHZilla is well-positioned for continued growth with the support of our institutional shareholders.”

Ethereum on the balance sheet

The deal boosts ETHZilla’s already substantial reserves of both ETH and cash. Currently, the company holds 102,264 ETH, with USD equivalents worth approximately $462 million. It also has $559 million in cash and US Treasuries, 1.5 million earned protocol tokens, and 160,176,122 in total shares outstanding.

Beyond passive holdings, ETHZilla is pursuing a hybrid strategy where it is investing in short-term securities to generate yield and also investing ETH into Ethereum scaling protocols as it explores the tokenization of real-world assets to generate more cash flow. The company has bought back roughly 6.45 million of its shares in September alone, reducing its outstanding stock by 0.3%.

The business model follows the trend of corporate entities acting as quasi-fund managers for digital assets. ETHZilla’s management has introduced new reporting metrics such as ETH Net Asset Value (NAV) and Market Net Asset Value (mNAV) to capture the value of its crypto-centric balance sheet.

These measures, however, remain unconventional, with management warning they should not be confused with traditional net asset value calculations.

Supply squeeze and what it means for ETHZilla

The timing of ETHZilla’s financing coincides with mounting pressure on Ethereum’s liquid supply. Roughly 30% of the total supply of ETH has been reportedly staked. It was recently reported that this figure represents a record high and continues to climb.

Other observers note that ETHZilla’s approach mirrors the corporate treasury strategies pioneered by Bitcoin-focused companies, which helped tighten available supply and contributed to price surges in previous cycles.

Management has promised fresh guidance with its third-quarter earnings later this year, outlining how it plans to balance ETH accumulation with cash-flow generation.

ETHZilla’s latest financing shows that it has both the appetite for corporate ETH accumulation. With nearly half a billion dollars in convertible debentures now outstanding, the company has fresh firepower to deepen its presence in Ethereum’s Layer-2 landscape and tokenization projects.

KEY Difference Wire helps crypto brands break through and dominate headlines fast