- Michael Saylor’s Strategy (MSTR) is on track to surpass the entire 2024 funding through capital fundraising.

- The company faces a critical MSCI ruling on January 15 that could result in index removal.

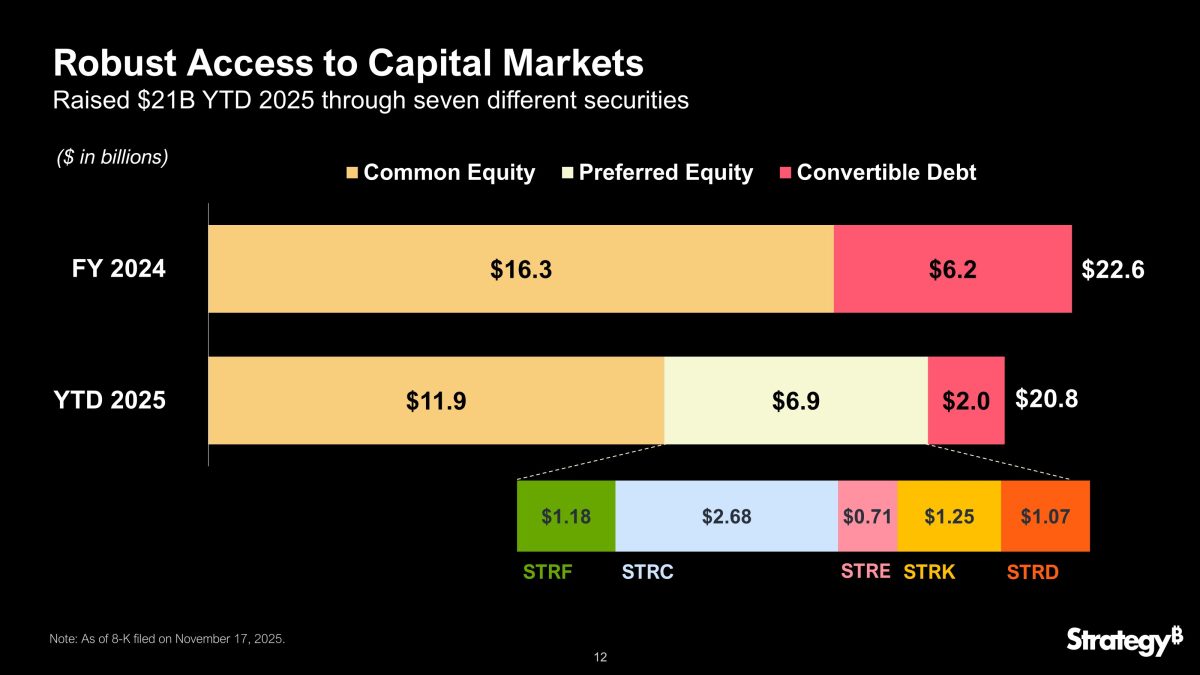

Michael Saylor’s Strategy (MSTR) has raised nearly $21 billion in new funding so far in 2025, and is on track to overtake its 2024 numbers. The company has shifted its funding structure from the last fiscal year, raising a total of $22.6 billion across common equity and convertible debt.

So far in 2025, Michael Saylor’s Strategy has raised $20.8 billion through multiple funding sources. This includes $11.9 billion in common equity, an additional $6.9 billion in preferred equity, and $2.0 billion in the form of convertible debt. The latest funding round includes multiple structured securities. The company has issuances of $1.18 billion in STRF, another $2.68 billion in STRC, a minor $0.71 billion in STRE, $1.25 billion in STRK, and another $1.07 billion in STRD.

As we reported earlier this month, the company further plans to issue 3.5 million shares of its 10% Series A Perpetual Preferred Stock in a euro-denominated initial public offering, which will trade under the ticker symbol STRE.

This year, the company introduced this measure of preferred equity, marking a notable divergence from 2024. Furthermore, Saylor has continued to position the firm as a significant corporate buyer of Bitcoin. Previously, he also referred to BTC as a strategic treasury reserve asset.

According to the recent information provided by Strategy, the ongoing fundraising for 2025 is nearly equal, to the entire amount raised in 2024. It appears that the firm is poised to exceed its yearly capital-raising record by the conclusion of 2025.

Source: Strategy

Source: Strategy

MSTR Stock Under Pressure As Company Faces Major Challenge Ahead

The Strategy (MSTR) stock listed on Nasdaq has been facing major selling pressure and is down over 40% in just over the past month. This has led to major concerns among investors as institutions withdrew approximately $5.4 billion from Strategy during the third quarter. JPMorgan reduced its exposure by 24.5 percent and simultaneously added roughly $117 million in put option positions.

A key decision looms on January 15, when MSCI will determine whether companies with more than 50 percent of their assets in cryptocurrency should remain eligible for equity index inclusion. Strategy currently allocates about 95 percent of its assets to Bitcoin.

As a result, JPMorgan estimates that the removal of MSTR stock from MSCI indices could trigger up to $8.8 billion in forced selling. Commenting on the recent stock decline, popular analyst Shanaka Perea wrote :

“Strategy Inc. holds 649,870 Bitcoin worth $57.2 billion. Its stock is worth $50 billion. For the first time in five years, the company trades at a discount to its own assets. The flywheel that built a $128 billion empire has broken”.

Despite these looming concerns, Michael Saylor remains confident that Wall Street won’t be able to hurt the firm. In his latest interview , Saylor said that the company is ready to face even massive 80-90% BTC drawdowns.