Decentralized finance players and major crypto institutions are moving swiftly to restore stability and confidence after one of the sharpest sell-offs in the digital asset market this year, with stablecoin issuers Tether and Circle minting billions in new tokens and Ethereum’s largest treasury firm, Bitmine, scooping up large amounts of Ethereum.

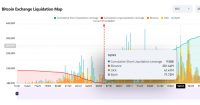

The October 10 crash, triggered by renewed trade tensions between Washington and Beijing, sent shockwaves through both traditional and digital markets. Analysts say the downturn tested the resilience of the sector’s liquidity systems but has also sparked a quick rebound in on-chain activity.

Investors buy the dip as Tether, Circle mint new stablecoins

Data from on-chain analytics platform Lookonchain showed that Tether and Circle, issuers of USDT and USDC, respectively, minted a combined $1.75 billion in new stablecoins in the immediate aftermath of the crash.

In a post on X, the analytics firm said the new issuance reflected “liquidity injection” as investors repositioned into dollar-pegged assets during the sell-off.

Not everyone was retreating. Blockchain analytics also revealed that Bitmine, one of the sector’s largest digital asset investors, bought 27,256 ETH, worth around $104.24 million, during the downturn. The purchase came as part of what market observers describe as bottom-fishing by whales seeking discounted assets ahead of a possible rebound.

Bitmine( @BitMNR ) just bought another 27,256 $ETH (104.24M).

Tom Lee said that today's dip was a good shakeout and the market is likely to rise in a week. https://t.co/RT53NaLoMF https://t.co/qlNEWX7DLQ pic.twitter.com/4Ighq8PpX6

— Lookonchain (@lookonchain) October 11, 2025

Tom Lee, Wall Street strategist and Head of Research at Fundstrat, shared his insights on the current state of the market and how investors will likely react, calling the event “a good shakeout,” and adding that the market was likely to rise in a week.

Andrei Grachev, managing partner at DWF Labs, shares similar sentiments. He described the crash as the product of technical liquidations rather than a collapse in fundamentals.

“This crash happened not because of fundamentals like the FTX collapse,” Grachev wrote on X . “It was because of the tariffs announcement and following leveraged liquidations. Liquidity got drained, but Bitcoin and strong projects should recover quite soon. DYOR .”

The journey to recovery

The speed of the post-crash adjustments shows how much more automated and liquid the crypto ecosystem has become since the major market disruptions of 2022. Within hours of the sell-off, stablecoin supplies expanded, liquidity pools rebalanced, and DeFi protocols such as Aave and Uniswap reported record transaction volumes with minimal downtime .

Analysts say that if the market stabilizes in the coming days, this episode may be remembered less as a crash than as a liquidity test, one that key crypto institutions appeared ready to pass.

However, if macroeconomic tensions escalate with Trump making another decision that sends panic into the market or a major liquidity crunch hits the stablecoin market, the recovery could stall. Lee also pointed out, as he said, “Unless there’s a real structural change, this pullback is a buying opportunity.”

So far, the tone across the crypto sector is shifting from fear to measured optimism, and as Grachev noted, the turbulence may have been a test rather than a reckoning; “Bitcoin and strong projects should recover quite soon.”

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.