Payment Giant Klarna to Explore Consumer Crypto Wallets

The move comes at a moment when the Swedish fintech — valued at just over $12 billion — is searching […]

The post Payment Giant Klarna to Explore Consumer Crypto Wallets appeared first on Coindoo.

The move comes at a moment when the Swedish fintech — valued at just over $12 billion — is searching for new product pathways amid volatile market performance.

- Klarna is researching a potential consumer crypto wallet through a new partnership with Privy.

- The exploration follows Klarna’s launch of its own stablecoin, KlarnaUSD.

- Privy’s large-scale wallet infrastructure will guide Klarna’s R&D on usability and compliance.

Rather than announcing a product, Klarna is setting up an R&D track focused on wallet infrastructure and user experience. The company recently introduced its own stablecoin, KlarnaUSD, in partnership with Tempo and Bridge, and is now assessing whether a wallet could make digital assets a more natural extension of its existing payments network.

CEO Sebastian Siemiatkowski said the company’s advantage lies in consumer familiarity. Klarna already manages shopping, budgeting and savings tools for millions, he noted, which positions it to “translate crypto into something useful for normal customers.”

Privy’s Infrastructure Becomes the Backbone of the Experiment

Privy — now operating under Stripe’s corporate umbrella — brings a different kind of scale to the partnership. Its infrastructure supports more than 100 million accounts across 1,500+ developers, powering activity on platforms such as OpenSea and Hyperliquid. Billions of dollars in crypto and stablecoins move across systems built on Privy’s tooling every month.

The Klarna–Privy collaboration is meant to examine whether this infrastructure can be adapted for a consumer-fintech environment, where custodial flows, compliance layers and wallet simplicity must coexist. Henri Stern, Privy’s CEO, said the company aims to supply the foundational components for businesses that want to integrate “the capabilities of crypto and stablecoins” without forcing users into complex Web3 interfaces.

READ MORE:

Ripple Stablecoin RLUSD Expands as Gemini Adds XRPL Support

Market Conditions Provide Context — Both Opportunity and Pressure

Global crypto participation continues to expand. According to figures cited from a16z, around 716 million people hold digital assets, and tens of millions conduct transactions monthly. This growing audience is one of the reasons large fintechs are revisiting crypto after years of hesitation.

For Klarna, the timing is notable. The company’s share price has fallen nearly 30% over the past six months, and InvestingPro signals that the stock may be trading above its fair value. Even so, Klarna remains highly liquid, posting a current ratio close to 30, indicating ample resources to fund experimental initiatives.

Revenue growth continues as well — Klarna reported a 45% jump in U.S. sales volume during the Black Friday shopping period, suggesting that its core business still has momentum.

Klarna Expands Partnerships and Consumer Features Across Borders

Beyond crypto-related pilots, Klarna has been widening its reach in more traditional digital payments. Apple Pay support was recently extended to France and Italy, lifting the number of integrated markets to eight. The company also unveiled new membership tiers, Premium and Max, in the U.S., offering benefits such as cashback rewards and travel protection.

Retail and travel partnerships have been expanding too. Canadian furniture brand Cozey now offers Klarna’s installment options across North America, and Lufthansa, working with Adyen, plans to introduce Klarna-powered “Pay Later” and financing features for travelers later this year.

These developments, combined with Klarna’s crypto research efforts, point toward a company experimenting with both emerging and established forms of digital financial infrastructure as it looks for its next growth phase.

The post Payment Giant Klarna to Explore Consumer Crypto Wallets appeared first on Coindoo.

Haftungsausschluss: Der Inhalt dieses Artikels gibt ausschließlich die Meinung des Autors wieder und repräsentiert nicht die Plattform in irgendeiner Form. Dieser Artikel ist nicht dazu gedacht, als Referenz für Investitionsentscheidungen zu dienen.

Das könnte Ihnen auch gefallen

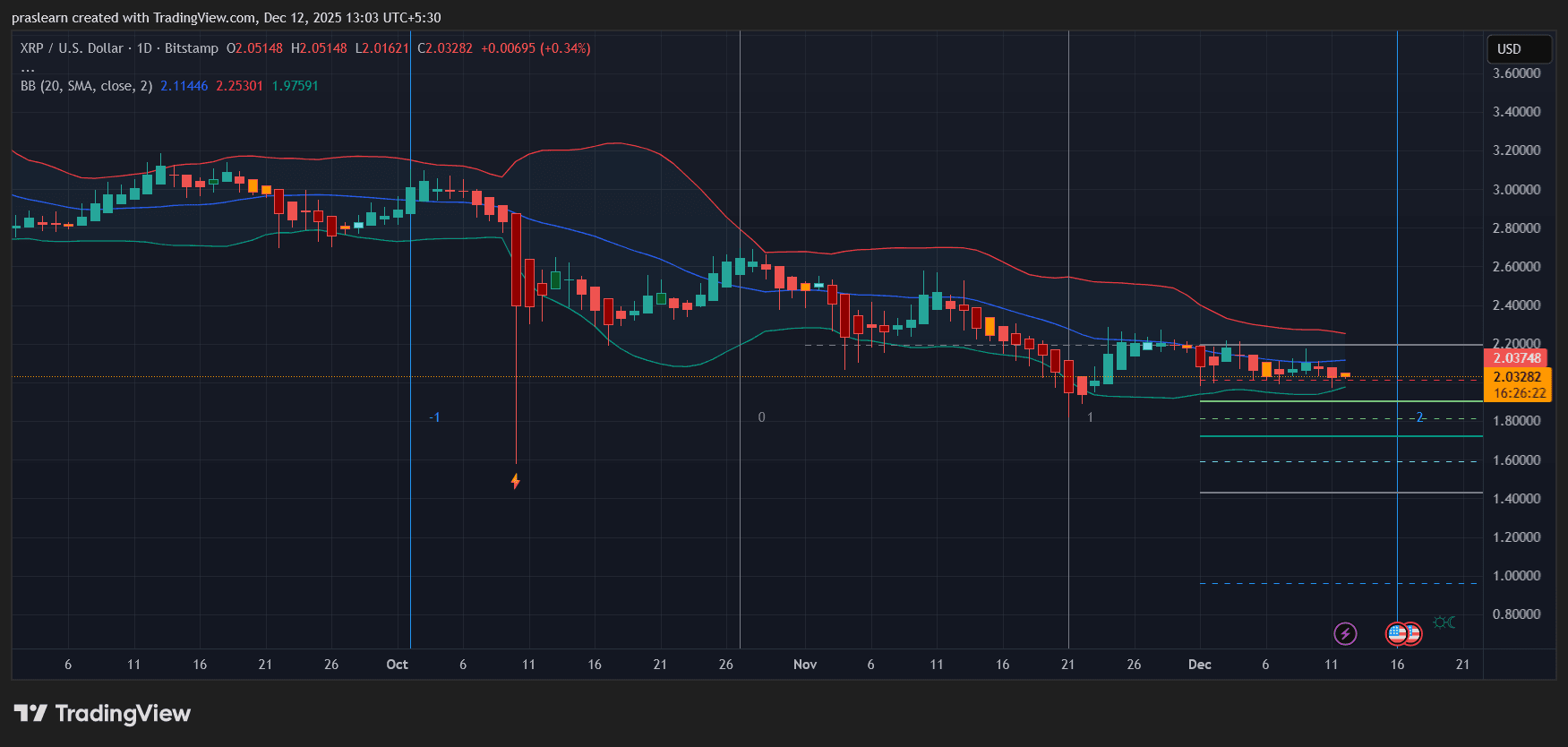

Begrenzt die Fed Unsicherheit das XRP Aufwärtspotenzial 2026?

XRP hält sich nahe der 2 Dollar Marke, während Unsicherheit bei der Fed den Ausblick für 2026 belastet. Bremst politische Unklarheit die nächste Rallye?

Cathie Wood: Bitcoin-Zyklus durch institutionelle Adoption nachhaltig verändert

Zusammenfassung des Artikels Cathie Wood von ARK Invest glaubt, dass die institutionelle Adoption den traditionellen Vier-Jahres-Zyklus von Bitcoin durchbrechen wird und prognostiziert eine positive Entwicklung für die Kryptowährung. Experten wie Brad Garlinghouse erwarten zudem einen Anstieg des Bitcoin-Kurses auf 180.000 US-Dollar bis Ende 2026, während politische Faktoren und Zinssenkungen ebenfalls Einfluss auf den Markt haben könnten.

Wrapped XRP startet auf Solana und Ethereum – Kursentwicklung bleibt angespannt

Zusammenfassung des Artikels Die Einführung von Wrapped XRP (wXRP) auf Solana und Ethereum könnte die DeFi-Integration von XRP stärken, während der Kurs in einer engen Spanne gefangen bleibt. Trotz positiver Fundamentaldaten zeigt der Markt eine defensive Haltung, was auf mögliche Herausforderungen hinweist.

Tom Lee: Ethereum könnte langfristig die 100.000-Dollar-Marke erreichen

Zusammenfassung des Artikels Tom Lee prognostiziert, dass Ethereum langfristig die $100.000-Marke erreichen könnte, während institutionelle Investoren und große Wallets Rücksetzer als Kaufgelegenheit nutzen.