Bitget Q3 2025 Transparency Report

TLDR;

– Bitget Turns 7 – Introduced the Universal Exchange (UEX), merging CEX-grade performance with DEX autonomy and real-world finance.

– BGB Migration – 440M BGB transferred to Morph Foundation, making BGB the gas and governance token for Morph and deepening its on-chain utility.

– Bitget Onchain Growth – Expanded to Ethereum, Solana, BSC, and Base; achieved $113M in daily trading volume; launched AI-powered Onchain Signals.

– Derivatives Leadership – Maintained top-three global ranking in BTC and ETH open interest, averaging $9–11B and $5–8B respectively.

– Strong Reserves & Security – 1.8x Proof-of-Reserves ratio and $800M+ Protection Fund reaffirm Bitget’s financial transparency and stability.

– TradFi Integration – Launched tokenized U.S. stocks and ETFs via Ondo Finance and USDT-margined Stock Futures for round-the-clock equity exposure.

– AI & Yield Innovation – Enhanced GetAgent into a unified smart trading hub and introduced Auto Earn to generate yield on margin collateral.

– Bitget Wallet Expansion – Rolled out Mastercard-linked crypto card and integrated Brazil’s Pix network, driving real-world crypto payments.

Overview

Q3 was the quarter UEX moved from vision to operating model, a trend observed worldwide amongst CEXs. Turning seven, Bitget set out a universal exchange experience where one account spans spot, futures, on-chain discovery, staking, payments, and tokenized assets. That strategy advanced on three fronts. First, market depth and risk scaffolding remained strong, with top-tier open interest in BTC and ETH, rising BTC and ETH reserves, an all-asset PoR near 1.8x, and an expanding Protection Fund. Second, the on-chain footprint grew fast: Bitget Onchain reached Ethereum, Solana, BSC, and Base, crossed nine figures in daily volume, and introduced AI-driven Onchain Signals for one-click execution. Third, the bridge to real-world finance widened as tokenized U.S. stocks and ETFs arrived through Ondo Finance, USDT-settled stock futures went live, and wallet payments in Brazil paired a Mastercard card with Pix for everyday spend. BGB became the connective tissue for this architecture, migrating to Morph as gas and governance, adding programmatic burns and long-term locks, and reinforcing UEX as a unified, chain-aware trading stack.

Quarterly Highlights

Bitget Turns 7, Introduces UEX

Marking its seventh anniversary, Bitget unveiled its next major evolution — the Universal Exchange (UEX) — redefining how users interact with digital assets across centralized and decentralized platforms. The UEX vision bridges CEX-grade performance with DEX autonomy, enabling users to access spot, futures, staking, payments, and onchain products within one unified experience. The announcement was made as part of Bitget's 7th Anniversary Celebration, where CEO Gracy Chen described UEX as “a new era of universal connectivity” that breaks down barriers between crypto, fiat, and real-world assets. Bitget also introduced new user-centric upgrades, including enhanced Bitget Wallet, AI-driven trading tools, and multi-chain accessibility, reinforcing its position as a global leader in integrated Web3 trading infrastructure.

Bitget’s UEX model also drew global recognition during the quarter. In the Animoca Brands report,“Exchanges’ Next Phase: Reaching the Mainstream”, Bitget was featured as a benchmark example of how centralized exchanges are evolving into gateways that bridge trading, onchain assets, and tokenized finance — a validation of UEX’s role as the future of exchange architecture.

Bitget Transfers BGB to Morph Foundation

In a strategic milestone for its ecosystem expansion, Bitget transferred 440 million BGB tokens to the Morph Foundation to support the development of the Morph Layer-2 network. This move extends Bitget’s UEX strategy on-chain, aligning BGB’s utility with next-generation scalability and interoperability solutions. Through the transfer, the Morph Foundation will now oversee BGB as the gas and governance token of Morph, powering payments and utility across the layer. The migration also demonstrates Bitget’s commitment to enhancing BGB’s long-term value by integrating it more deeply into the broader Web3 landscape, positioning it as a core asset in the evolving onchain market.

Bitget Onchain Expands to Unlock Access to Millions of Tokens

With its latest upgrade, Bitget Onchain now supports four major blockchains — Ethereum, Solana, BSC, and Base — allowing users to trade, stake, and manage millions of tokens from a single Bitget account without juggling multiple wallets or cross-chain transfers. The release also introduces Onchain Signals, an AI-powered tool that tracks high-quality market activity across chains and delivers real-time token alerts and one-click execution opportunities. Anchored by rigorous token pre-screening and exchange-level safeguards, the upgrade advances Bitget’s UEX vision by fusing DeFi’s diversity with CEX-grade usability and security.

Bitget Onchain Hits $100M in Daily Trading Volume

With its latest upgrade, Bitget Onchain now supports four major blockchains: Ethereum, Solana, BSC, and Base, allowing users to trade, stake, and manage millions of tokens from a single Bitget account without juggling multiple wallets or cross-chain transfers. The release also introduces Onchain Signals, an AI-powered tool that tracks high-quality market activity across chains and delivers real-time token alerts and one-click execution opportunities. Anchored by rigorous token pre-screening and exchange-level safeguards, the upgrade advances Bitget’s UEX vision by fusing DeFi’s diversity with CEX-grade usability and security.

Bitget ecosystem in numbers

Derivatives, Futures & Liquidity Leadership

|

|

|

In Q3 2025, Bitget reinforced its leadership in the global derivatives market, ranking consistently among the top three exchanges for both Bitcoin and Ethereum futures open interest, according to The Block and Coinglass. Bitcoin OI held steady at around $9–11 billion, while Ethereum OI rose from $5 billion to nearly $8 billion, reflecting robust participation from both institutional and retail traders.

External market studies further validated this momentum. According to CoinDesk’s Market Data Deep-Dive, Bitget averaged $750 billion in monthly trading volume and over $11.5 trillion in cumulative derivatives activity, ranking #1 in ETH and SOL spot market depth and #2 for BTC globally. The report highlighted Bitget’s growing share of institutional flow and its consistent liquidity performance, positioning it among the most efficient trading venues worldwide.

Echoing these findings, Bitcoin.com ’s Crypto Derivatives 101: Market Breakdown spotlighted Bitget as one of the leading global derivatives exchanges driving innovation and trading volume growth. It cited the exchange’s deep liquidity pools, resilient infrastructure, and expanding open interest as central to its competitive edge in perpetual and options markets.

Providing a macro view, CoinGecko’s Centralized Crypto Exchanges Market Share Report underscored Bitget’s consistent quarter-on-quarter growth, ranking it among the world’s top exchanges by derivatives market share and user activity. The report pointed to Bitget’s expanding customer base and sustainable volume trajectory as evidence of its long-term resilience in an increasingly competitive market.

Together, these independent validations reinforce Bitget’s position as a cornerstone of global liquidity and market depth—an achievement aligned with the Animoca Brands report, “Exchanges’ Next Phase: Reaching the Mainstream”, which recognized Bitget’s Universal Exchange (UEX) model as the next evolution of hybrid financial infrastructure connecting CeFi, DeFi, and real-world assets.

Reserves & On-Exchange Behavior

|

|

|

Throughout Q3 2025, Bitget’s Bitcoin and Ethereum exchange reserves demonstrated sustained and healthy growth, strengthening user confidence and balance sheet robustness. According to CryptoQuant, Bitcoin reserves increased steadily from ~18K BTC in early July to over 28.6K BTC by October, marking a 58.9% increase. While Ethereum reserves climbed from ~150K to above 205K ETH, a 37% increase, during the same period. The synchronized rise in reserves alongside strong BTC and ETH prices—both near multi-month highs—suggests that institutional and high-net-worth participants are entrusting more capital to Bitget. Combined with the exchange’s 1.8x Proof-of-Reserves ratio and $800M+ Protection Fund, these reserve trends reinforce Bitget’s reputation as one of the most transparent and solvent exchanges in the industry.

Exchange Token & Market Dynamics

|

|

|

In Q3 2025, Bitget’s native token BGB evolved into a core infrastructure asset through a combination of deflationary measures, ecosystem expansion, and strategic partnerships. According to The Block's Exchange Token Performance, BGB surged over 400% year-on-year, and quarterly rising from $4.25 to $5.25, supported by major supply reductions and growing on-chain utility. In July, Bitget burned 30M BGB (~$138M, 2.56% of supply), followed by a landmark September 2 transfer of 440M BGB to the Morph Foundation, where 220M BGB—equivalent to 22% of total supply—were instantly burned, and the remaining half locked for long-term ecosystem incentives. This action set a path toward 77% total deflation, aligning with Bitget’s vision of sustainable tokenomics. With BGB now serving as the gas and governance token of Morph Chain (EVM L2) and introducing new fee-based burn mechanisms tied to wallet and exchange activity, the token’s fundamentals strengthened, solidifying BGB’s role as the core asset powering Bitget’s Universal Exchange (UEX) ecosystem.

The integration of BGB into Morph aligns with what the Animoca Brands report called the “Universal Exchange” evolution—where tokens, infrastructure, and users converge within one interoperable ecosystem bridging CeFi and DeFi.

New top listings

Bitget continues to broaden its token roster in Q3 with a dynamic mix of decentralized AI, omnichain data solutions, advanced DeFi applications, and next-generation blockchain infrastructure.

On the AI frontier, Gaia (GAIA) debuts with a decentralized platform for creating, deploying, and monetizing autonomous agents, enabling new user-driven AI applications in a secure and privacy-preserving environment. Chainbase (C) joins the Innovation and AI Zone, providing developers and users with omnichain access to blockchain data through an AI-powered analytics layer that unlocks deeper real-time insights and interoperability across multiple networks.

As for DeFi, Fragmetric (FRAG) enters as Solana’s pioneering liquid (re)staking protocol, introducing multi-asset management and modular yield strategies—paving the way for more flexible and sophisticated opportunities in decentralized finance.

Rounding out the quarter, Boundless (ZKC) launches in the Innovation Zone as a breakthrough infrastructure protocol. Leveraging its Proof of Verifiable Work mechanism, Boundless brings universal zero-knowledge scaling, boosting computational capacity and enabling blockchains to operate on the internet scale.

These new listings underscore Bitget’s leadership in curating high-potential projects across the most promising sectors of crypto, reinforcing the exchange’s position at the forefront of the evolving Web3 landscape.

Product and integrations

Bitget and Bitget Wallet Onboards Tokenized Stock Tokens via Ondo Finance

Bitget and Bitget Wallet integrated with Ondo Finance to enable trading of more than 100 tokenized U.S. stock tokens and ETFs, bringing fully backed real-world assets on-chain for eligible users outside the U.S. The integration aligns with UEX’s goal to merge TradFi and DeFi, enabling users to access diversified financial exposure in one place. These initiatives reflect a growing trend highlighted by Animoca Brands and CoinDesk, where exchanges are transforming into full-fledged financial ecosystems that blend liquidity, identity, and real-world utility across decentralized networks.

Bitget GetAgent Gets Supercharged

Bitget has enhanced its AI assistant GetAgent, transforming it into a unified smart trading hub that integrates futures trading, personalized wealth insights, and adaptive AI bots within a single conversational interface. Instead of navigating multiple tools, users can now execute futures strategies, manage portfolios, and automate trades seamlessly in one place. Following its public rollout in mid-August, GetAgent is now open to all traders and introduces three new membership tiers, designed to cater to varying experience levels and trading needs.

Bitget Stock Futures Debut Expands Access to U.S. Equities in Crypto Markets

Bitget launched USDT-margined Stock Futures, becoming the first major crypto exchange to offer seamless exposure to U.S. equities through perpetual futures settled in stablecoins. This innovation allows users to trade synthetic representations of top Nasdaq-listed companies like Tesla, Apple, and Nvidia directly on the Bitget platform 24/5 and without needing a brokerage account. The launch highlights Bitget’s mission to bridge traditional and digital finance under the UEX framework, expanding accessibility to global markets while maintaining transparency and risk management. By combining the familiarity of stock trading with crypto-native flexibility, Bitget continues to blur the boundaries between conventional finance and decentralized ecosystems.

Bitget Launches Auto Earn for Futures Margin Yield

Bitget rolled out Auto Earn, a feature that lets traders use BGUSD and BGSOL as margin collateral while generating yield at the same time. The upgrade turns inactive margin balances into productive assets, supporting both Classic and Unified Accounts. Users can earn up to 5 percent APR on BGUSD and 6.67 percent on BGSOL without changing their trading setup. The feature streamlines capital use by merging yield generation and derivatives trading within one system.

Bitget Wallet

Crypto Payments Go Mainstream in Brazil

Bitget Wallet deepened its foothold in Latin America with two major milestones — the rollout of its zero-fee Mastercard-linked crypto card and the integration of Pix, Brazil's $4.6 trillion instant payment network. Through Pix, users can now pay any local merchant by simply scanning a QR code and settling in stablecoins. The Mastercard integration extends that flexibility globally, allowing stablecoin holders to spend directly at over 150 million merchants. The dual rollout marks Bitget Wallet's most comprehensive step yet toward making crypto a practical payment method in one of the world's most active digital-asset markets.

Strengthening Fiat Gateways with Mercuryo and MoonPay

To simplify fiat access, Bitget Wallet expanded both its on-ramp and off-ramp infrastructure. A partnership with Mercuryo introduced seamless fiat-to-crypto purchases alongside a global fee-free promotion for new USDC buyers. On the exit side, a new integration with MoonPay unlocked direct stablecoin-to-fiat withdrawals in more than 25 currencies — a first for the wallet. Together, these partnerships complete a full fiat gateway within Bitget Wallet, letting users move between traditional finance and Web3 with minimal friction.

Expanding Stablecoin Yield Across Chains

In the yield vertical, Bitget Wallet launched Stablecoin Earn Plus in collaboration with Aave, offering up to 10% APY on USDC. The feature delivers instant liquidity and real-time earnings, reflecting the platform's emphasis on flexibility. Bitget Wallet also integrated Jupiter Lend, Solana's fastest-growing lending protocol, bringing additional stablecoin yield opportunities to Solana. The wallet has aggregates leading DeFi protocols, positioning its Earn section as a cross-chain yield hub for stablecoin holders seeking transparent and accessible returns.

Deepening Collaboration Within the Base Ecosystem

Bitget Wallet has deepened its collaboration within the Base Layer 2 ecosystem, introducing native support for Aerodrome, the network's key DEX and liquidity platform, allowing users to trade, provide liquidity, and access Base-native assets directly within the wallet. The wallet also announced a strategic integration with Spindl, a Web3 attribution and growth analytics platform, to tackle the discovery problem in decentralized applications. Looking ahead, Bitget Wallet plans to continue expanding its partnerships within the Base ecosystem.

Gas Abstraction Across Major Networks

Bitget Wallet rounded out the quarter by expanding its gas-free transaction infrastructure to five major public chains — Solana, TRON, Arbitrum, Base, and Polygon. This multichain gas abstraction framework automatically covers gas fees, allowing users to transact without holding each network's native token. The feature reflects a broader industry push toward seamless user experiences that abstract blockchain complexity. For Bitget Wallet, it's another step toward lowering entry barriers for newcomers, bringing mainstream usability to self-custody wallets across global markets.

Security: Updates, POR, and Protection Fund

Security remained a central focus for Bitget in Q3 2025, as the exchange continued to strengthen its safeguards amid a volatile market environment. The platform maintained a 1:1 Proof of Reserves (PoR) across all major assets, with reserve ratios of 200% in July, 188% in August, and 186% in September, consistently above industry norms. The July peak reflected a 45% increase in user Bitcoin holdings, coinciding with the asset’s price rebound, underscoring the platform’s ability to sustain strong liquidity and full asset backing even during heightened trading activity.

In parallel, Bitget’s Protection Fund remained a core element of user security, valued at $749 million in July, $746 million in August, and $735 million in September. Slight dips mirrored overall market sentiment, but an above-average fund shows continued prioritization of user protection and prudent fund management. Together, the PoR and Protection Fund reinforce Bitget’s position as one of the most transparent and financially secure UEX.

Events: Across the world

Taipei Blockchain Week

As a Gold Sponsor, Bitget paired main-stage thought leadership with a high-engagement booth and an official side-event presence. On stage, COO Vugar Usi Zade joined “Next-Gen Exchanges: The Intelligence Layer,” while Will Wu represented Bitget Wallet on UX and security—spotlighting both the Exchange and Wallet narratives. On the floor, a MotoGP-themed game and strategic placement sustained traffic, complemented by a Bitget Girl Group meetup and limited-edition merchandise for memorable photo moments. Clear exterior signage near official TBW placements extended passive visibility across attendee content, underscoring a cohesive brand experience throughout the week.

|

|

|

|

|

|

|

MotoGP Catalunya

Bitget activated a landmark presence at Circuit de Barcelona–Catalunya with a two-storey booth and a multi-touchpoint experience stack, including the Bitget × MotoGP simulator, a 360° VR circuit tour, two creator-friendly photo moments, and a curated merchandise station. A guided “mini-carnival” flow with stamp cards encouraged deeper participation and repeat visits, while a fast-lane/standard-lane system ensured smooth, compliance-aware crowd management. Mobile-first content capture and strong collaboration with regional partners helped turn on-site excitement into shareable stories, reinforcing Bitget's role at the engagement of MotoGP culture and Web3, with the shared spirit of #MakeItCount.

|

|

|

|

|

|

|

Ethiopia Blockchain Week

Bitget participated in Ethiopian Blockchain Week at the Addis Ababa Science Museum with a Silver-tier presence, featuring a well-branded exhibition space, a keynote—“From P2P to Tokenized Markets”—and a panel contribution. Over two days, we engaged traders, developers, banks, and policymakers on liquidity pathways, on-chain adoption, and Ethiopia's fintech potential, pairing product education with ecosystem dialogue to strengthen brand trust and position Bitget as a long-term partner in the country's growing Web3 landscape.

|

|

|

|

Crypto Summit

Bitget delivered a visible, high-engagement presence at Crypto Summit Moscow, anchoring a dedicated brand hub in a high-traffic respite zone and pairing it with an interactive activation that kept visitors circulating throughout the day. Thought leadership complemented the on-site experience: head of CIS spotlighted Bitget’s trading product suite on the main stage. A curated gala dinner extended the Summit experience for VIPs, builders, and KOLs. A nice side-event was executed with great vibe, live broadcast, and exclusive co-branded merchandise. Together, these touchpoints deepened relationships across the local community and reinforced Bitget's brand as both a product innovator and a committed ecosystem partner.

|

|

|

|

Conclusion

Q3 2025 underscored Bitget’s evolution from a leading exchange into a fully realized Universal Exchange (UEX), a connected financial ecosystem bridging centralized precision, decentralized innovation, and real-world integration. Across every vertical, the quarter’s performance reaffirmed Bitget’s long-term vision: to make digital finance simpler, smarter, and seamlessly accessible to everyone.

Externally, that vision is now being recognized across the industry. Reports from CoinDesk, Bitcoin.com, and CoinGecko all placed Bitget among the world’s top exchanges for liquidity, trading activity, and user growth, reflecting both its scale and market trust. Meanwhile, the Animoca Brands report, “Exchanges’ Next Phase: Reaching the Mainstream” recognized UEX as a blueprint for the next phase of exchange evolution, one that unites tokenized assets, AI tools, and cross-chain markets under a single interoperable model.

Internally, Bitget’s achievements, from the BGB migration to Morph, to the expansion of Bitget Onchain and the launch of tokenized stock products, reflect a clear shift from individual innovations to ecosystem synergy. The exchange’s 1.8× Proof-of-Reserves ratio and $800M+ Protection Fund continue to define transparency standards, while global activations and user engagement campaigns reinforce Bitget’s presence as both a market leader and a cultural force.

As the company enters Q4, Bitget remains focused on deepening interoperability across the UEX ecosystem, expanding institutional partnerships, and driving real-world adoption through payment and tokenization initiatives. By combining transparency with technology, and user trust with innovation, Bitget is not just adapting to the future of finance — it is actively building it.

- BitgetBitget Monthly Transparency Report: October 2025 TLDR; — US Stock Futures Volume Tops $200M — Bitget’s tokenized stock futures gained momentum, showing strong demand for synthetic exposure to major equities like Apple, Tesla, and NVIDIA. — Institutional Liquidity Surge — Joint Bitget x Nansen report revealed $23.1B in institutional liquidity inflows, signaling Bitget’s expanding role as a preferred execution venue under the UEX framework. — Reserve Strength — DefiLlama ranked Bitget #2 globally in CEX monthly inflows at $1.78B, with reserve

2025-11-13

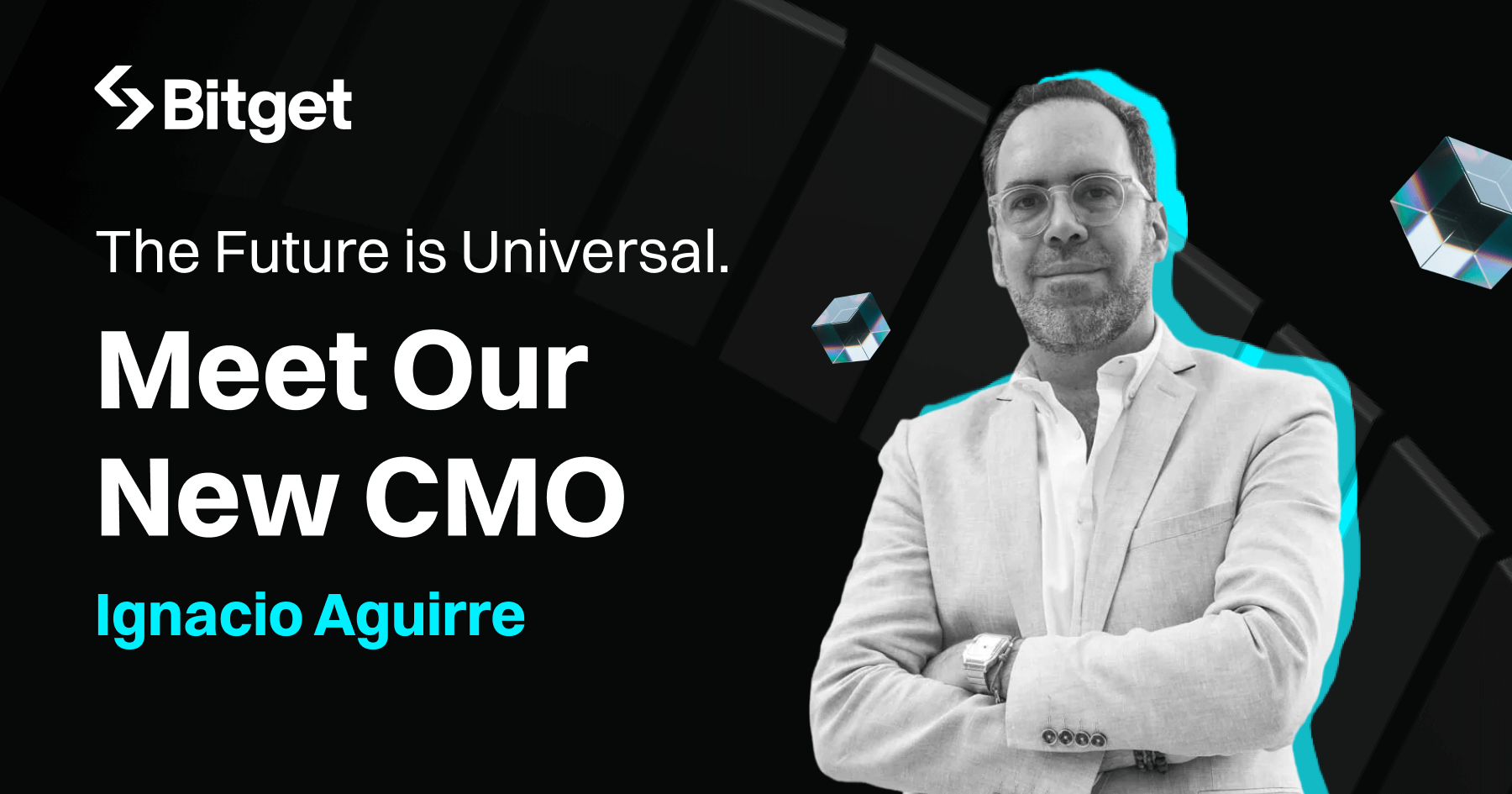

- BitgetWhy I joined Bitget to Boost the UEX Story — Chief Marketing Officer LetterThroughout my career, I’ve been driven by a single principle that technology should solve real-life problems and that people around the globe should have access to it. My own story begins in Mexico City, where, at the age of 13, I received my first computer from my father. A moment that changed my whole life's trajectory was when I first connected to the World Wide Web. That moment sparked a lifelong fascination with technology. I began coding, deconstructing devices, and seeking to understand

2025-11-07

- BitgetBitget Q2 2025 Transparency ReportTLDR; Bitget is rapidly gaining ground now the world’s second-largest exchange by volume and the largest women-led platform, growing its user base from 100M to 120M. Bitget joins the UNICEF Game Changers Coalition, launching a three-year global digital literacy program through Blockchain4Her. Official MotoGP Regional Partnership kicks off with Jorge Lorenzo and four global Grand Prix events. Regulatory footprint expands with new licenses in El Salvador and Georgia. Bitget launched in

2025-07-17