Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Grayscale just secured the green light from the New York Stock Exchange to list two new ETFs tied to Dogecoin and XRP . Both products begin trading Monday, marking another step in the rapid expansion of crypto ETFs in the United States. Here’s what’s going on and why it matters.

What Exactly Did the NYSE Approve?

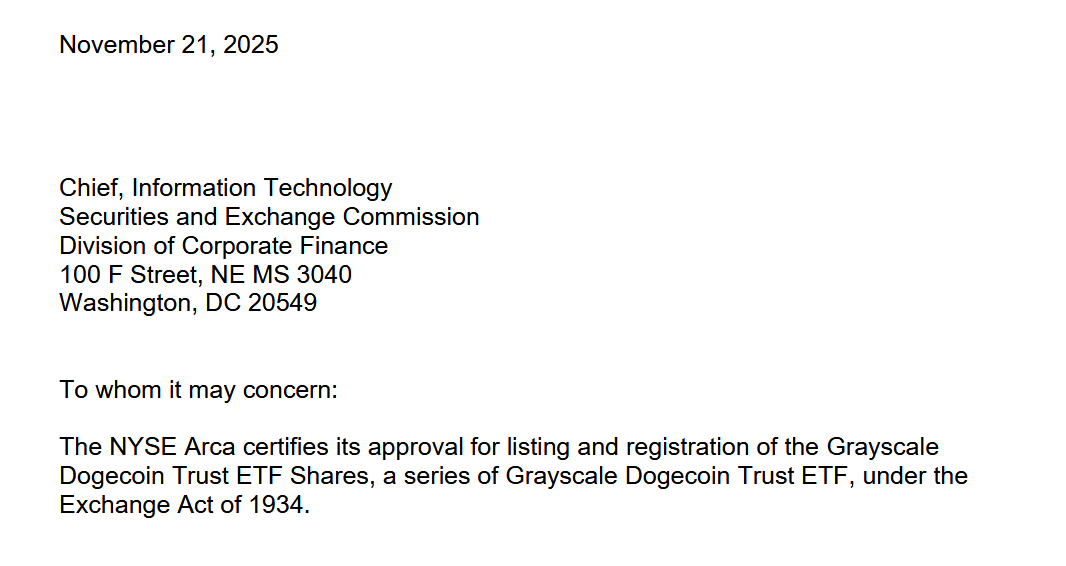

NYSE Arca certified the listing and registration of the Grayscale XRP Trust ETF Shares and the Grayscale Dogecoin Trust ETF Shares. This certification is the final administrative step that allows both products to debut on the open market.

These ETFs are not brand-new funds. They’re conversions of existing private-placement products that Grayscale has offered for years. Once they switch over into ETFs, they become easier to access for retail investors and institutions that prefer exchange-listed, regulated instruments.

Why These Two ETFs Are a Big Deal

Dogecoin isn’t just a meme coin anymore. It’s the original and largest memecoin by market value, with a community that behaves more like a movement than a fanbase. XRP, meanwhile, is one of the most established altcoins, sitting among the top assets by market cap and enjoying worldwide liquidity.

Adding both coins to Grayscale’s ETF lineup strengthens its already broad shelf, which includes bitcoin, Ethereum, Solana, and Dogecoin products. For the market, this signals something bigger: U.S. crypto ETFs are expanding beyond the usual majors and moving into a diversified multi-asset era.

Part of a Much Larger ETF Wave

These approvals didn’t happen in isolation. Over the past year, the U.S. has seen a consistent push toward altcoin-based ETFs. Litecoin, HBAR, SOL, and XRP ETFs have all appeared recently. Many of these launched during the government shutdown, when the SEC issued special guidance explaining how firms could go public without waiting for direct approval. The funds still had to meet strict listing standards, which the SEC signed off on in September.

That opened the door for Grayscale to move quickly with its own trust conversions.

Dogecoin ETF: Grayscale Joins a Small but Growing Club

Grayscale’s Dogecoin ETF will be only the second DOGE ETF to hit the U.S. market. The first was launched by REX Shares and Osprey Funds in September. Their DOGE product took a different regulatory route, listing under the Investment Company Act of 1940. That makes it more similar to an actively managed mutual fund structure, whereas Grayscale’s ETF conversion follows the traditional exchange-listed path.

The takeaway: the DOGE ETF space is small, experimental, and growing. Adding Grayscale’s scale and brand power could accelerate adoption.

Why Monday’s Launch Matters for Crypto Investors

Every time a new XRP ETF or any ETF goes live, liquidity deepens. Price discovery improves. More traditional capital flows into crypto without investors needing to self-custody or touch an exchange. With Dogecoin and XRP getting ETFs, two coins with massive communities and high global turnover suddenly get a new pipeline of institutional money.

This isn’t just another pair of products. It’s a sign that altcoin ETFs are steadily becoming a mainstream asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Major DEX Compromised as Centralized DNS Vulnerability Threatens DeFi Security

- Aerodrome and Velodrome DEXs suffered DNS hijacking attacks, redirecting users to phishing sites via centralized domain vulnerabilities. - Attackers exploited compromised domains to trick users into signing malicious transactions, mirroring a 2023 incident that caused $300,000+ losses. - Platforms urged users to revoke token approvals and use ENS mirrors, emphasizing secure smart contracts but highlighting DeFi's front-end risks. - The breach occurred days after Aerodrome's planned merger with Velodrome,

KITE Price Forecast Post-Listing: Understanding Market Fluctuations and Initial Investor Reactions

- 2025 Q3 IPO market surged 19% in deals and 89% in proceeds, driven by Fed rate cuts and AI/tech dominance. - KITE Realty (KITE) faces retail sector risks despite IPO gains, with EPS loss and debt concerns amid re-leasing challenges. - Institutional investors show divided KITE stakes, contrasting with AI IPO volatility, as REITs balance stability and macroeconomic uncertainties. - KITE's future hinges on tenant resilience, Fed policy, and retail sector shifts, with mixed analyst views on its dividend grow

MMT Token TGE and Its Impact on the Market: Analyzing Tokenomics and Investor Attitudes Toward New Crypto Assets

- MMT's November 2025 TGE saw an 885% price surge but a 34.6% weekly decline due to unlocks and macroeconomic factors. - Tokenomics allocated 42.72% to community, 24.78% to early investors, creating liquidity risks as large unlocks pressured prices. - Institutional backing and airdrops fueled initial FOMO, but U.S. government shutdown risks and Bitcoin dominance eroded altcoin liquidity. - Long-term sustainability questions arise from lack of intrinsic scarcity and reliance on macroeconomic stability amid

MMT Token Experiences Rapid Price Increase: Uncovering the Causes Behind the Spike

- MMT Token surged 1,300% on Binance in Nov 2025 via airdrops, listings, and institutional backing. - Binance's 0.75% genesis supply airdrop and multi-exchange listings drove retail adoption and liquidity. - 1607 Capital's 84.7% stake increase and regulatory clarity under CLARITY Act/MiCA 2.0 reduced legal risks. - Structural factors (scarcity model, yield strategies) outperformed hype, but $4.31-$4.90 volatility exposed speculative risks. - Investors must balance MMT's institutional alignment with liquidi