Analysis: Super whales suffered significantly lower losses in this correction compared to previous ones, with core holdings still firmly held

BlockBeats News, November 16, on-chain analyst Murphy stated that, despite deteriorating market sentiment, the super whale group that truly holds massive amounts of tokens remains relatively calm. On-chain data shows that large wallets holding 1,000–10,000 BTC realized a loss of only $80 million (7D-SMA), a scale significantly lower than the levels seen during the two key correction periods in August 2024 and March 2025. The same is true for even larger whale groups. Super whales holding 10,000–100,000 BTC realized a loss of about $40 million (7D-SMA) during this downturn, also much lower than the losses in the previous two periods. The main funds in this round appear more mature and stable in terms of psychological expectations, risk tolerance, and position management, and these core tokens are still being firmly held.

In terms of token structure, the BTC price is still within the large token accumulation range of $92,000–$117,000. The position with the most high-price locked tokens, $112,000, has only decreased by 11,000 compared to last week, indicating that most tokens have been absorbed by long-term funds and are not sensitive to short-term price fluctuations. The largest decrease in tokens occurred near $100,000, with a reduction of 102,000 BTC compared to last week, leaving 363,000 currently, making this the area with the most severe short-term selling pressure. The current price of $96,000 has seen an increase of 160,000 tokens compared to last week, with the vast majority coming from token sell-offs at the $100,000 level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions

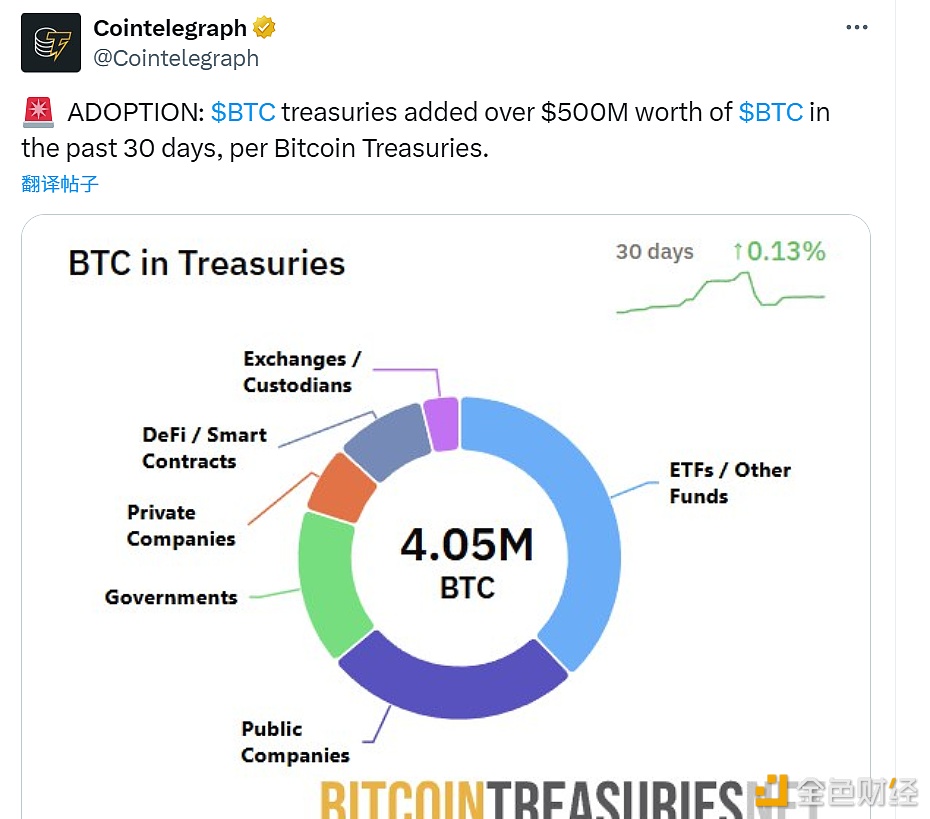

Institutions increased their BTC holdings by over $500 million in the past 30 days

Adam Back: Strategy's leverage ratio is very low, previously only transferred BTC to another custodian and did not sell