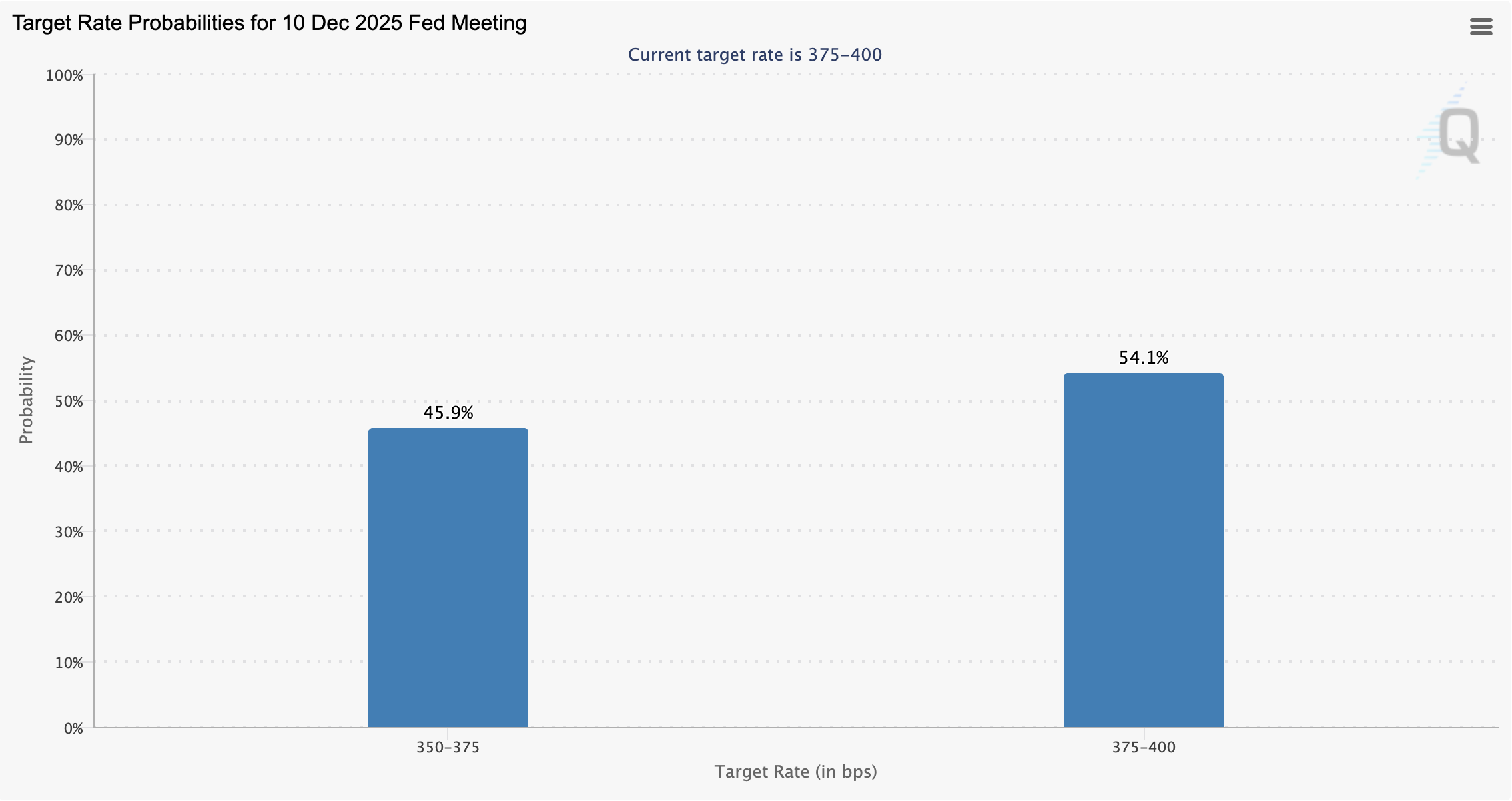

Probability of December interest rate cut falls below 50%

Only 45.9% of investors anticipate an interest rate cut at the next US Federal Open Market Committee (FOMC) meeting in December, amid declining market sentiment and a downturn in the cryptocurrency market.

The odds of a 25 basis point (BPS) interest rate cut in December were nearly 67% on Nov. 7, according to data from the Chicago Mercantile Exchange (CME) Group.

In September, several banking institutions forecast at least two interest rate cuts in 2025, with market analysts at investment banking company Goldman Sachs and banking giant Citigroup each projecting three 25 BPS cuts in 2025.

Interest rate decisions influence crypto prices. Lower interest rates translate into more liquidity flowing into asset markets and propping up prices, while higher rates mean liquidity and prices will be constrained.

The declining odds of a December rate cut are feeding negative market sentiment and may signal that more short-term price pain is coming to the crypto market until the Federal Reserve resumes easing rates.

Related: Stablecoin demand is growing, and it can push down interest rates: Fed’s Miran

Federal Reserve’s Jerome Powell casts doubt on a December rate cut

“There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it. Policy is not on a preset course,” Federal Reserve Chair Jerome Powell said in October.

As expected, the Federal Reserve slashed rates by 25 BPS in October; however, crypto prices extended their decline following the lowered rates.

The October rate cut was “fully priced in” by investors, who widely anticipated the cut months ahead of time, according to Matt Mena, a market analyst at investment company 21Shares.

Economist and former hedge fund manager Ray Dalio warned that the Federal Reserve is cutting rates into record-high asset prices, relatively low unemployment and low credit spreads, a historic anomaly.

In November, Dalio said the Federal Reserve is likely stimulating the economy into a bubble, adding that this is a feature typical of debt-laden economies headed toward hyperinflation and currency collapse.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari: Crypto Kid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: Hype or Practical Use? The 2025 Altcoin Scene Strives for Equilibrium Between Excitement and Real-World Application

- Datavault AI (DVLT) distributes Dream Bowl 2026 meme coins to shareholders, boosting pre-market shares 4.91% and reflecting meme token-driven retail engagement trends. - Scilex's $150M Bitcoin investment in Datavault and Empery Digital's Bitcoin treasury shift highlight traditional-digital asset convergence amid strategic restructuring. - DeFi innovator Mutuum Finance (MUTM) nears $18.7M presale completion with 250% token growth, while Canary XRP ETF's $26M debut signals institutional altcoin interest. -

DASH surges 21.6% fueled by collaboration with Old Navy and independent growth

- DoorDash shares surged 21.6% in 24 hours after announcing a new on-demand apparel delivery partnership with Old Navy and expanding autonomous delivery in Miami. - The rally followed Q3 revenue growth of 27.3% and a cybersecurity breach disclosure, with the company enhancing security measures and settling a $18M Chicago lawsuit over alleged deceptive practices. - Despite recent gains, DASH remains 26.1% below its 52-week high after a 15.5% drop in October due to weak earnings and EBITDA guidance, with ana

Ethereum News Update: Major investors redirect funds toward AI infrastructure as they reduce holdings in Nvidia

- Bridgewater cut 65.3% of its Nvidia stake in Q3 2025, reflecting institutional caution amid macroeconomic risks and AI-driven capital reallocations. - SoftBank fully exited its $5.8B Nvidia position to fund new AI ventures, while Bridgewater boosted holdings in AI chip manufacturing firms AMAT and LRCX . - Ethereum institutions increased 34% ETH holdings despite price declines, signaling blockchain's growing role in AI infrastructure alongside traditional tech stocks. - Analysts remain bullish on Nvidia'

XRP News Today: XRP ETF Makes History with Nasdaq Launch, Connecting Cryptocurrency and Traditional Finance

- Canary XRP ETF (XRPC) became first U.S. spot XRP ETF on Nasdaq on November 13, 2025, marking XRP's entry into traditional finance. - The SEC-approved fund saw $58M in first-day trading volume, surpassing expectations and outperforming Solana's BSOL ETF debut. - Managed by Canary Capital with 0.5% fees, it reflects regulatory progress after months of scrutiny and aligns with Bitcoin/Ethereum ETF inflow patterns. - Despite XRP's 2.7% post-launch dip, analysts view XRPC as a positive catalyst, with JPMorgan