When Polkadot's $500 million security cost becomes a burden, Gavin Wood offers three solutions!

This article is the second part of Gavin Wood's speech at the Web3 Summit in July, translated into Chinese. Due to the extensive content of the speech, we will release it in four parts to help everyone gradually understand and digest it. Although the major information from Gavin at the Web3 Summit has already been widely circulated in the community, there are still many more details in the original text that are worth knowing!

The first part: "Gavin Wood Speech: JAM Delivery Status and the Medium- and Long-Term Strategy for Introducing ZK into JAM!"

In the second part, Gavin focuses on the economic dilemma of Polkadot Staking:

1. The huge gap between the annual $500 million security expenditure and the negligible income;

2. Staking rewards are massively sold off due to tax issues, with staking costs constantly spilling over;

3. To address this long-term structural deficit, he proposed three main paths:

- Increase the value of Coretime — make the "product" Polkadot sells more useful and attractive;

- Compress costs and reshape the issuance curve — reduce annual costs from $500 million to less than $100 million;

- Explore native stablecoins and Proof of Personhood (PoP) — while reducing security costs, optimize payment methods and reshape the network security mechanism.

The core of all this is fiscal discipline, which is also the key to Polkadot's long-term sustainable development.

Next, please continue reading to learn more about the second part of Gavin's speech.

The Economic Dilemma Facing Polkadot Staking

Let's bring the topic back to staking costs, which can also be referred to as fiscal discipline.

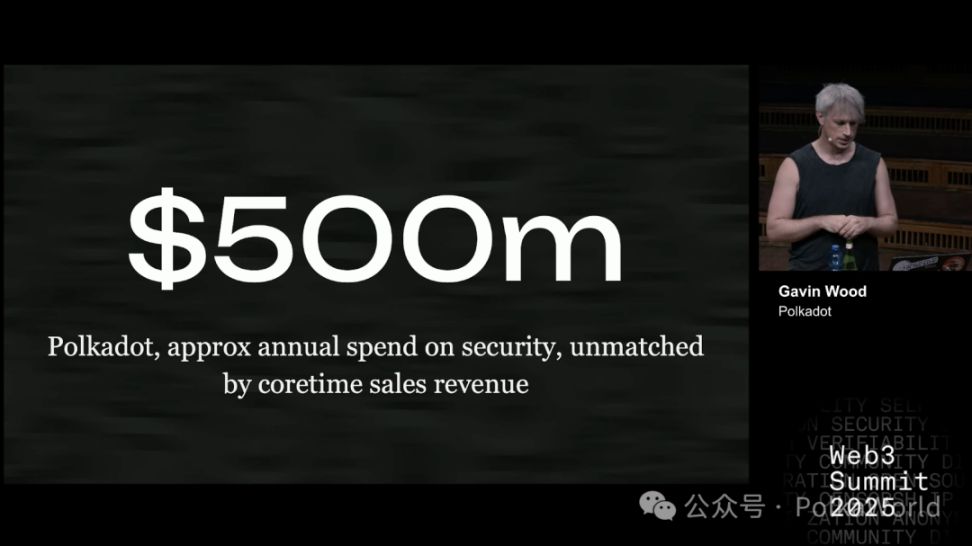

The most intuitive figure is: $500 million. This is roughly Polkadot's current annual expenditure on network security. In other words, Polkadot invests such a huge amount of funds every year to maintain its own security.

However, this expenditure is not matched by corresponding income. The sources of income are almost negligible, mainly coming from the sales of coretime. If this money always circulated within the DOT ecosystem, it might not be a problem. The issue is, we know that a considerable portion of the funds flows outside the system. The reason is simple—many stakers are located in high-tax jurisdictions.

Here's a real-life example:

How many people have participated in staking? — Almost everyone.

How many have paid taxes on staking rewards? — Almost everyone.

Paid more than 10%? — Almost everyone.

More than 20%? — Still quite a few.

More than 35%? — Maybe one or two.

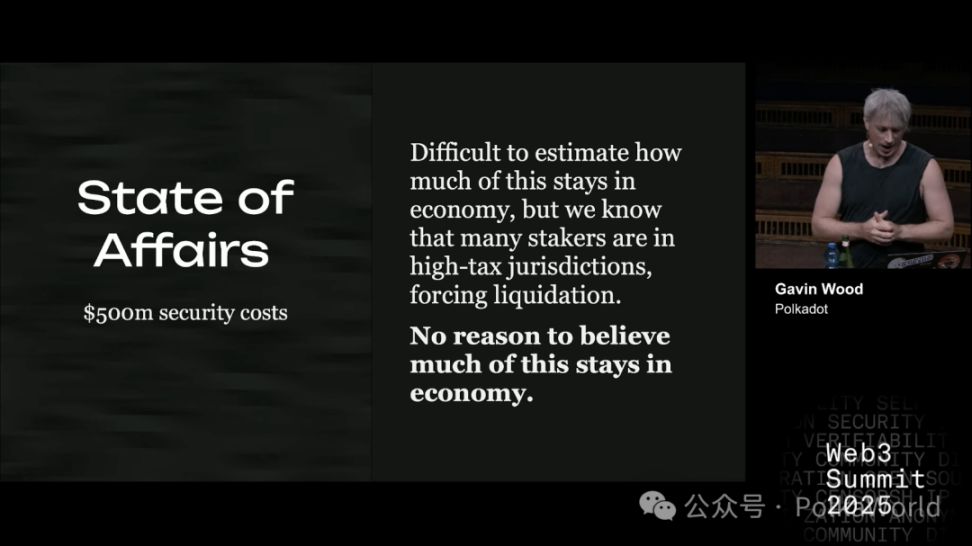

So overall, stakers are generally in the 20%–30% tax bracket.

By contrast, the situation with mining is completely different. The mining industry is highly concentrated and institutionalized, making tax optimization much easier. Common methods include putting mining machines under offshore companies or using gray channels to smooth relationships.

In other words, mining rewards are more easily channeled through institutional means to avoid taxes; while staking rewards are distributed to ordinary people scattered across various normal legal jurisdictions. Governments in these places are financially strained and naturally won't miss any tax opportunities. Especially nowadays, as countries' fiscal situations become increasingly tight, taxing staking—which "looks like free income"—becomes a logical choice.

Therefore, staking rewards have almost become an obvious tax target.

I want everyone to think about a question: If you are paying taxes on staking rewards, how many would be willing to move to a low-tax jurisdiction just to avoid this tax?

The answer is: only one person present.

This shows that most people do not have a strong willingness to relocate just for tax avoidance. In other words, the commitment to keeping staked assets within the system for the long term is actually not that deep.

This is the problem, and also the economic dilemma faced by staking.

Of course, I can't assert that all staking rewards will be immediately cashed out. But we already know that a considerable portion of rewards will be quickly sold off due to tax pressure. Frankly, I don't see why the remaining rewards wouldn't be sold at the same time. This is, of course, just a hypothesis, but there aren't many reasons to refute it. If you're interested, you can continue to ask about this in the final discussion session.

The First Step to Addressing the Structural Deficit: Increasing the Value of Coretime

The question is, how should we address such a long-standing major structural deficit?

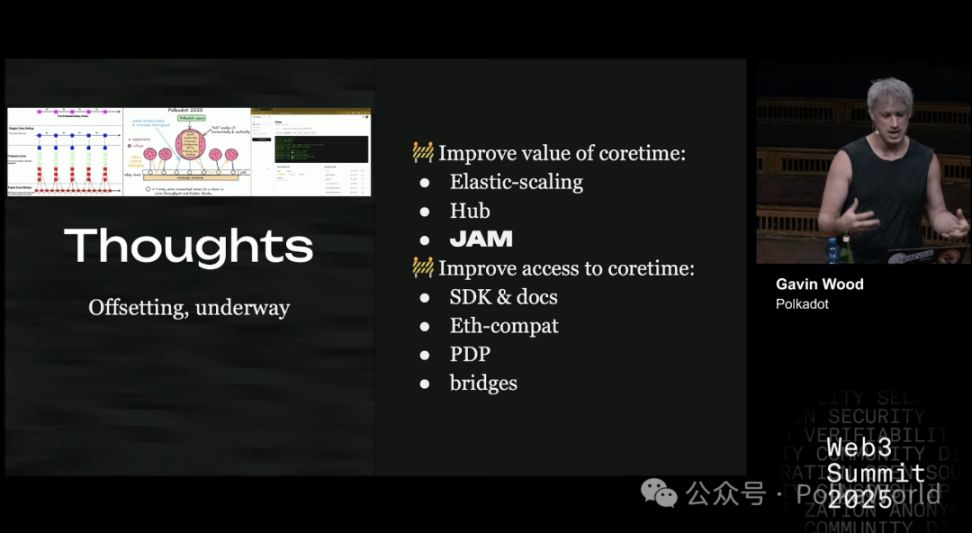

In my view, the current situation is clearly unsustainable in the long term. The first thing we can do is hedge—increase revenue. In business logic, the way to increase revenue is to make the product better and more valuable.

In Polkadot, what we are really selling is coretime. The reason the network spends $500 million a year is to produce secure and trustworthy coretime. Therefore, increasing the value of coretime is a perfectly reasonable path.

This has actually already begun and has been underway for quite some time.

- Elastic Scaling, Polkadot Hub, JAM—their goal is precisely to make coretime more useful and valuable.

- Improving accessibility is also important, such as SDKs, documentation, and the very user-friendly Polkadot Deployment Portal. There are also initiatives like Ethereum compatibility and cross-chain bridges (not listed here one by one).

All these efforts are continuous attempts to increase the value of the "product" we are selling.

The Second Step to Addressing the Structural Deficit: Reducing Costs and Reshaping the Issuance Curve

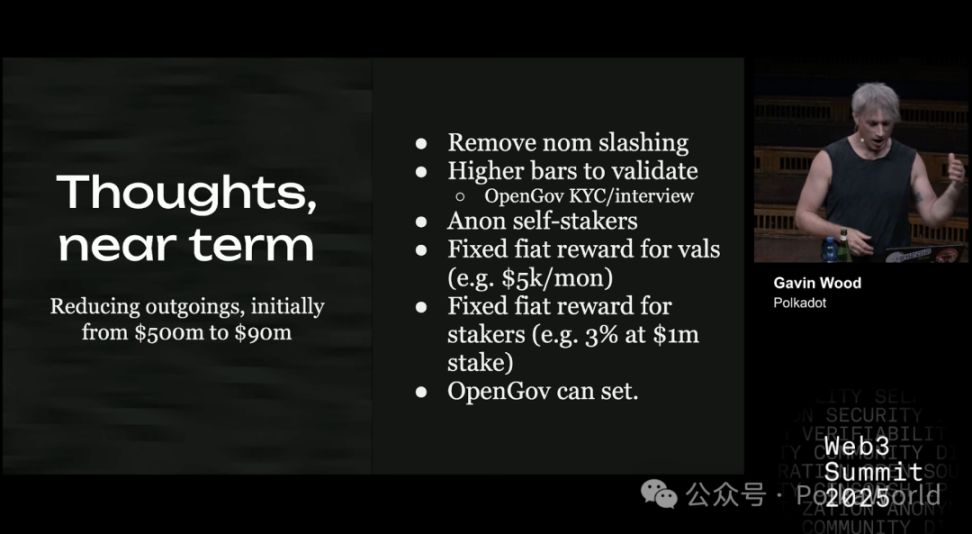

Besides increasing revenue, another reasonable direction is to reduce costs.

One proposal I support is to compress the annual cost from $500 million to less than $100 million. Specific measures include:

- Eliminate nominator slashing: This makes nomination basically risk-free, allowing for lower payments to nominators, while balancing risk by raising the entry threshold for validators.

- Allow validator self-staking to be anonymous (some views from Jeff).

- Validators receive a fixed fiat reward: Because they do have fixed costs (living, hardware, etc.). Since it will ultimately be converted to fiat for consumption, direct fiat payment is more reasonable.

- Stakers receive a fixed return: The reward amount is determined and fixed by the system, set with reference to opportunity cost. For example, if the full self-staking cost is $1 million and the risk-free rate is 3%, then a reasonable fixed return is $30,000 per year.

This way, a predictable and controllable reward model can be established.

As for the fine-tuning of these parameters, it can be left to OpenGov to decide. You could even set up an expert group of economists to make such governance decisions more professional and valuable for reference.

The key is that this requires deep insight, and I believe it also requires major reforms. We must take on long-term responsibility, such as implementing fiscal discipline through a fixed issuance curve. This may sound controversial, but I think it's reasonable.

First, we need a clear maximum issuance. It's best to choose a number that is easy to understand, easy to remember, rational, and reasonable. For example, "π billion" is a simple and elegant solution.

When designing issuance, introducing a decay curve is also necessary. This curve can be as direct and brutal as bitcoin's halving curve, but I personally prefer a stepwise decay. I don't see any reason to reject the stepwise approach; at least in bitcoin, it has proven to be an effective signaling mechanism. So I'm willing to take that risk. The decay period can be every two years, or it can be set to every 12 months.

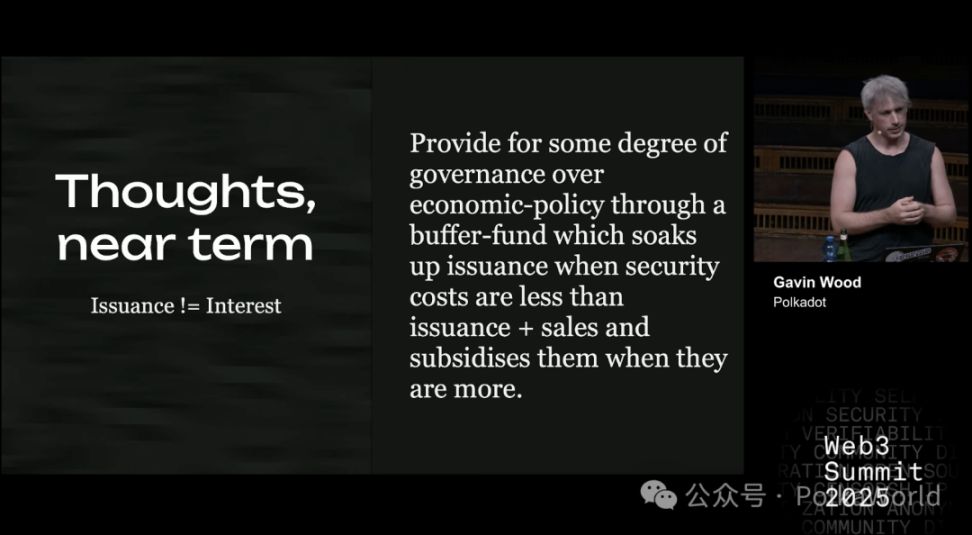

It should be emphasized: a fixed issuance curve does not mean that there must be fixed interest payments.

Bitcoin actually binds the two together: it stipulates that the halving period is the block reward halving, resulting in a block every ten minutes, with the corresponding reward amount fixedly reduced. But in my view, there is no need to implement this in Polkadot.

Polkadot has a governance mechanism that can be flexibly adjusted as needed. I think having a clear issuance curve is reasonable because it represents a long-term commitment; but at the same time, decoupling the issuance curve from interest payments is also very valuable.

The amount of staking rewards and the level of security required by the system do not necessarily have to be tied to a "rigid issuance curve." Therefore, there is absolutely no need to require that interest payments must strictly correspond to the issuance at a certain point in time.

In my view, separating the two is more reasonable. We can rely on governance to make adjustments:

- It could be an economist committee,

- It could be the Fellowship,

- It could be OpenGov,

- Or it could be put directly to a referendum.

- It could even be achieved algorithmically.

In any case, the core goal is to establish a dynamic mechanism to adjust the interest rate or reward level paid to validators.

The source of funds can be a pool filled by issuance, rather than necessarily coming from the treasury. You can think of it as "unspent inflation."

In principle, if sales grow or issuance exceeds security cost needs, then this pool will be full; if sales are insufficient or issuance cannot cover security costs, then this pool will decrease.

This way, governance will have ample time to reassess:

- Have we set the security target too high?

- Or, in another case, have we set the security threshold too low?

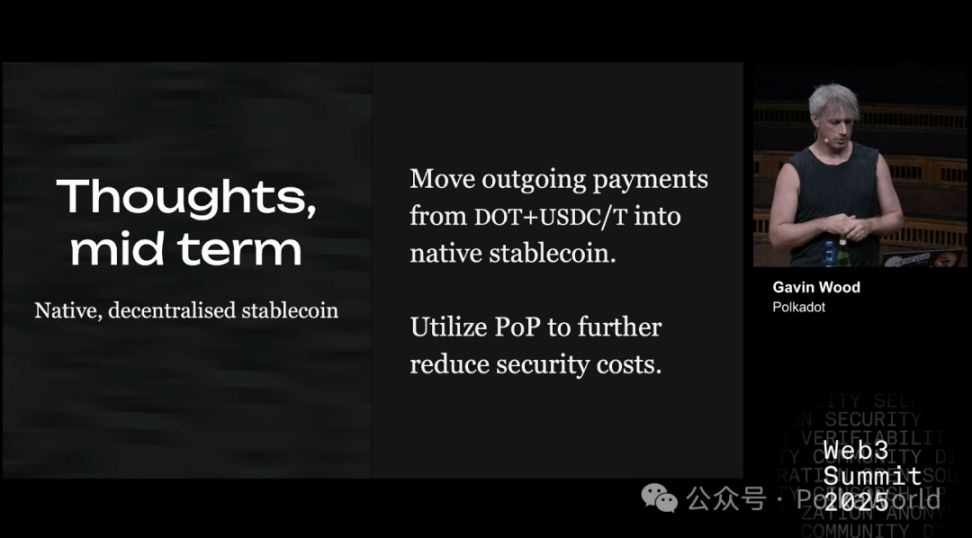

The Third Step to Addressing the Structural Deficit: Native Stablecoins and PoP

In the medium term, issuing a native stablecoin on Polkadot will bring huge benefits, especially in the expenditure payment process.

For income (i.e., purchasing coretime), continuing to settle in DOT is reasonable; but the situation is different for expenditures. We know that most of these expenditures are for market-based service compensation, which will essentially be immediately exchanged and spent in the real world—on food, hardware, accommodation, or other costs. Therefore, letting the system itself (i.e., Polkadot governance) decide when and how these funds are converted into stablecoins is clearly more reasonable.

If a native stablecoin can be issued, it means we can pay in a way close to "fiat" without putting the same cost pressure on the DOT ecosystem, which is undoubtedly meaningful.

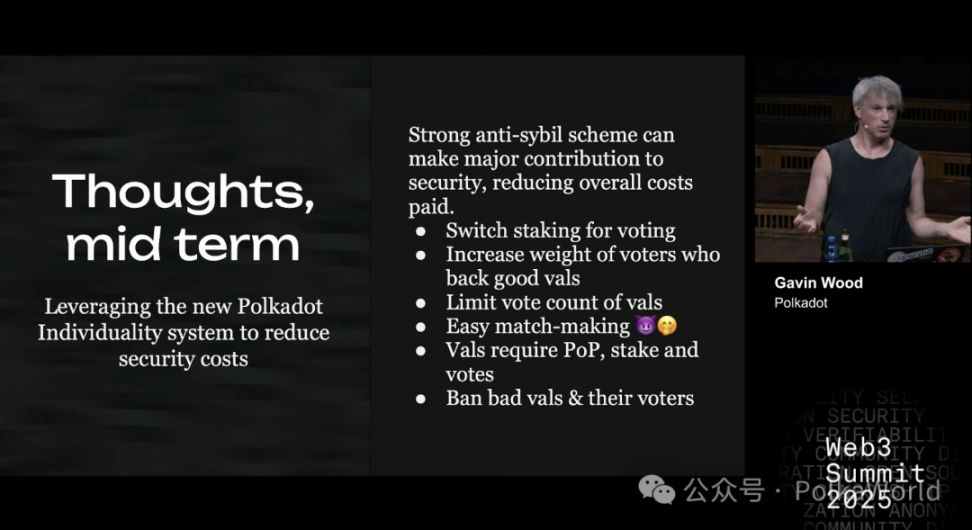

In addition, security costs can be further reduced through Proof of Personhood (PoP, anti-sybil mechanism).

This is a project I mentioned last year, first proposed as early as the summer of 2022, and has now been in progress for three years. The slow progress is not due to lack of effort, but because this mechanism must be nearly perfect.

I believe that a mature and robust anti-sybil solution can make a major contribution to network security and significantly reduce the overall operating costs of the core protocol.

So, how exactly can this be achieved? This solution has just moved out of the conceptual stage and has just begun to be written down, but the basic idea is as follows. Currently, the system relies on nominators taking on risk capital through staking and then voting to select validators to run the network.

In the new mechanism, validators still exist and continue to be rewarded to cover hardware and daily expenses; but "nominators" will be replaced by ordinary voters. In other words, users will no longer take on risk by staking DOT, but will express support for validators through "voting."

The specific rules are:

- Support high-quality validators → your voting weight will be increased.

- Support low-quality validators → your voting weight will be reduced or even reset to zero; you may also be banned from voting for a period of time.

- If the validator itself is low-quality → then the validator will be permanently banned or severely punished.

- Limit the number of votes a validator can receive → forcing voters to spread their votes instead of everyone voting only for the most popular validators.

The most difficult part to solve is the matchmaking mechanism: how can ordinary users identify high-quality validators? This requires new solutions, and I already have some ideas, essentially involving UI-level integration, but it is still under development and not suitable for public disclosure.

But, under this mechanism:

- Validators must pass proof of personhood to ensure they can be disabled when necessary;

- Validators still need to stake to maintain a minimum trust base;

- The core driving force of the system comes from voting.

If this design can be implemented, we are expected to significantly reduce staking cost expenditures, possibly by as much as half.

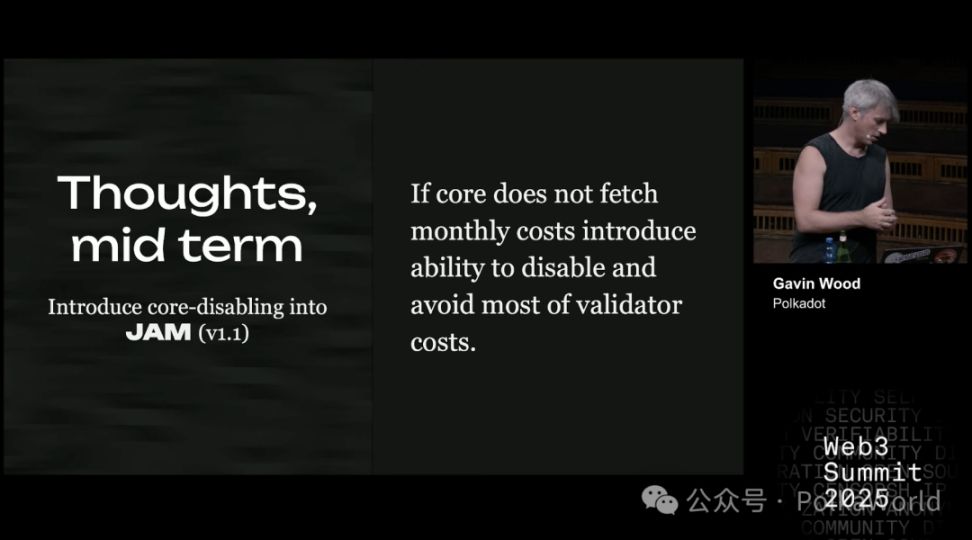

So, what other measures can be taken? The answer is to introduce core disabling.

Elves, JAM, and Polkadot can run efficiently in part because they can rely on the same set of validators and allocate the security provided by these validators to multiple parallel tasks. In other words, they can "amplify" the efficiency of security use.

But the problem is that this "amplification" itself requires a high base security cost. If the number of users is insufficient, you end up spending a lot without getting corresponding value.

The role of core disabling is to reduce the actual workload of the system, thereby reducing the number of validators required and, accordingly, the rewards that need to be paid.

This mechanism cannot be implemented yet—it will not appear in JAM v1, but future upgrades (such as JAM v1.1) may introduce it.

Through core disabling, we can compress costs to the minimum while maintaining the required security level.

The above is the first half of the speech. Next, in the second half, I will share some new directions we are exploring—not just myself, but the entire Parity team and even the Web3 field are paying attention to these topics.

PolkaWorld note: We will continue to share the follow-up content on the PolkaWorld official account. Follow us to learn more about Polkadot!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Bitcoin rise or fall next year? Institutions and traders are fiercely debating

Bitcoin continues to decline, once again dropping below 100,000.

Swiss Startup To Launch Cloud Alternative Powered By Phones