Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

Bitcoin has struggled to rebound after last month's plunge. Despite traditional risk assets rallying on the US government reopening, Bitcoin failed to break through key resistance levels and ETF inflows have nearly dried up, highlighting a lack of market momentum.

Written by: Ye Huiwen

Source: Wallstreetcn

After suffering a massive blow last month that wiped out hundreds of billions of dollars in market value, Bitcoin is struggling to recover. Fragile market sentiment and persistent selling pressure are making any attempts at a rebound extremely difficult.

Although the positive news of Washington ending the government shutdown boosted traditional risk assets, the crypto market did not see the strong rally that was expected, highlighting the lingering unease among investors after heavy losses.

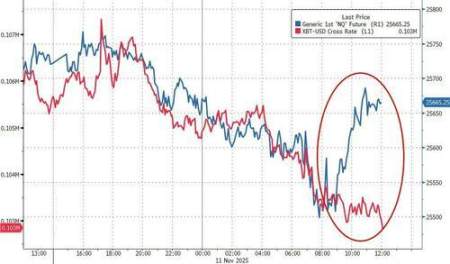

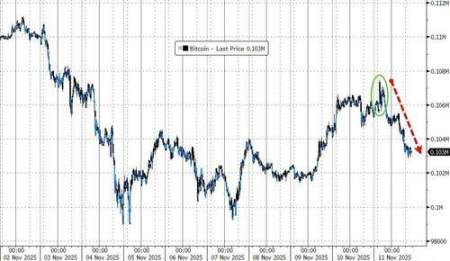

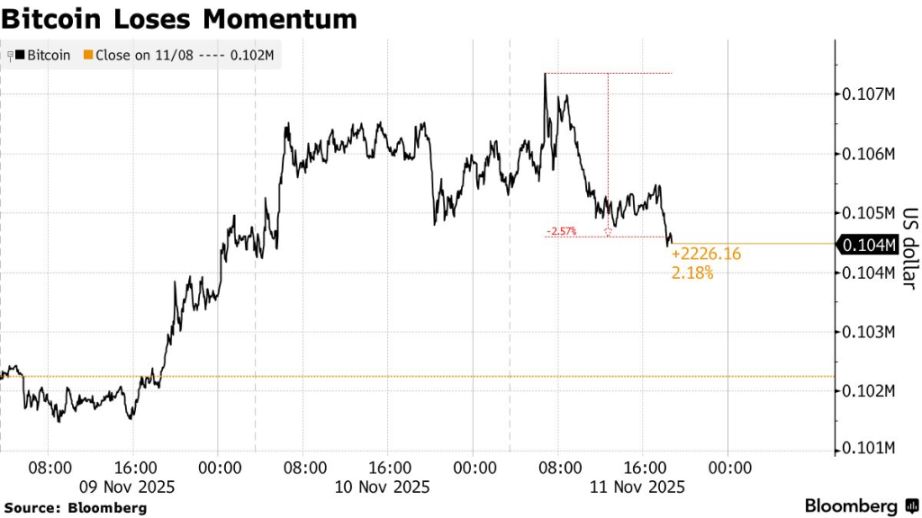

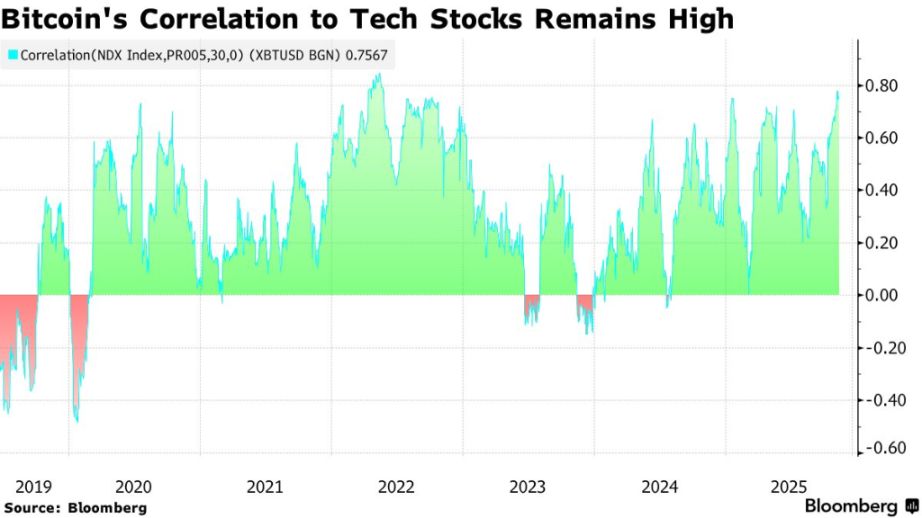

The world’s largest cryptocurrency briefly broke above $107,000 (UTC+8) on Monday, but quickly fell back below $105,000 (UTC+8). This lackluster price action stands in stark contrast to the gains in equities and credit markets following the US government reopening, indicating that internal momentum for crypto assets remains insufficient.

According to Bloomberg, since the record liquidations triggered by Trump’s surprise tariff announcement on October 10, Bitcoin’s market cap has shrunk by about $340 billions. The market generally believes that the recent slump is partly due to early large holders (the so-called “OG whales”) taking profits near annual highs, while the shadow of the large-scale liquidation event in early October still lingers.

Signs of weakness are evident in several key indicators. Measures of market sentiment and leverage show that investor enthusiasm is far from recovered. Meanwhile, key resistance levels on technical charts are heavily suppressing prices, and market participants remain divided on the outlook.

Key Indicators Show Lack of Momentum

A range of data suggests that the momentum driving Bitcoin higher has yet to return. The total open interest in Bitcoin perpetual futures is currently around $68 billions (UTC+8), well below last month’s peak of $94 billions (UTC+8), reflecting a significant cooling of speculative interest in the derivatives market. At the same time, funding rates—which measure the cost of leveraged positions—remain stable, indicating that traders are not aggressively leveraging up on longs.

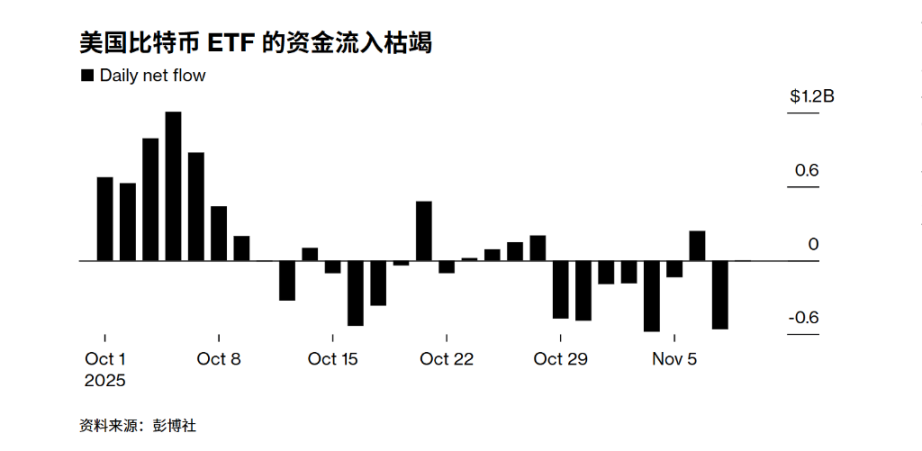

More notably, spot Bitcoin ETFs, a key source of new capital for the market, have also been underwhelming. According to data compiled by Bloomberg, despite a broad rally in US equities on Monday, US-listed Bitcoin ETFs saw only $1 million (UTC+8) in net inflows that day. George Mandres, Senior Trader at XBTO Trading, pointed out that the lack of new capital represented by ETF inflows continues to weigh on market risk sentiment.

Technical Resistance Remains Strong

From a technical perspective, Bitcoin’s outlook is also facing challenges. Currently, its price remains below the 200-day moving average (now near $110,000 (UTC+8)), a level widely seen by analysts as a key threshold for any sustained rally.

Tony Sycamore, analyst at IG Australia, stated that the price needs to consistently break above the 200-day moving average to “greatly increase confidence in the view that (the uptrend has resumed).” Alex Kuptsikevich, Chief Market Analyst at FxPro, also observed that the broader crypto market cap is encountering technical resistance at the 50-day moving average near $3.62 trillions (UTC+8). He believes the market may be forming a new, lower local high, continuing the downtrend that began over a month ago.

BTC Markets analyst Rachael Lucas added that $103,000 (UTC+8) is a key structural support level. If this level is breached, it could open the way for prices to fall towards $86,000 (UTC+8) or even deeper to $82,000 (UTC+8) (in line with the 100-week moving average). Any move below these areas could reignite selling pressure.

Market Views Diverge: Dead Cat Bounce or Trend Reversal?

There is a clear split among market participants in interpreting Monday’s brief rally. Some see it as merely a temporary respite in a bear market, while others are searching for early signs of a trend reversal.

George Mandres bluntly stated that this rebound “feels like a dead cat bounce.” He believes that sentiment in the crypto space is different from equities, with much attention focused on reports of early Bitcoin buyers selling large amounts of tokens, and this supply pressure is dampening risk appetite. Alex Kuptsikevich also said the market is clearly not ready to shift into “crazy optimism mode,” and profit-taking continues after growth impulses are realized.

However, some analysts are relatively optimistic. Tony Sycamore pointed out that the most notable feature in the past 24 hours (UTC+8) was that, after last month’s breakdown in correlation, Bitcoin briefly tracked the rally in risk assets. He sees this as a “positive sign” and, from a technical perspective, suggests that the correction from the $126,272 (UTC+8) high may have ended at the recent $98,898 (UTC+8) low.

Rachael Lucas described the recent rally as a “classic short-covering bounce, mixed with some institutional FOMO (fear of missing out).” This view suggests that the current rise is driven more by structural market factors than by a solid return of fundamental confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why prediction markets are still in the exploratory stage

In-depth analysis of the five major systemic obstacles hindering the development of prediction markets.

Analysis of Monad's 18-page Sales Document: How Does 0.16% Market Making Allocation Support a $2.5 Billion FDV?

This document also systematically discloses a large amount of important details such as legal pricing, token release schedule, market-making arrangements, and risk warnings.

From Queen’s Dream to Prison Gate: The Absurd Scam of Qian Zhimin and 60,000 Bitcoins

The specific disposition of this large amount of Bitcoin will be decided early next year.

Bitcoin slides near $103,000 as December rate cut becomes more uncertain

Quick Take Bitcoin fell near $103,000 on Tuesday, driven primarily by investor profit-taking and macroeconomic uncertainties. Hopes for a December interest rate cut have dwindled following a report detailing growing internal conflict among Federal Reserve officials over the decision.