Date: Sun, Nov 09, 2025 | 06:06 PM GMT

The cryptocurrency market continues to highlight strong performance among Dino altcoins. Internet Computer (ICP) has already surged more than 200 percent in one week, and now attention is shifting toward several other tokens displaying similar early-stage reversal setups — including Uniswap (UNI).

UNI has returned to the green with a 11 percent jump today, and more importantly, its technical structure is beginning to show a classic bullish pattern that could support a strong upside continuation.

Source: Coinmarketcap

Source: Coinmarketcap

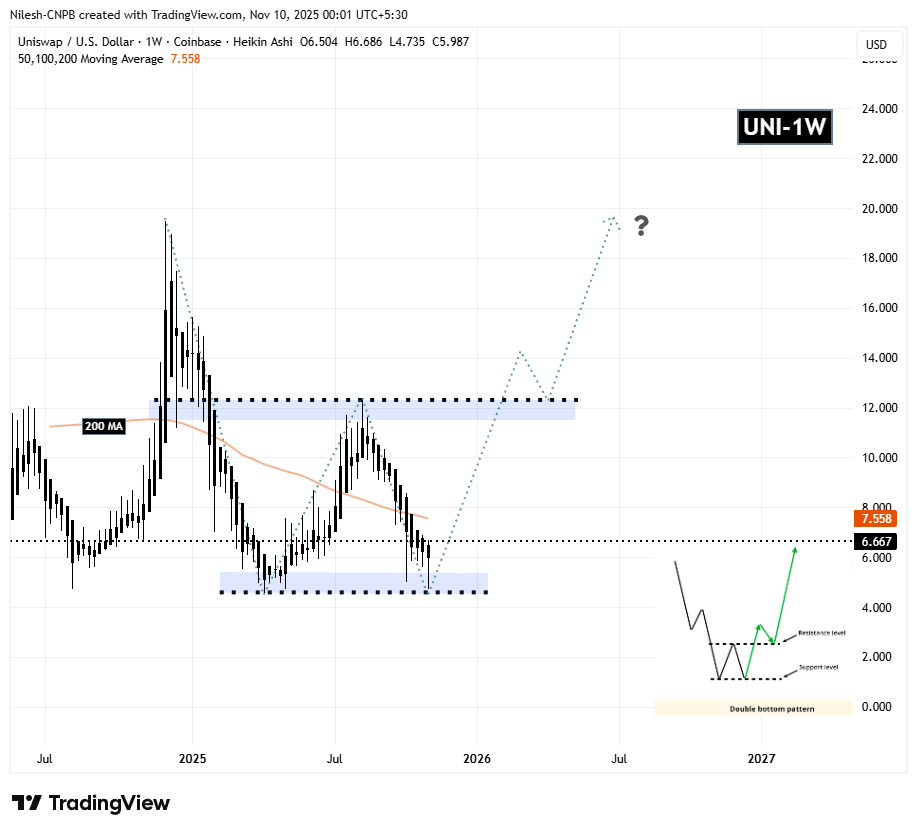

Double Bottom Pattern in Play

On the weekly chart, UNI is forming a double bottom pattern, a well-known bullish reversal formation that often appears near the end of prolonged downtrends. The first bottom developed in April when the token dropped to the $4.70 region, followed by a recovery that pushed UNI toward the neckline at $12.28 in August.

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

However, the token faced rejection there and rolled over into a second drop, tagging the same $4.70 support area once again and made a strong bounce to current price of $6.66

This repeated defense of a major support level strengthens the case that buyers are attempting to establish a long-term bottom.

What’s Next for UNI?

If this pattern continues to unfold, UNI must first reclaim the 200 week moving average at $7.55. A sustained move above that level would signal improving momentum and set the stage for a retest of the neckline resistance at $12.28.

A clean breakout above the neckline — ideally supported by volume and followed by a retest — would confirm the full activation of the double bottom setup. In that scenario, UNI could extend toward the projected technical target near $19.87. This level represents a significant expansion move of nearly 20 percent above the neckline and roughly a 195 percent gain from where the token is currently trading.

For now, UNI’s structure appears constructive. The double bottom formation, repeated support at the same lows, and proximity to the 200 week MA all suggest this could be a pivotal moment for the token as it attempts to shift from accumulation into expansion.