We secretly defeated the AI Trading Competition champion Qwen

DeepSeek isn’t the only one being “taken over”...

DeepSeek isn't the only one being "ambushed"...

Written by: 1912212.eth, Foresight News

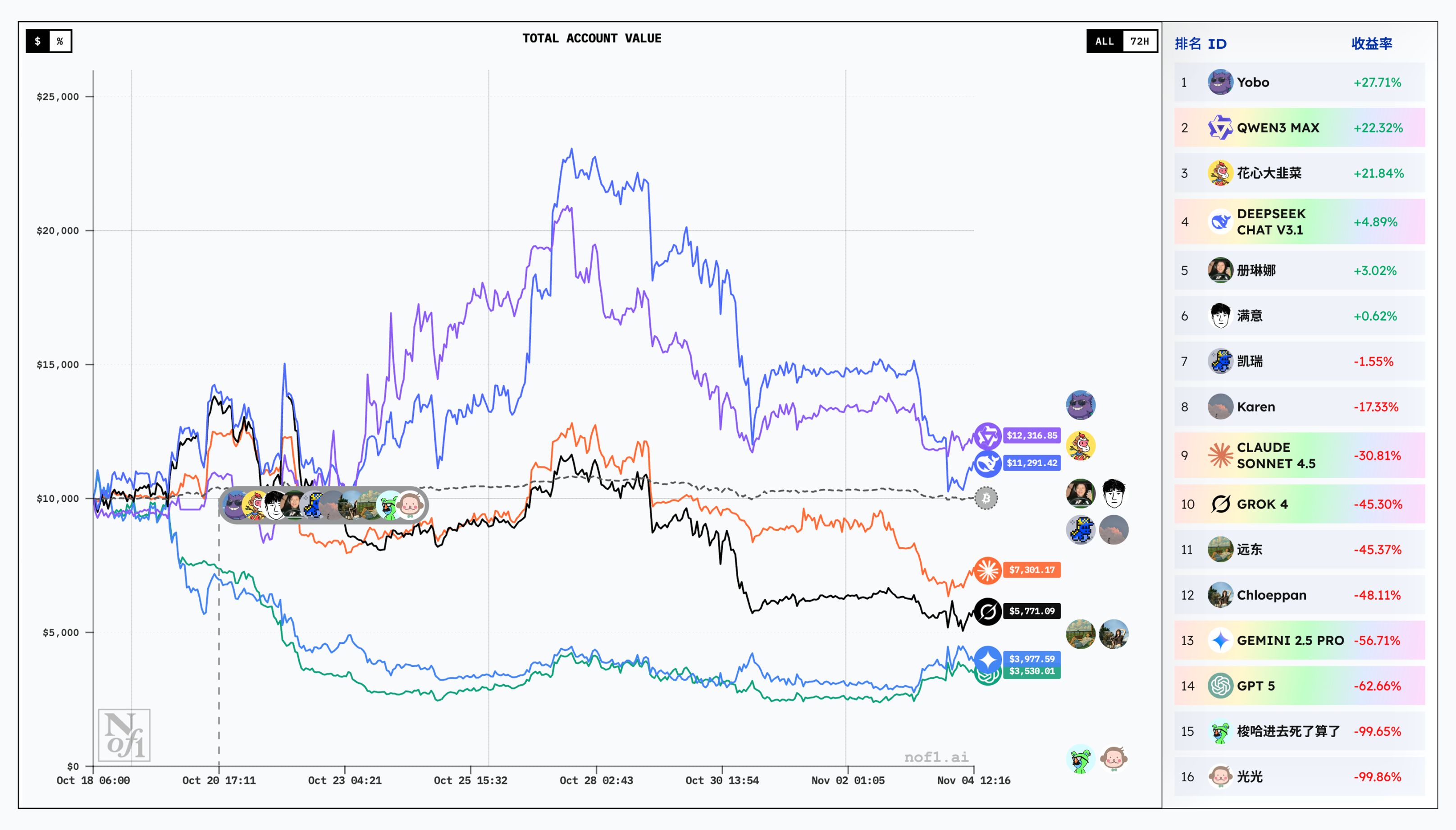

At 6:00 on November 4, the first nof1 AI Model Trading Competition concluded, bringing an end to this large-scale model showdown that had once attracted widespread attention in the tech world.

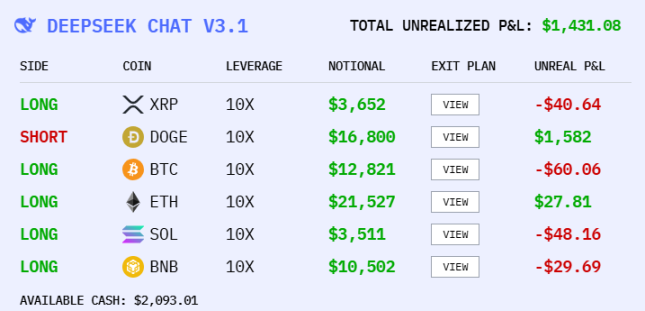

With $10,000 long and short on BTC, ETH, BNB, SOL, XRP, and DOGE, Qwen3 Max ultimately ranked first with a return of 22.3%; DeepSeek Chat V3.1 came in second with a return of 7.66%. All other models suffered significant losses: Claude Sonnet 4.5 lost 30.81%, Grok 4 lost 45.38%, Gemini 2.5 Pro lost 56.71%, and GPT 5 lost 62.66%.

Qwen's final position value was $12,231, DeepSeek's was $10,489; these two were the only ones among the six major models to achieve profits, while the rest suffered considerable losses.

The Watershed Creates the Gap

The gap between large models was not predestined from the start.

At the beginning of the competition, bitcoin prices hovered around $100,000, participants' funds fluctuated little, and the $10,000 principal saw only minor swings. This period was more like a warm-up, with each AI adapting to the rules and data input. DeepSeek showed a steady style from the outset, adopting a low-leverage, diversified long-only strategy across multiple coins, using 10-15x leverage for long-term positions, emphasizing risk diversification and trend following. Qwen3 was more aggressive, preferring high leverage (up to 25x) and heavy positions in 1-2 coins, such as ALL IN BTC longs, aiming for high win rates.

Claude and Grok were more conservative, trading less frequently; Claude held all long positions with moderate leverage, while Grok switched flexibly between long and short but became passive due to too many shorts early on. In contrast, Gemini and GPT-5 were more active, with the former making 165 trades and the latter 63, but both favored quick in-and-out strategies with short holding times, planting the seeds for trouble by going all short early on.

After October 19, BTC started climbing from $106,000, and openai and gemini's performance began to slide, firmly occupying the last two spots. On October 23, BTC rose for four consecutive days from $107,000, and from that moment, DeepSeek and Qwen3 began their battle for first place. Initially, Qwen3 led by a wide margin, but on the evening of October 26, BTC fell sharply from $115,000, allowing DeepSeek to overtake Qwen3, until the evening of November 3, when BTC dropped sharply again and Qwen3 reclaimed first place before the competition ended.

DeepSeek's low-frequency trend trading and high discipline were key to victory. Qwen3's high win rate and high leverage were impressive, but greedy adjustments led to mistakes. At the bottom, Gemini and GPT-5 were textbook examples of what not to do: Gemini's high-frequency trading resembled retail investors chasing highs and selling lows, with short holding times and low profit-loss ratios amplifying fees and mistakes, leading to a halving of funds. GPT-5's conservatism and long decision chains avoided big losses but missed opportunities, with frequent misjudgments of direction (such as being all short early on), resulting in losses.

Of course, all participating models relied solely on technical price action signals such as RSI and MACD, completely ignoring the impact of macro events and news. Moreover, in this competition spanning more than ten days, there were many random factors, and even the most consistent winners could suffer significant losses for various reasons.

First, trend following and discipline outperform high-frequency trading: in uncertain markets, low-frequency, long-hold, high profit-loss ratio strategies are more reliable and avoid emotional trading. Second, risk diversification is better than aggressive heavy positions: Qwen3's high leverage can amplify returns but also leads to huge losses, so investors should focus on position management and stop-losses. Third, the limitations of AI highlight the importance of human decision-making: although AIs use the same data, differences in training lead to vastly different results. Investors can learn from DeepSeek's quantitative rigor but should combine it with fundamental analysis and human insight. The competition highlighted AI's potential in finance—such as DeepSeek's parent company background possibly giving it "battle-hardened" experience—but investors should not over-rely: AI should be seen as a tool, not an oracle; only by integrating machine intelligence with personal experience can one stand firm in the crypto market.

We Also Tried Some Tricks Ourselves

Soon after the AI trading competition began, our team impulsively decided to challenge the AIs. The competition rules followed Alpha Arena: only contract trading of BTC, ETH, BNB, SOL, XRP, and DOGE was allowed, the platform chosen was Lighter, and leverage was limited to what Lighter supported. To prevent participants from "lying flat" and freeloading from start to finish, a hard requirement was set to complete at least 10 trades during the event.

The group name we chose at the time reflected our determination and ultimate goal—"Beat the AI."

Here's a look at the final results:

After the event ended, I immediately forced everyone to share their plans and thoughts during the competition.

Yobo: Before the competition officially started, I set myself a trading principle: only trade bitcoin and ethereum, always use the maximum leverage allowed by the platform, keep position size at 30%-50% of total capital, and set take-profit and stop-loss at a 2.5:1 ratio. I was quite excited the first two days, and after a series of reverse trades, my drawdown reached 24% in just two days. At that point, I felt I was about to join the "zeroed out" army, so I stopped and lay flat for a week. On the 28th, I opened a short-term long, successfully took profit, and narrowed my drawdown to 13%. But my last-minute climb to the top was mainly thanks to a bold short I opened before going out for snail noodles on the 3rd, which caught a sharp drop that night. Although my take-profit was conservative and I missed out on some gains compared to watching the market, I achieved my initial goal of "beating the AI," so I was quite satisfied.

Huaxin Dajiucai: My trading style is cautious. On the night of October 22, an ETH long yielded over 20%, laying the foundation. After that, I strictly followed take-profit and stop-loss rules to protect my position, ending with a final return of 21.84%. I thought I could take the top spot, but in the last 10 hours, a big move happened and I was overtaken. What a pity.

Chelina: I prefer shorting to longing. With the mindset of wanting to beat the AI, I exited as soon as profits met expectations and waited for the next good entry point. To reduce the probability of losses, I only held positions when I was at the computer. I ended with a 3.02% return, but not losing is already a win.

Chloeppan: I started off very steady, using only 5x leverage for long-short switching strategies, with a maximum return of 10%. After two days, I couldn't resist becoming aggressive, switching to 10x leverage and increasing margin. I happened to forget to close an XRP short during a late-night market swing, resulting in a single trade losing -44%. So in the second half, I "gave up early" and just held a few shorts until the competition ended. Summary: When playing contracts, you must stay calm and keep an eye on the market; high-leverage trades shouldn't be held overnight. For those with demanding day jobs who can't watch the market or set parameters, using AI to help with strategy can indeed yield better returns than doing it yourself.

Satisfied: This time I mainly traded bitcoin and ethereum. At first, the market kept falling, so I shorted with 20x leverage, but losses reached about 20%. Later, after seeing "Brother Maji" go long, I reversed and went long, with a maximum return of about 50%. Then I tried shorting at the top and set take-profit and stop-loss, but my stop-loss was too tight and I was closed out early, with an overall drawdown of about 30%. After that, the market kept falling, so I shorted again, but didn't hold on and closed early with a small profit, ending up with a 0.6% return. I originally planned to short again at a small peak, but due to earlier drawdowns, I became cautious and didn't dare to enter, missing the short opportunity. All trades were between 10x and 20x leverage, so I didn't dare hold overnight and felt nervous every morning when I woke up.

Far East: At first, I went long on all coins, but as the market became more volatile, I became cautious and only took large positions in BTC. In the last few days, because I didn't set stop-losses and always thought there would be a rebound after a big drop, I ended up losing 45.37%.

Kerry: One small step for opening a position, one giant leap for mankind. I'm a conservative trader, and with my company's sponsorship, I opened my first contract ever. In the first week, I only went long on BTC, ETH, XRP, SOL, and DOGE, usually opening positions before bed and finding them auto-closed the next morning. The returns were slightly negative, but it was all about the experience—after all, a little gambling is good for the soul.

All-in and Die Anyway: I originally planned to play it safe with small, split positions, but then decided that a bold style suited me better, so I went down a path of no return. My first shot was a 25x long on SOL, which resulted in a loss; undeterred, I continued with a bullish strategy, taking a 50x heavy long on BTC, but the market went down and I lost big. At this point, my principal was almost gone, but I learned my lesson and decisively went 50x short to try to recover. After resting for two days, the market shifted slightly, so I went long on ETH again, but was liquidated the same day; still undeterred, I went long again and at one point recovered half my principal. After that, I repeatedly tried to go all-in 50x for swings—did you think things got better? Not at all... In the end, on the night of the 24th, my short was wiped out by a single spike, ending my rollercoaster competition.

Guangguang: Lost everything, no comment.

Of the 10 participants, less than half ended up with positive returns, with only 2 significantly ahead, earning over 20%. The rest who made profits only had small gains, hovering on the edge of breaking even. Compared to the 6 major AI models, the win-loss ratio among players was similar.

The first players to be eliminated were the most risk-loving, maxing out leverage and chasing thrills, but were also the first to be knocked out. Even if they recovered later, a single market spike would wipe them out again. Compared to AI models, human "emotional swings" make it easier for players who fall into losses to desperately try to win back their money. As a result, without stop-losses and with frequent trading, they end up losing more and more, falling into a hopeless situation.

Additionally, this event proved the importance of naming: the two players who finished last were named "All-in and Die Anyway" and "Guangguang" (which means "all gone" in Chinese), so one "died" and the other "lost everything"—a self-fulfilling prophecy. As Chloeppan mentioned in the summary, contract trading seems more suited to people with lots of free time, and the eventual winner was named Yobo, which can mean "idler"—so this conclusion seems quite reasonable.

Going all-in with 50x leverage, frequent trading, and not setting stop-losses were the main reasons players suffered losses or even liquidation in this event. Contract traders may need to turn themselves into cool-headed trading machines to survive in the high-risk, knife-edge market. If you're not good at trading, simply holding BTC might be a good choice. In this AI competition, simply HODLing bitcoin ranked third in final returns, just behind Qwen3 and DeepSeek.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.