Kodiak launches Berachain native perpetual contract platform—Kodiak Perps, enhancing its liquidity ecosystem

The native liquidity platform of the Berachain ecosystem, Kodiak, recently launched a new product, Kodiak Perps,...

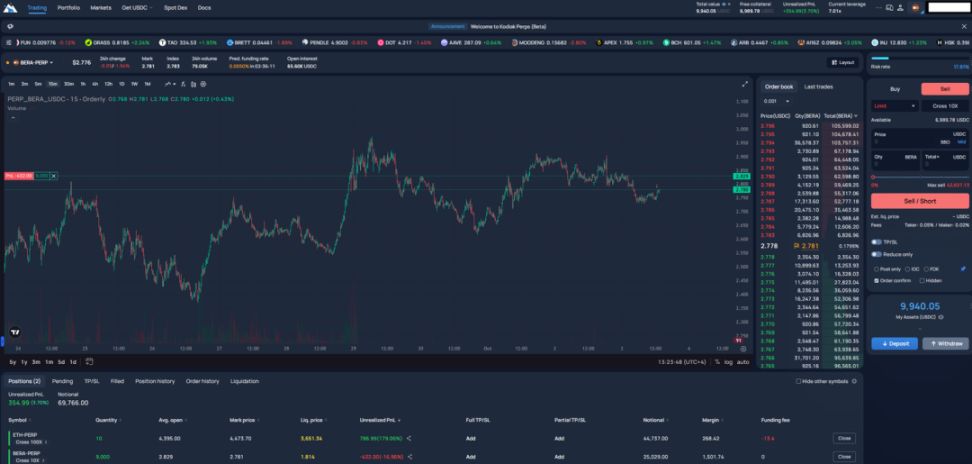

Berachain ecosystem's native liquidity platform Kodiak has recently launched a brand-new product, Kodiak Perps, an innovative perpetual contract DEX. Leveraging Kodiak’s unified liquidity architecture and multi-ecosystem cross-chain support, Kodiak Perps supports up to 100x leveraged trading on a variety of mainstream and RWA assets (including BTC, ETH, SPX500, NAS100, etc.), achieving full on-chain execution and instant settlement. Within just two weeks of launch, the platform’s trading volume exceeded $100 million, while significantly reducing trading costs: the Maker fee dropped from 0.02% to 0.013%, and the Taker fee from 0.055% to 0.04%.

As one of the core infrastructures of Berachain, Kodiak is backed by several well-known institutions, including Build-a-Bera, Hack VC, Amber Group, No Limit Holdings, and dao5. The project is committed to building an integrated liquidity ecosystem on Berachain, covering spot and perpetual DEX, automated liquidity management vaults, aggregator swap tools, zero-code token issuance tools, and an incentive layer deeply integrated with Berachain’s “Proof of Liquidity (PoL)” mechanism.

With the launch of Kodiak Perps, Kodiak’s ecosystem layout on Berachain has been further improved, marking Berachain’s transition from a liquidity infrastructure phase to a mature ecosystem supporting derivatives and complex financial protocols.

Kodiak’s Underlying Architecture Empowers Kodiak Perps

In fact, focusing on Kodiak itself, it is an innovative DEX with a multi-layered, modular architecture. Kodiak’s liquidity platform not only provides basic spot trading and token deployment functions, but also, through its inherent vertically integrated architecture, offers Kodiak Perps deep liquidity, stable market execution efficiency, and a sustainable incentive loop.

Deep Liquidity and Ultimate Execution Efficiency

For Kodiak Perps, market depth and execution efficiency are always key factors affecting the high-leverage trading experience, and Kodiak’s underlying architecture provides it with unique advantages.

Kodiak’s Islands design enables automated liquidity managers to continuously rebalance LP positions, keeping liquidity in the optimal range over the long term. No matter how volatile the market is, it ensures that market-making funds operate efficiently and generate sustained returns. As a result, Kodiak Perps achieves synergistic advantages in depth, liquidity, and stability, effectively reducing price impact and slippage risk during trading.

On one hand, Kodiak has established a unified order book system through deep integration with Orderly Network, working in tandem with Concentrated AMM (Automated Market Maker) mechanisms to ensure liquidity depth and price stability from the ground up. Orderly provides over $50 million in position depth and cross-chain shared liquidity, allowing Perps to approach the execution efficiency and slippage control standards of centralized exchanges.

In terms of security and risk control, Kodiak also adopts a multi-layered design.

The platform uses a non-custodial structure and Berachain’s native security mechanisms to ensure that user funds are always self-managed on-chain. At the same time, relying on Orderly’s automated risk control system, the platform can monitor abnormal trading behavior in real time and make dynamic adjustments, fundamentally reducing potential market manipulation or systemic risks.

Additionally, the Sub-accounts architecture further strengthens account isolation and position management, allowing risks between different strategies to be completely separated. For institutional and professional users, Kodiak also provides API interfaces to support high-frequency and algorithmic trading, offering execution efficiency close to that of centralized exchanges. Notably, users’ trading profits can be bridged with one click to spot LP or Baults vaults, enabling automatic BGT compounding and dual returns, balancing security and yield.

With its new integrated architecture, Kodiak Perps merges trade execution, liquidity management, and risk control into one, not only significantly improving capital efficiency but also creating a high-performance, low-risk, and sustainable compounding trading environment for high-frequency and institutional users.

Gains Brought by the PoL Incentive Mechanism

The core of PoL lies in continuously incentivizing on-chain liquidity through BGT reward vaults. Under this mechanism, validators inject BGT into the vaults, which are distributed to LPs based on TVL and liquidity contribution ratios, forming a long-term sustainable incentive loop.

On this basis, as a native protocol, Kodiak Perps can be directly embedded into the PoL architecture, with all net trading fees (after deducting platform fees and discounts) automatically injected into the Perps-exclusive BGT Vault to generate and distribute BGT rewards. This means that trading itself can earn governance token incentives, turning trading from a one-off profit and loss game into a continuous “trade-to-farm” accumulation process.

Within two weeks of launch, Perps’ trading volume has exceeded $100 million, with approximately $37,000 in fees injected into the Vault, and has already supported $100,000 worth of Volume/PnL competitions and trading rewards.

As perpetual trading volume increases, the system’s liquidity and TVL grow in tandem, and validators will inject more BGT rewards into Kodiak Islands and Baults vaults, driving LP returns and capital recycling. This is making PoL the growth engine for Perps.

Combined with a 10% referral rebate and gas-free USDC cross-chain deposit mechanism, Kodiak Perps is forming a self-reinforcing trading-liquidity flywheel through the PoL system, laying the foundation for long-term growth of the decentralized derivatives market on Berachain.

Expansion of the Derivatives System

Kodiak’s design is not limited to the current Perps product, but also provides a solid foundation for future expansion of the derivatives market.

As part of the Kodiak ecosystem, Perps will continue to expand with the addition of new asset classes, and may introduce more money market and derivatives products in the future, such as futures and options. Kodiak’s own liquidity integration and the stability of the PoL mechanism will help these new markets get off the ground smoothly and provide ongoing liquidity and capital support as the market matures.

Kodiak Perps: A Key Growth Engine for Berachain’s Liquidity System

As Berachain’s native perpetual contract platform, Kodiak Perps is gradually becoming the core liquidity engine of this ecosystem. Within three weeks of launch, the platform’s trading volume has exceeded $100 million. Through 100x leverage products and multi-chain USDC cross-chain settlement support, it has significantly improved capital utilization and market activity. Relying on seamless integration with the spot DEX, Kodiak Perps has built a liquidity channel connecting spot and derivatives, enabling efficient capital cycling across different trading scenarios.

The brand-new product structure not only drives Berachain’s TVL growth and leveraged capital lock-up, but also allows Kodiak to account for more than half of the ecosystem’s $990 million TVL, making it one of the most capital-attractive protocols in the ecosystem.

Kodiak Perps is expected to become Berachain’s “killer app”—with a sustainable growth mechanism, outstanding capital efficiency, and strong ecosystem momentum, it builds a self-reinforcing liquidity loop. Unlike short-term models that rely on airdrops or token inflation, Perps achieves long-term incentives and stable expansion through a fee self-circulation mechanism, giving liquidity endogenous growth momentum.

On this basis, 100x leverage and the BGT reward compounding mechanism together enhance capital utilization efficiency, making trading itself a process of continuous cumulative returns. About half of Perps’ trading volume feeds back into the spot market, amplifying liquidity returns through the PoL mechanism and forming a closed loop of “trading, incentives, and re-liquidity.” This multi-layered linkage design not only strengthens Berachain’s capital efficiency but also shifts the ecosystem’s growth logic from external stimulus to internal self-driving.

Kodiak Perps is not only representative of Berachain’s derivatives market, but also a key node in the self-reinforcing cycle of its liquidity system. It turns liquidity into an accumulable asset, makes incentives a sustainable mechanism, and drives the endogenous growth and collaborative development of the entire ecosystem.

The new season of Kodiak Perps rewards activities has officially started. Interested parties can keep an eye on it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

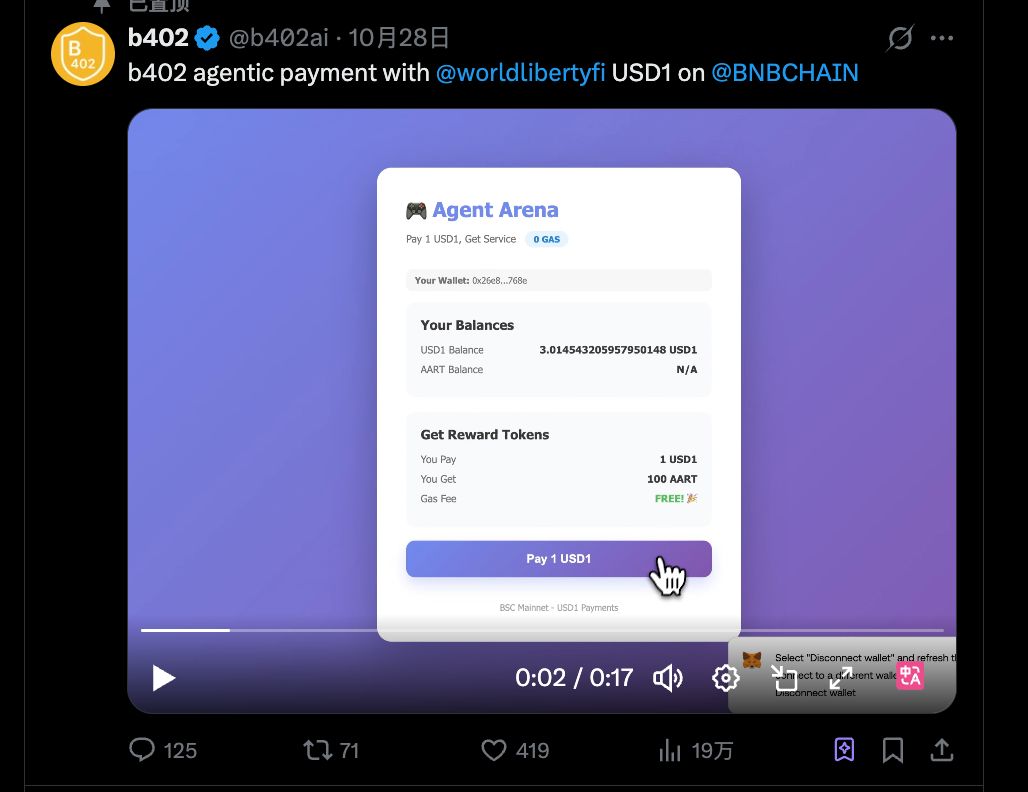

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?