Finland Sets Crypto Reporting Framework for 2026 Launch

- Finland adopts new crypto reporting, effective January 2026.

- Finnish Tax Administration leads framework implementation.

- Broad reporting on crypto transactions for CASPs mandated.

Finland will implement the Crypto-Asset Reporting Framework domestically by 2026, requiring crypto service providers and exchanges to report transactions for both Finnish and non-Finnish users.

The move marks Finland as an early adopter among EU nations, potentially influencing market transparency and compliance within the cryptocurrency sector.

Starting in 2026, Finland will operationalize its Crypto-Asset Reporting Framework (CARF) , making it one of the first EU countries to do so. This move, led by the Finnish Tax Administration, imposes new reporting obligations on crypto-asset service providers (CASPs).

The Finnish Tax Administration, alongside the Government of Finland and Ministry of Finance, is spearheading this initiative. Changes require CASPs to report transactions involving both Finnish and non-Finnish service users, ensuring comprehensive data collection on crypto activities.

Financial implications are apparent, as all crypto assets serviced by CASPs fall under the new regulations, including BTC and ETH. This extensive initiative encompasses reporting both domestic and international transactions, boosting regulatory oversight in the growing crypto sector.

Historically, similar EU directives like DAC8 and CRS have enhanced tax compliance, but without significant market disruption. The CARF establishes Finland’s position as a forerunner in EU crypto regulation, aligning with over 48 jurisdictions in data exchange by 2027.

Potential outcomes could include increased regulatory compliance costs for CASPs, akin to those seen under the DAC8 directive, although no severe market impact is anticipated. The Finnish Tax Administration continues to provide updates to ensure transparency and systematic compliance.

“Starting in 2026, crypto asset service providers reporting to Finland must collect information on service users and their purchases, sales and transfers of crypto assets. Information will be collected on both Finnish and non-Finnish service users.” — Vero.fi

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC Lists Five XRP Spot ETFs, Fueling Anticipation for U.S. Market Debut

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

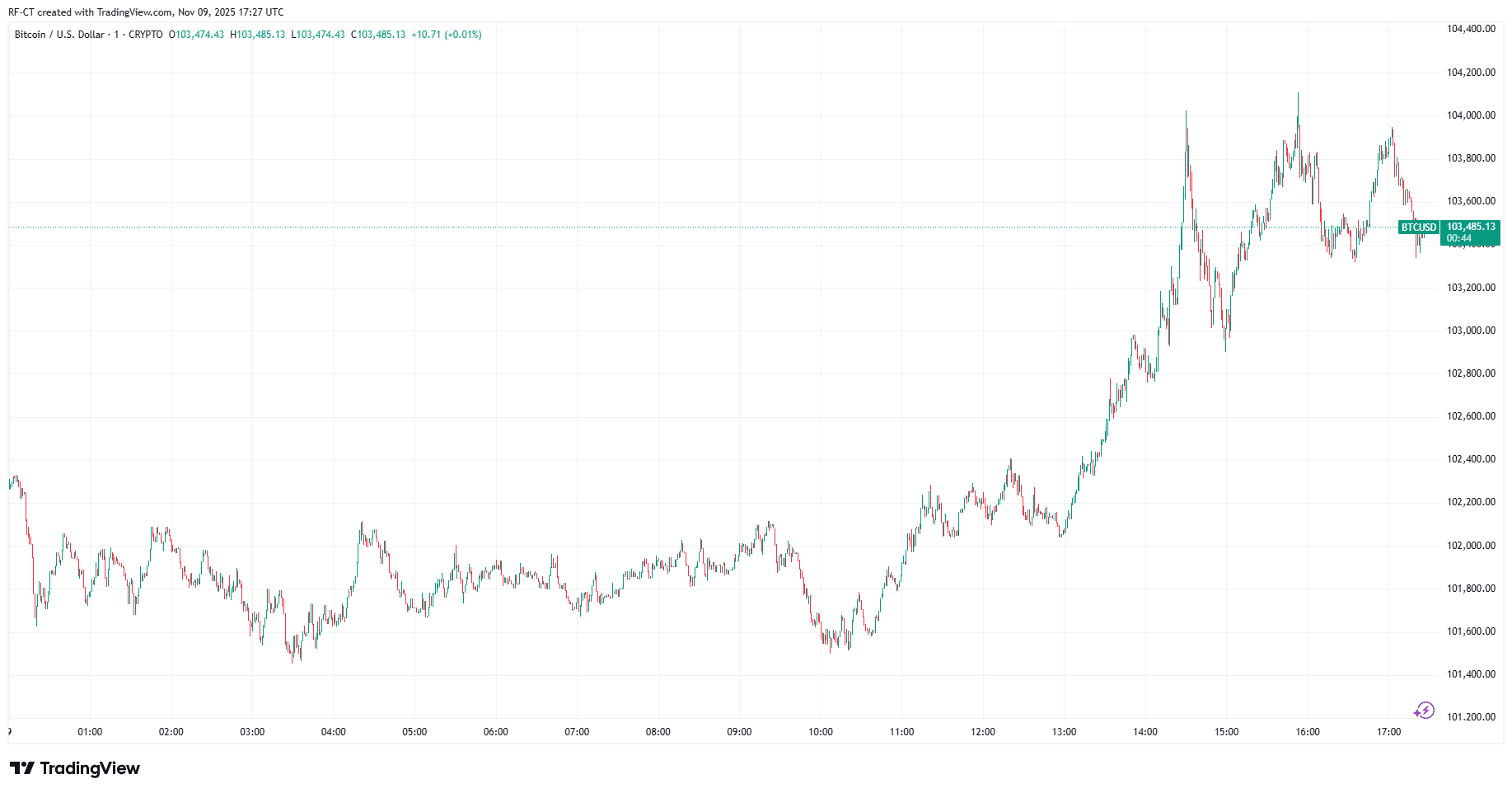

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

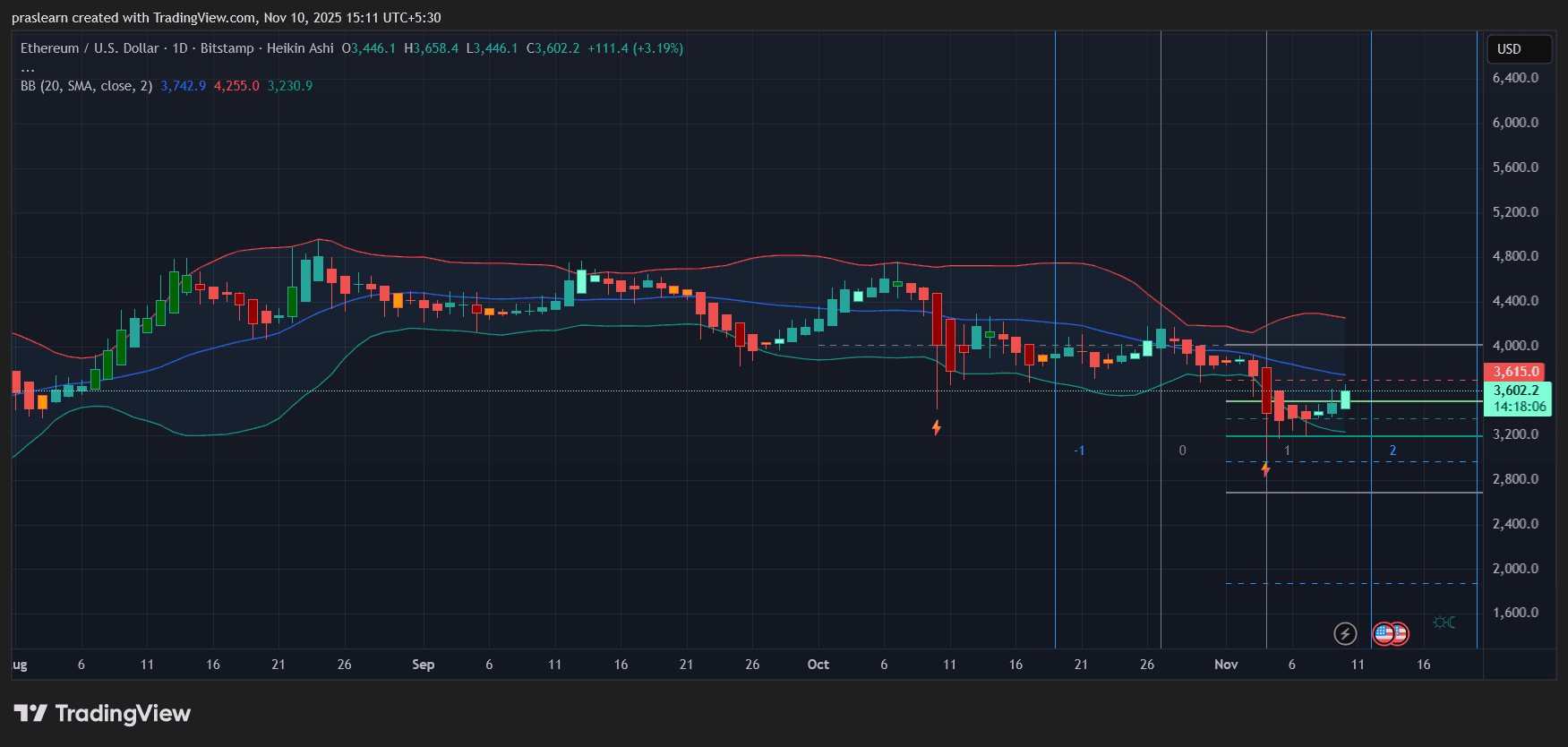

Will Political Calm Push ETH Price Toward $4,000?