Peter Schiff Urges Bitcoin Sale Above $100,000

- Schiff’s advice coincides with increased Bitcoin whale activity.

- Bitcoin price fluctuates, testing market stability.

- Crypto experts see potential market volatility.

Peter Schiff urges Bitcoin holders to sell before its price falls below $100,000. As a critic of cryptocurrencies, Schiff views the current price as transient and emphasizes previous warnings during price surges, often seen as contrarian signals.

Schiff’s statement matters as it underscores skepticism from traditional finance figures while influencing Bitcoin’s market narrative and trader sentiment.

Market Insights

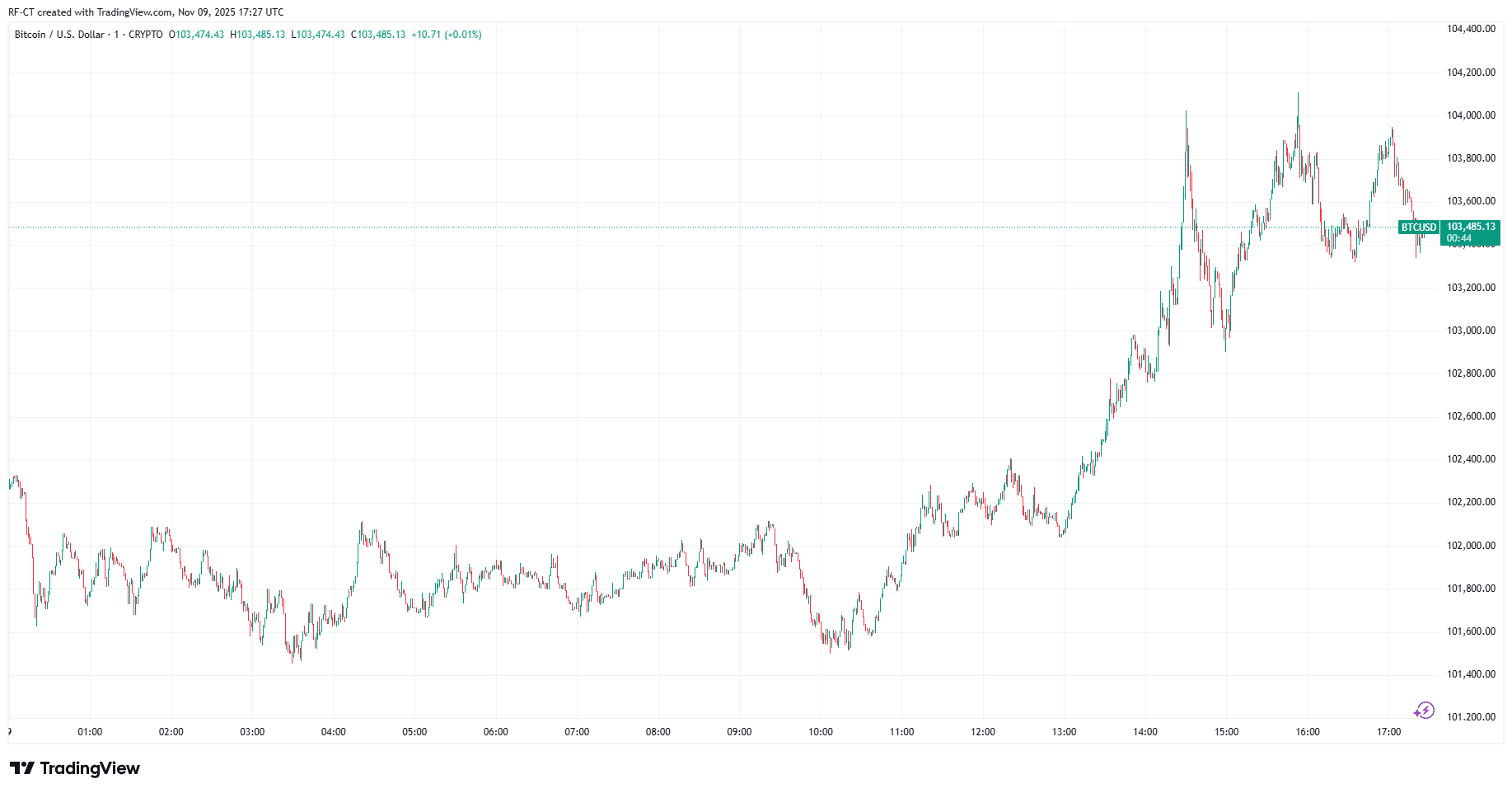

Bitcoin critic Peter Schiff recently advised selling Bitcoin above $100,000. Peter Schiff, CEO of Euro Pacific Capital, urged Bitcoin holders to “hurry and sell it now, while the price is still above $100K”: source . Schiff’s anti-crypto stance, well-known in the industry, was reiterated on Twitter. The statement coincided with increased whale activity, reportedly selling over $500 million in Bitcoin. Schiff remains consistent in his critique, previously describing Bitcoin as devoid of intrinsic value.

The suggestion prompted further debate among cryptocurrency influencers, many viewing it as a contrarian signal. Bitcoin’s price volatility increased, with heightened activity near the $100,000 psychological level. Financially, no large institutions confirmed direct reactions to Schiff’s commentary.

Regulatory bodies, including the SEC, have not issued specific statements concerning this event. The market saw increased volatility, with some traders considering Schiff’s comments when making decisions. The comments reflect a persistent skepticism from traditional finance voices.

Market reactions were swift, though largely focused on Bitcoin’s whale activity rather than regulatory impacts. Cryptocurrency experts observe potential trends for price volatility . Historical trends suggest Schiff’s negative stance often coincides with market excitement, fueling speculative action despite his bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

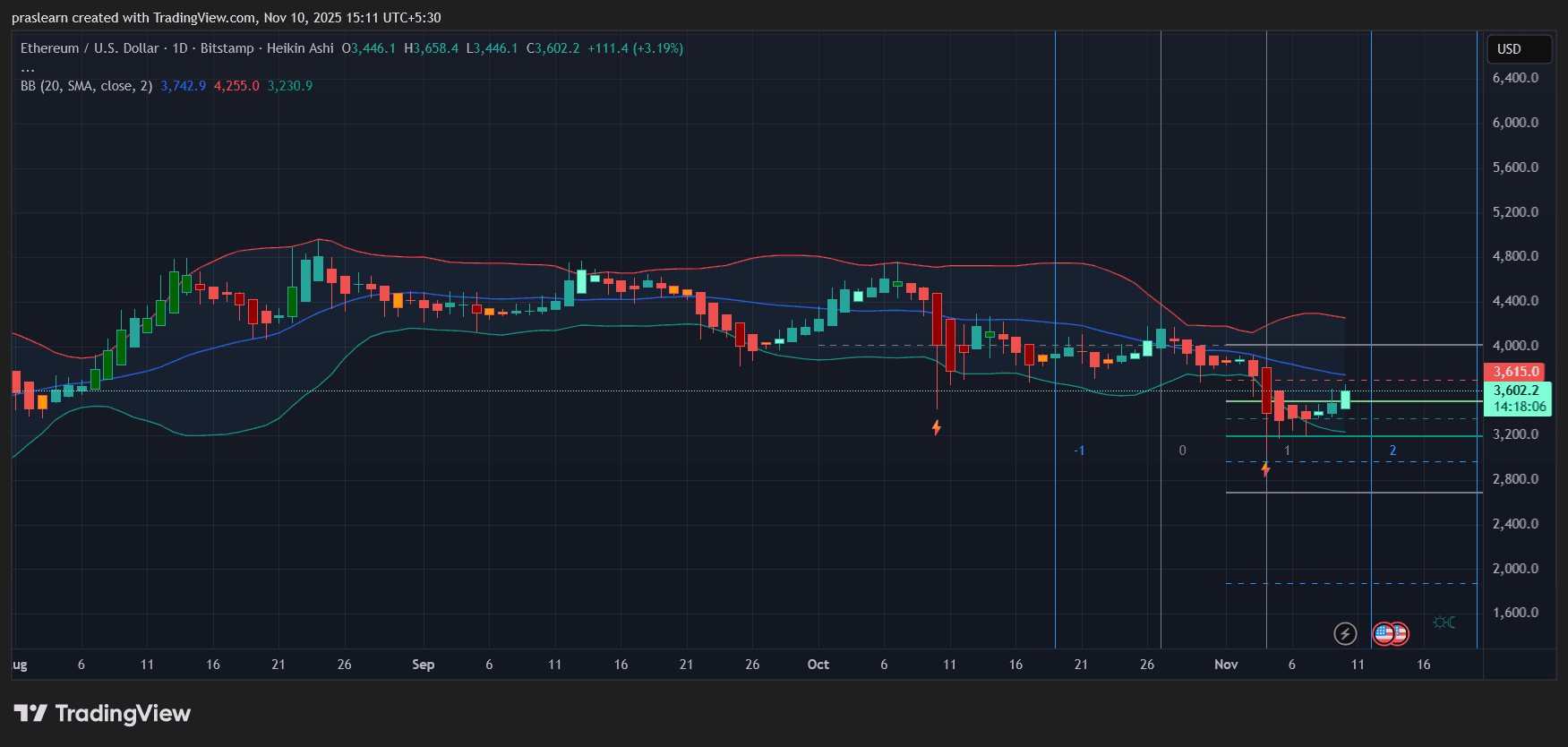

Will Political Calm Push ETH Price Toward $4,000?

Vitalik Buterin's Latest Advocacy for ZK Technology in Ethereum: Evaluating the Impact of ZK on Ethereum's Future Scalability and Investment Potential

- Vitalik Buterin prioritizes ZK proofs to enhance Ethereum's scalability, privacy, and quantum resistance amid institutional demand and post-AGI risks. - Ethereum's "Lean Ethereum" upgrades remove modexp precompiles and adopt GKR protocol, boosting TPS and quantum security while temporarily affecting gas fees. - ZK layer 2 solutions like Lighter (24k TPS) and ZKsync (15k TPS) drive institutional adoption, with 83% of enterprise smart contracts now using ZK-rollups. - ZK-driven infrastructure (ZKsync, Star