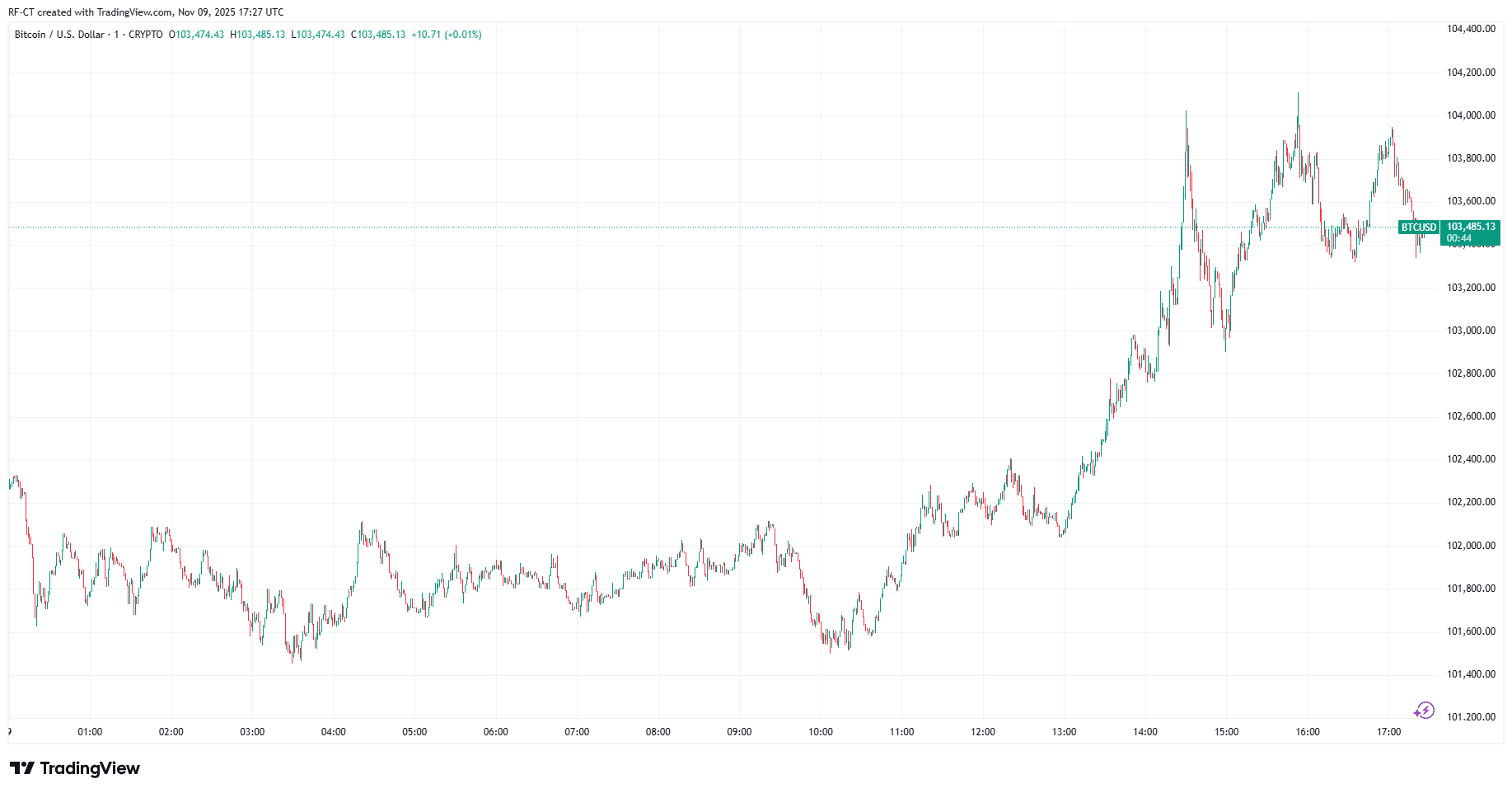

Bitcoin Breaks Through $102,000 Amid Market Volatility

- Bitcoin surpasses $102,000(UTC+8) during volatile trading period.

- Institutional outflows signal cautious investor sentiment.

- Potential for increased financial risk in related assets.

Bitcoin experienced a significant price movement by surpassing $102,000(UTC+8), climbing 0.28% on the day. The surge led to $177 million in liquidations, with major institutional ETF inflows contrasting recent net outflows, enhancing market dynamics.

Bitcoin briefly exceeded $102,000(UTC+8), marking a significant event in cryptocurrency trading. This surge, experienced within recent days, was marked by high volatility with a momentary peak over $103,000(UTC+8) before slightly retracting.

The event highlights the market’s volatility and its potential to affect institutional investments and trader strategies in significant ways.

Bitcoin’s brief surge above $102,000(UTC+8)

was noted for its volatility and involved substantial asset liquidations. Reports indicate that around $177 million was liquidated in under an hour, mainly from long positions. More details can be found in this Market Faces Pressure With Bitcoin’s Rise Over $102,000(UTC+8) .

Participants of interest include figures and entities such as Michael Saylor’s MicroStrategy and Cathie Wood’s ARK Invest.

Cathie Wood, CEO, ARK Invest, – her forecast revision for BTC is now $1.2M by 2030, noting “stablecoins increasingly taking on Bitcoin’s transactional role” while reaffirming its “digital gold” status.Institutional investors like BlackRock and Fidelity noted significant activity, reflecting cautious sentiment Institutional Investors Show Caution During Bitcoin’s Surge .

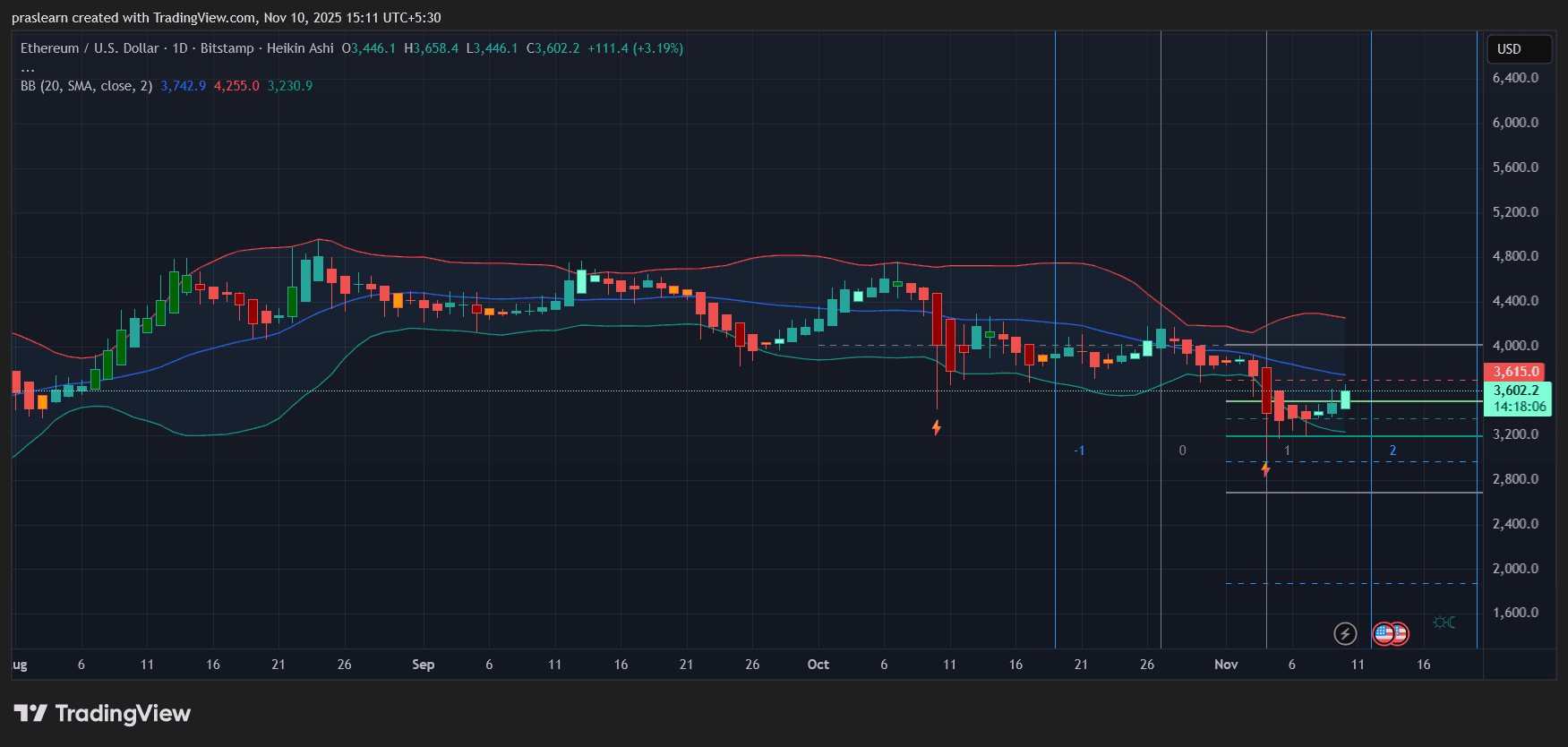

The impact on related markets was marked by institutional outflows from spot Bitcoin ETFs and pressure on secondary assets like ETH. These movements raise questions about potential liquidity challenges and market stability as discussed in detail here .

From a financial perspective, the surge indicates potential fluctuations in asset values and increased volatility in BTC-centric DeFi products, given ongoing outflows. Market participants watch for further institutional reactions additional insights available here

Historical data suggests similar fluctuations have prefaced significant market corrections. Participants eyeing BTC’s price action are advised to consider potential drawdowns, especially in light of recent strategic investor decisions. More context on these movements can be found in Historical Trends Indicate Possible Corrections Post Bitcoin Surge .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

Will Political Calm Push ETH Price Toward $4,000?

Vitalik Buterin's Latest Advocacy for ZK Technology in Ethereum: Evaluating the Impact of ZK on Ethereum's Future Scalability and Investment Potential

- Vitalik Buterin prioritizes ZK proofs to enhance Ethereum's scalability, privacy, and quantum resistance amid institutional demand and post-AGI risks. - Ethereum's "Lean Ethereum" upgrades remove modexp precompiles and adopt GKR protocol, boosting TPS and quantum security while temporarily affecting gas fees. - ZK layer 2 solutions like Lighter (24k TPS) and ZKsync (15k TPS) drive institutional adoption, with 83% of enterprise smart contracts now using ZK-rollups. - ZK-driven infrastructure (ZKsync, Star